National Insurance Voluntary Contributions Abroad

Have paid NIC for three years. Others may choose to pay them to help qualify for benefits when they get.

Taxation And Contributions Finnish Centre For Pensions

Taxation And Contributions Finnish Centre For Pensions

However if you have moved abroad your National Insurance contributions will cease.

National insurance voluntary contributions abroad. Who can pay voluntary NIC from abroad. Send it back to HMRC using the address. They have lived in the UK for three years in a row.

It may be possible to pay voluntary Class 3 National Insurance contributions Class 2 if youre self-employed or possibly if youre living abroad in order to get a higher State Pension. Class 3 but only if at some point youve lived in the UK continuously for 3 years or paid 3. You can pay your National Insurance contributions from abroad by Bacs online or telephone banking or CHAPS.

You should be able to qualify for class 2 if you are living and working abroad and have previously lived in the UK for 3 years in a row as described here. You can ask HMRC for a statement of your National Insurance account. The scope is limited for expats who want to pay voluntary NIC.

These payments contribute towards your State Pension and secure particular state benefits in case you move back to the UK. Gaps can mean you will not have enough years of National Insurance contributions to get the full State Pension sometimes called qualifying years. Pay Class 2 voluntary contributions pay Class 3 voluntary contributions If youre living abroad read leaflet NI38 and fill in form CF83 found at the end.

You must be eligible to pay voluntary National Insurance contributions for the time that the contributions cover. And youve previously lived in the UK for 3 years in a row or paid 3 years National Insurance. For example if you are working for a UK-based employer who sends you overseas for a limited period of time up to two years you may be required to continue making NICs while you work abroad.

It also describes arrangements for getting health. You must be eligible to pay voluntary National Insurance contributions for the time that the contributions cover. Your entitlement to certain State benefits and the amount you can get depends on.

Last updated 7 January 2019 In essence if you live and work in the UK and have sufficient income you will automatically pay National Insurance contributions. It will tell you how much if anything your shortfall is whether you are able to make up that shortfall and how you can pay if you wish to do so. Expats living and working overseas Class 2 Providing they have lived and worked in the UK immediately before leaving.

Those who qualify are. Class 3 voluntary National Insurance contributions for 202021 are a pricier 1530 per week 79560 pa and are for those expats l iving abroad but NOT working but only if at some point youve lived in the UK for at least 3 years in a row or paid at least 3 years of contributions. Statement of your National Insurance account.

Voluntary class 2 contributions are possible if you qualify at an even lower cost around 158 per year. Alternatively you can choose to. You can usually only pay for gaps in your National Insurance.

There are various reasons as to why gaps may arise in an individuals national insurance contributions NIC record for example because that person has been on low earnings for several years they have been living abroad or because they have been unemployed and have not been claiming benefits. Living abroad but not working. Checking your National Insurance contributions record - GOVUK.

Why are National Insurance contributions important. If exceptionally youre unable to pay electronically you can pay by cheque or sterling draft. Introduction Some people employed abroad have to pay UK NICs.

It also gives details about getting benefits abroad. For more information about paying us go to wwwgovukpay-class-2-national-insuranceoverview. This leaflet describes the classes of National Insurance contributions and how paying them affects your entitlement to social security benefits.

If you are going abroad this leaflet will help you decide if you should pay National Insurance contributions NICs to the UK National Insurance scheme. Yes you can continue to make National Insurance contributions as an expat though this can depend on where youre working and for how long. If you are working abroad for up to two years and for a UK-based employer you will likely be required to continue paying Class 1 NICs.

If you live abroad you can continue paying UK Voluntary National Insurance contributions provided specific conditions are satisfied and build up these years.

Expatnhis Jpg National Insurance Maternity Pay Uk States

Expatnhis Jpg National Insurance Maternity Pay Uk States

How To Check Your National Insurance Contributions Saga

How To Check Your National Insurance Contributions Saga

What Are National Insurance Contributions Low Incomes Tax Reform Group

What Are National Insurance Contributions Low Incomes Tax Reform Group

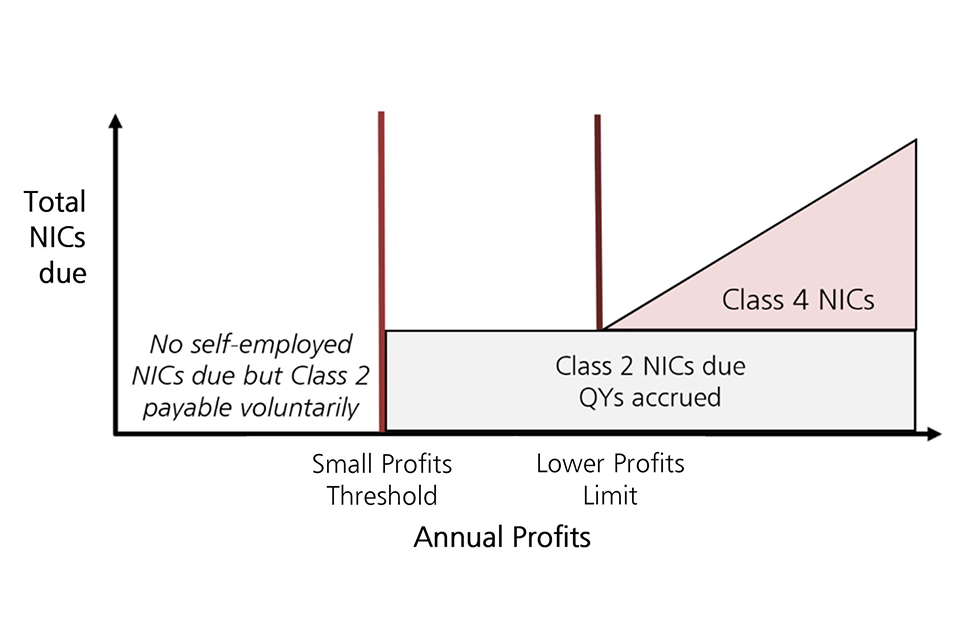

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

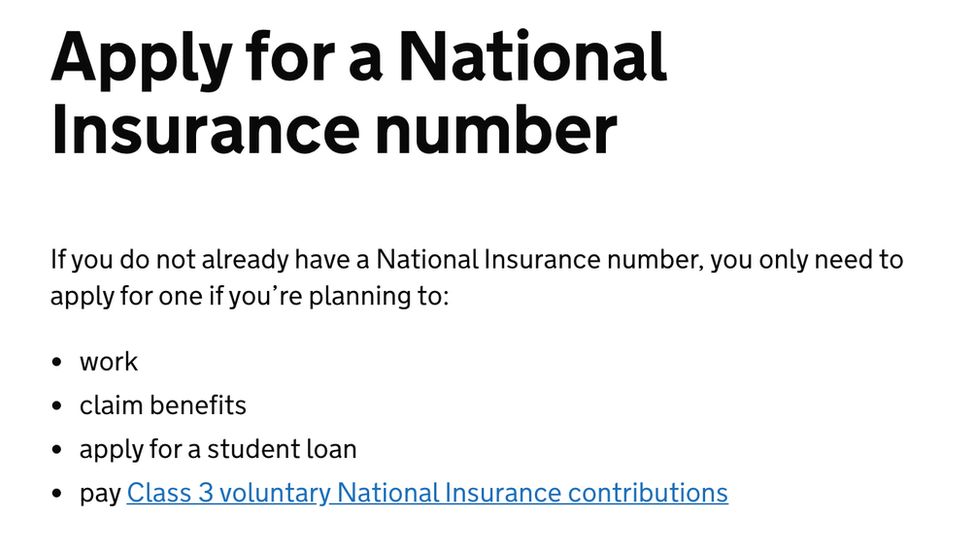

Thousands Unable To Get An Ni Number Because Of Coronavirus Bbc News

Thousands Unable To Get An Ni Number Because Of Coronavirus Bbc News

Contributions To The Cyprus National Health Insurance System Nhis Fsmo

Contributions To The Cyprus National Health Insurance System Nhis Fsmo

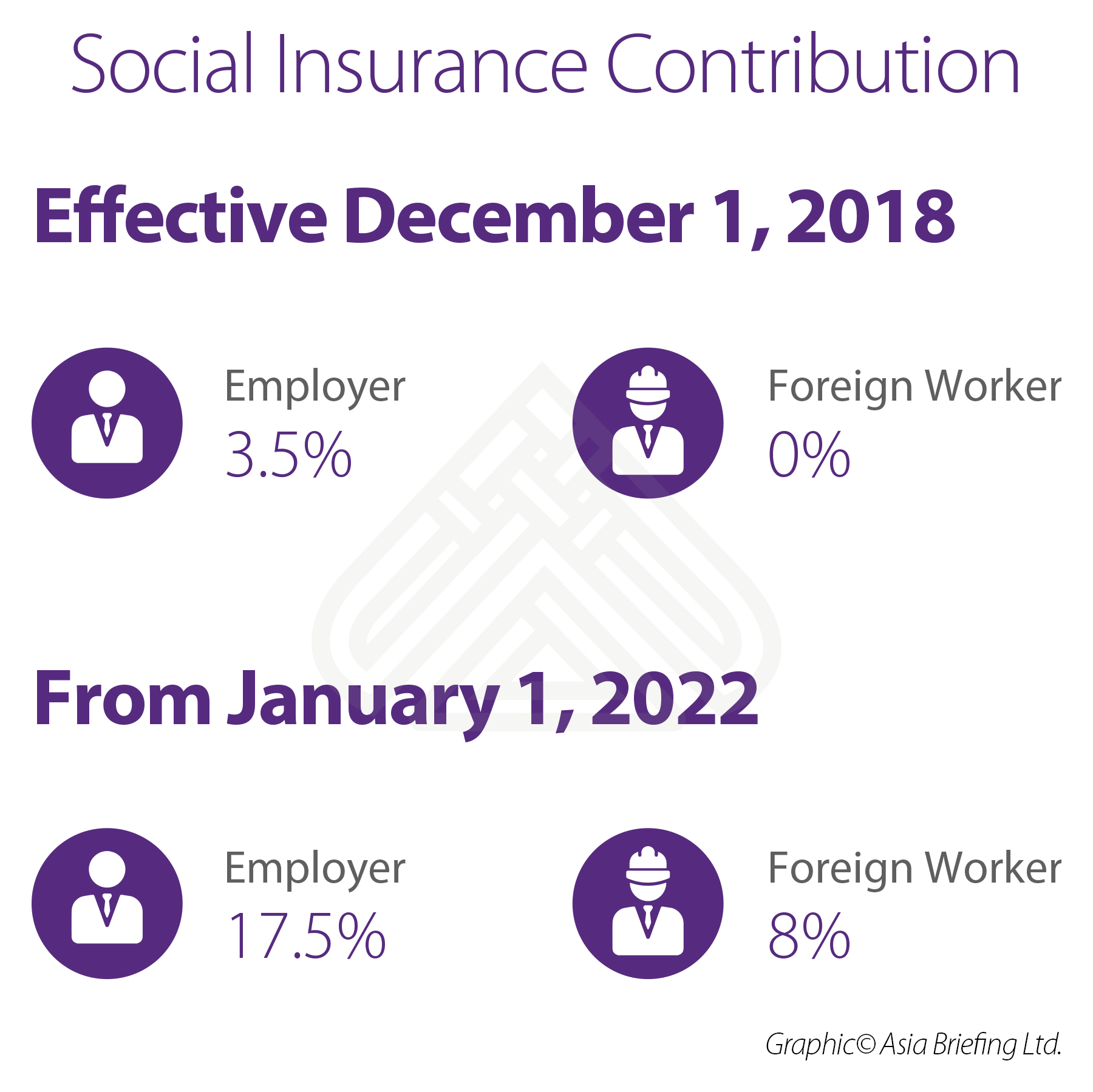

New Minimum Basic Salary Social Insurance Rates In Vietnam

New Minimum Basic Salary Social Insurance Rates In Vietnam

Uk National Insurance As An Expat Experts For Expats

Uk National Insurance As An Expat Experts For Expats

Paying Voluntary Class 3 National Insurance Contributions

Paying Voluntary Class 3 National Insurance Contributions

What Are National Insurance Contributions Low Incomes Tax Reform Group

What Are National Insurance Contributions Low Incomes Tax Reform Group

Paying Voluntary Class 3 National Insurance Contributions

Paying Voluntary Class 3 National Insurance Contributions

Uk State Pension Voluntary Contributions The Spectrum Ifa Group

Uk State Pension Voluntary Contributions The Spectrum Ifa Group

National Insurance Contributions For The Self Employed All You Need To Know Mileiq Uk

National Insurance Contributions For The Self Employed All You Need To Know Mileiq Uk

Check Your National Insurance Contributions Online

Check Your National Insurance Contributions Online

Do You Have A Gap In Your National Insurance Record

Do You Have A Gap In Your National Insurance Record

Voluntary National Insurance Contributions Should You Pay Arthur Boyd

Voluntary National Insurance Contributions Should You Pay Arthur Boyd

Do You Pay National Insurance On Pension Income The Accountancy Partnership

Do You Pay National Insurance On Pension Income The Accountancy Partnership

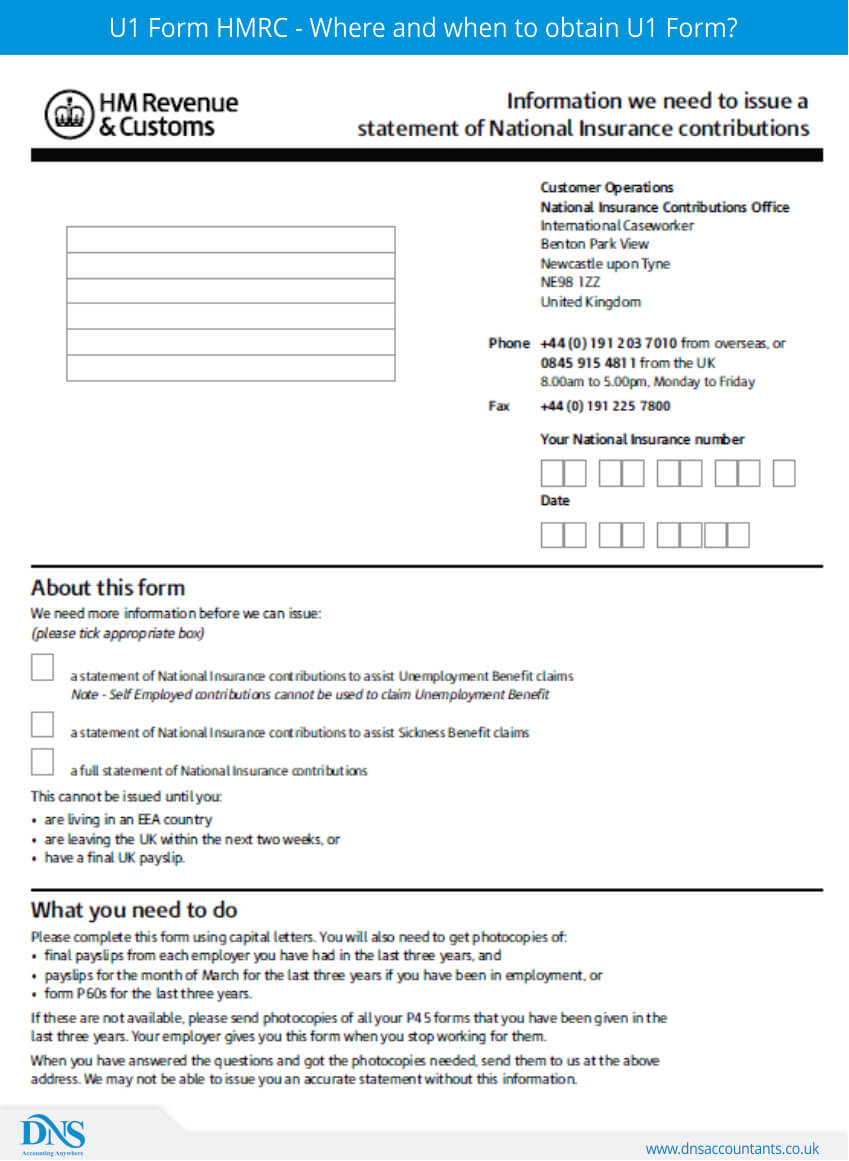

Where And When To Obtain U1 Form Use Of U1 Form Dns Accountants

Where And When To Obtain U1 Form Use Of U1 Form Dns Accountants

Coronavirus Problems Getting A National Insurance Number Low Incomes Tax Reform Group

Coronavirus Problems Getting A National Insurance Number Low Incomes Tax Reform Group

Post a Comment for "National Insurance Voluntary Contributions Abroad"