0 National Insurance Contributions

196 of the gross wage will be paid by the employee and by the employer together half and half. For 202021 this threshold is 183 a week or 792 a month.

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

National Insurance contributions for employees Employees and most agency workers make Class 1 contributions collected via PAYE together with their income tax.

0 national insurance contributions. They contain the following contributions. You pay National Insurance contributions to qualify for certain benefits and the State Pension. You pay mandatory National Insurance if youre.

The smallest period of work paid by companies to their employees is typically a week due to the overheads and costs associated with running a payroll for their staff printing payslips calculating and reporting various taxes benefits and allowances incl. 92 if your total Class 1 National Insurance both employee and employer contributions is above 45000 for the previous tax year 103 if your total Class 1 National Insurance for the previous. Employers are not required to pay Class 1 NICs on earnings up to the Upper Secondary Threshold UST for any employee aged under 21.

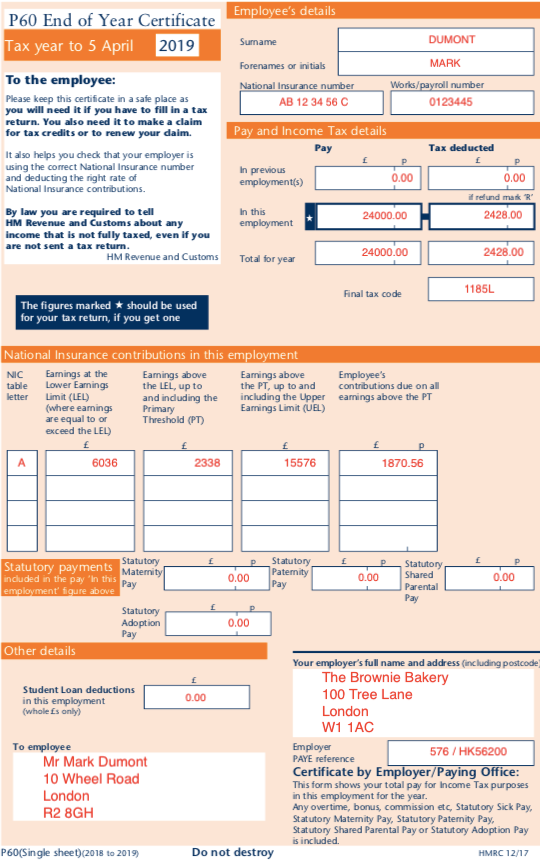

Although no NICs are payable to protect an employees entitlement to contributory benefits notional Class 1 NICs are deemed to have been paid on earnings between the LEL and the ET. Contact HM Revenue and Customs. NI and SSP to various government departments incl.

Are self-employed and making annual profits exceeding of 636500. National Insurance Contributions NICs in 2021 are payable by all individuals who. For 202021 the weekly rates of Class 1.

Under the flat-rate state pension class 2 NI contributions made by self-employed people who make a profit above 6515 in 202122 and class 2 and class 4 NI contributions for those with a profit above 9568 in 202122 will be treated the same as employee contributions and count towards the new state pension in the same way. Registering and logging into your personal tax account to view a letter with it on. In 2020-21 you pay 12 on earnings between 9500 and 50000 and 2 on anything more.

Filling in the online form. Half will be paid by the employee and half by the employer. Employees Class 1 payable.

If we assume that a working life is more like 45 years you can have several gaps in your NI record and. 57000 50000 7000 2 140. You may also be eligible for National Insurance credits if you claim benefits because you cannot work are unemployed or caring for someone full time.

Earn more than 18400 per week Are aged between 16 and 65 years of age. 9500 0 0. National Insurance Category Letter B.

Many contractors ask why they as employees have to pay employers NICs the answer lies in the nature of the contractual relationships in the contract chain. Total Employees Class 1 NIC payable 5000. National Insurance Contributions User Guide V210 4 National Insurance Contributions NI Details on the calculation of National Insurance Contributions NI are contained within Her Majestys Revenue Customs HMRC on-line guidance and the online Basic PAYE Tools.

Earn more than 18400 per week Are aged between 16 and 65 years of age. Why is UK National Insurance calculated weekly. Note that when you are calculating the NIC payable you need to start paying from 9500.

By law all employers must pay Employers National Insurance Contributions on the salaries paid to their employees. In addition they must also pay a 05 Apprenticeship Levy. The actual amount of Class 1 NIC you pay depends on what you earn up to the upper earnings limit which is 962 per week or 4167 per month for 202021.

These contributions are obligatory but are limited to a maximum fee. Specific HMRC information can be found at. Yes and no.

Get your National Insurance number. National Insurance Contributions NICs in 2021 are payable by all individuals who. NI contribution 0 138 is then deducted for the earnings above 16201 NI Contribution 11564 The total contribution from this employer per week would be 11564.

Nothing is taken for the first 162. Broadly speaking the new state pension is based on 35 years of full rate NI contributions. Get your National Insurance number by.

30 of the gross wage. In 2019-20 you paid 12 on earnings between 8632 and 50000 and 2 on anything more. Any National Insurance credits youve received if gaps in contributions or credits mean some years do not count towards your State Pension they are not qualifying years if you can pay voluntary.

50000 - 9500 40500 12 4860.

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Salary Calculator Salary Net Income

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Salary Calculator Salary Net Income

Net Salary Greece Salary Calculator Salary National Insurance

Net Salary Greece Salary Calculator Salary National Insurance

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

Hmrc U1 Form And Its Benefits Accounting Self Employment Accounting Services

Hmrc U1 Form And Its Benefits Accounting Self Employment Accounting Services

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

National Insurance What It Is How It S Calculated Who Has To Pay It

National Insurance What It Is How It S Calculated Who Has To Pay It

The Benefits Of National Insurance

The Benefits Of National Insurance

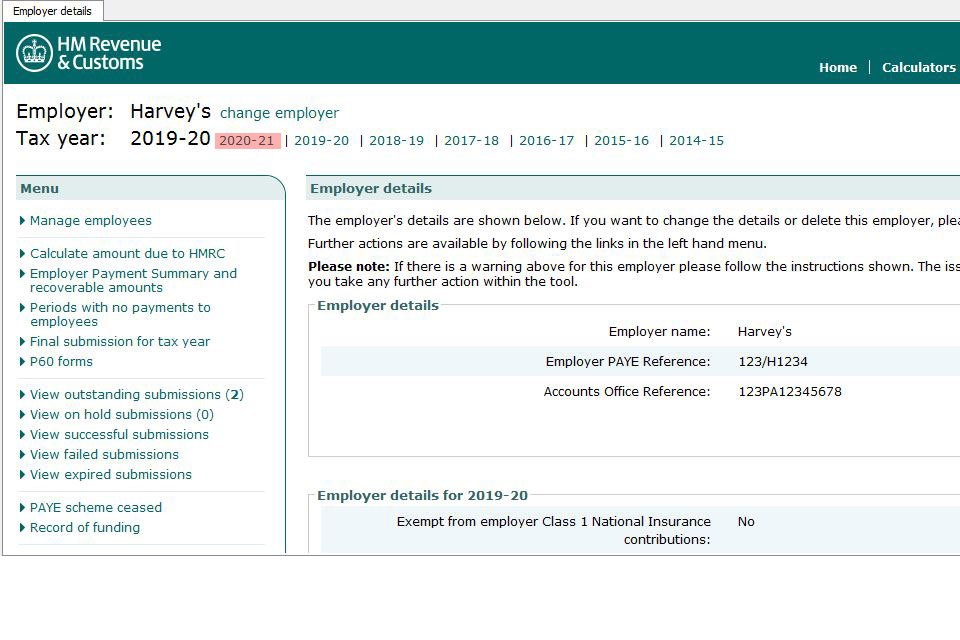

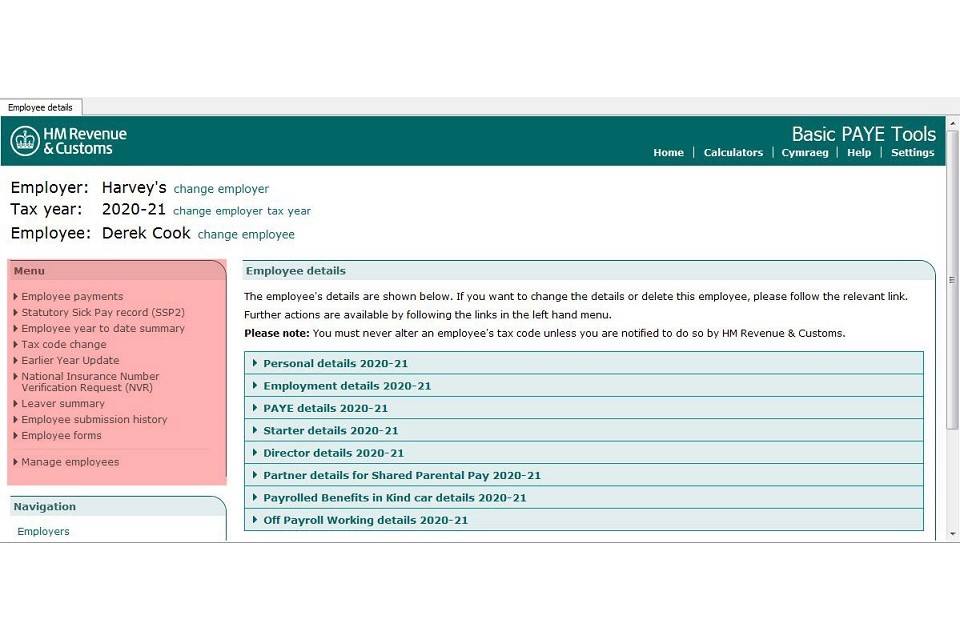

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

How To Check Your National Insurance Contributions Saga

How To Check Your National Insurance Contributions Saga

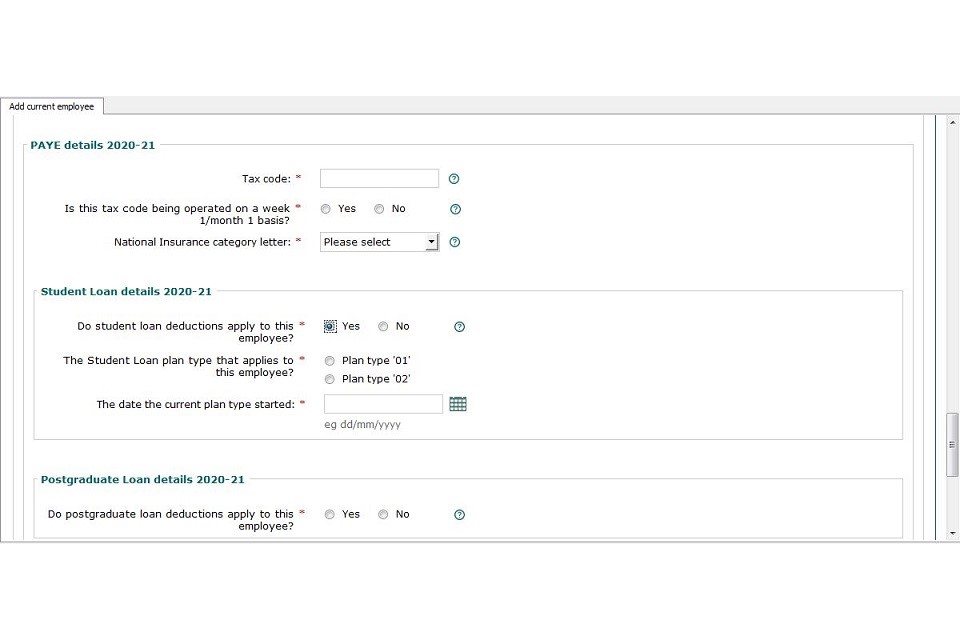

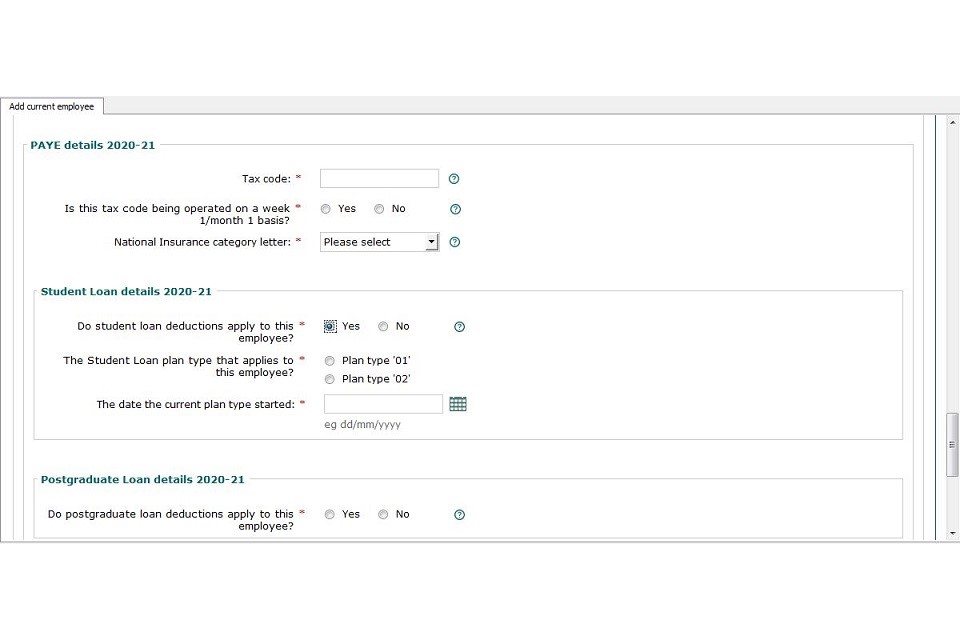

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

I Have Lost My National Insurance Number What Do I Do Worksmart The Career Coach That Works For Everyone

I Have Lost My National Insurance Number What Do I Do Worksmart The Career Coach That Works For Everyone

Indonesia Payroll What Is Bpjs How To Set Bpjs Statutory Settings Contribution In Deskera People

Indonesia Payroll What Is Bpjs How To Set Bpjs Statutory Settings Contribution In Deskera People

National Insurance How Much You Pay Gov Uk

National Insurance How Much You Pay Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

20 000 After Tax 2021 Income Tax Uk

20 000 After Tax 2021 Income Tax Uk

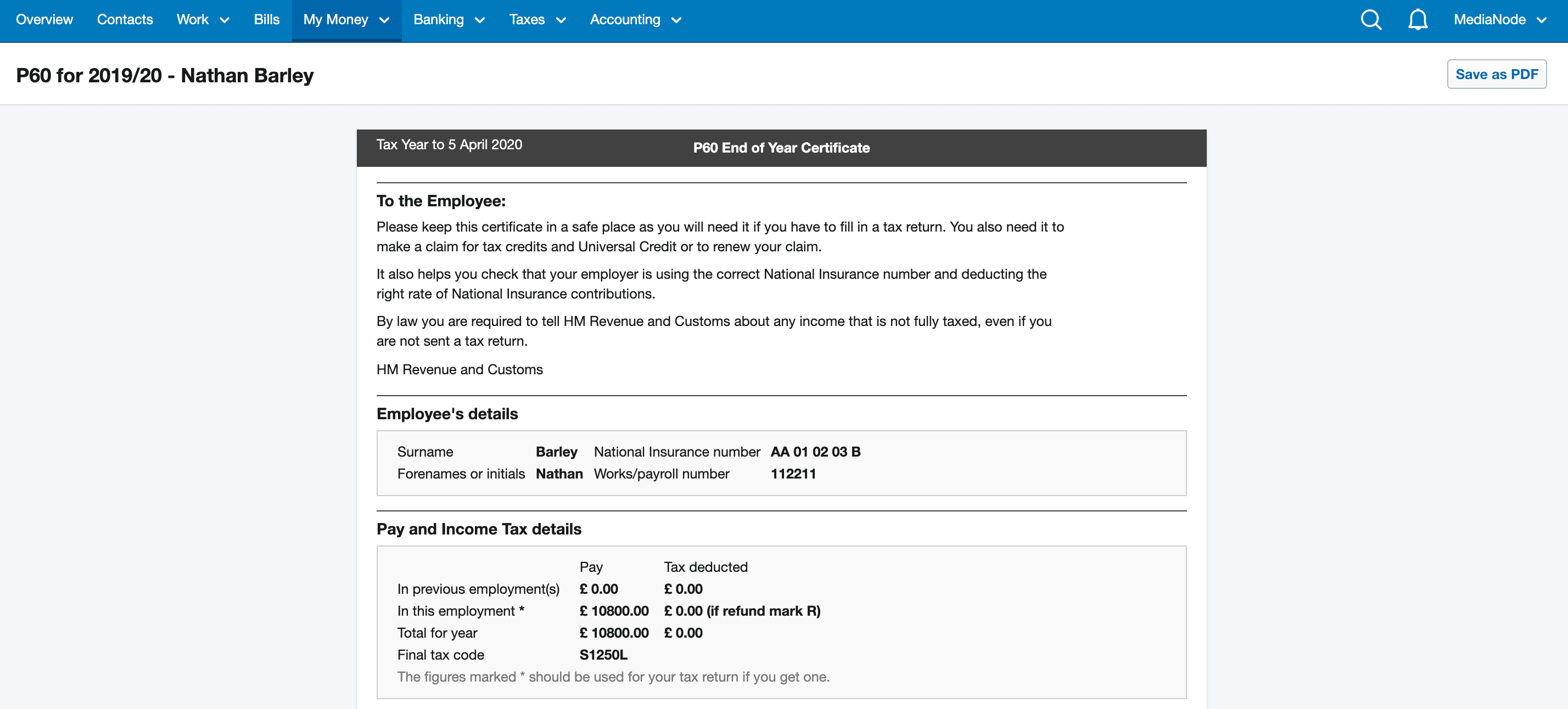

Accessing P60s In Freeagent Freeagent

Accessing P60s In Freeagent Freeagent

Expatnhis Jpg National Insurance Maternity Pay Uk States

Expatnhis Jpg National Insurance Maternity Pay Uk States

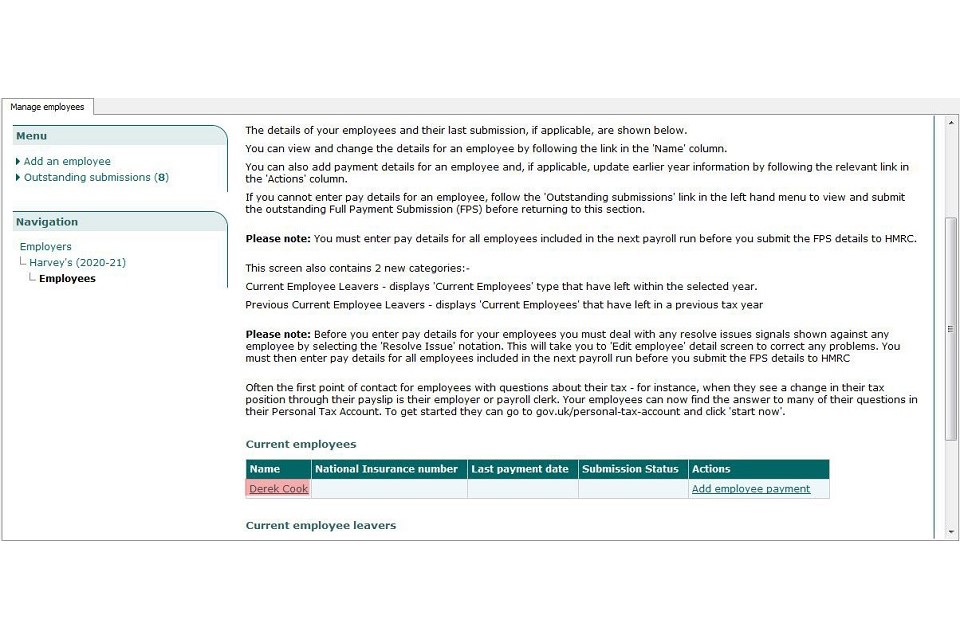

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Thanks for the information. One best thing to do to help you with any legal process is to hire a company formation service provider. They provide great solutions and guidance on specialist corporate support such as company registration, bank account creation, accounting, and tax optimization due to their extensive knowledge.

ReplyDeleteIn Hong Kong, they offered benefits that are uniquely available among other cities when it comes in taxes and insurance. Ang what also I love about there, even before I come, as a non-resident I can remotely open a local integrated Hong Kong bank account that is ideal for my banking needs as I start register company in Hong Kong.

ReplyDeleteThis blog on National Insurance Contributions was an eye-opener for me, especially in the context of my business venture. As I'm currently in the process of Hong Kong company formation, understanding the intricacies of contributions is crucial. The article brilliantly simplifies the concept, shedding light on how it impacts businesses.

ReplyDeleteFurthermore, it highlighted the significance of having a reliable company formation service provider in Hong Kong. Their expertise in handling these matters is indispensable. I'm grateful for stumbling upon this resource—it's proven to be incredibly insightful.