National Insurance Rates 2005/06

Ad Extensive Motor Insurance Policy. More than 45000 NI rate is 2 285 per week.

Ad Search Rates Insurance.

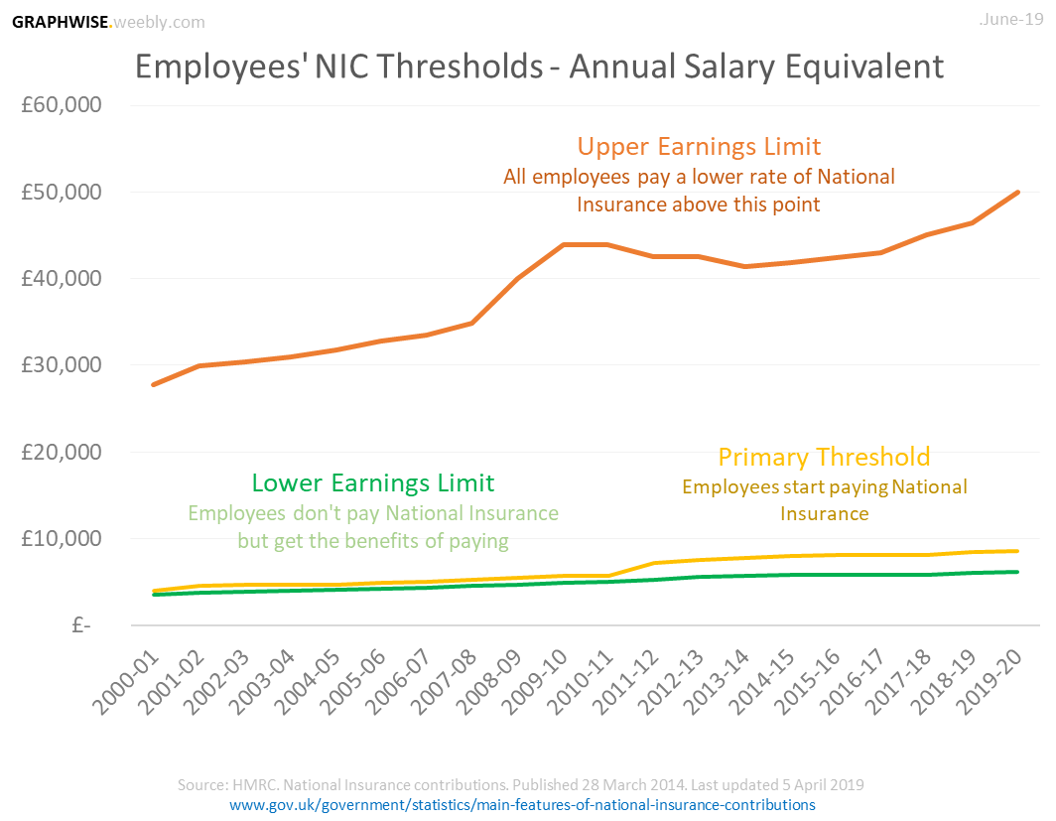

National insurance rates 2005/06. Upper weeekly earnings limit. Class 1 National Insurance rate. Lower weekly earnings limit.

Of the 55 as of April 2019 275 is to be deducted from the employees salary and matched by the employer. Rates allowances and duties have been updated. Youre a married woman or widow with a valid.

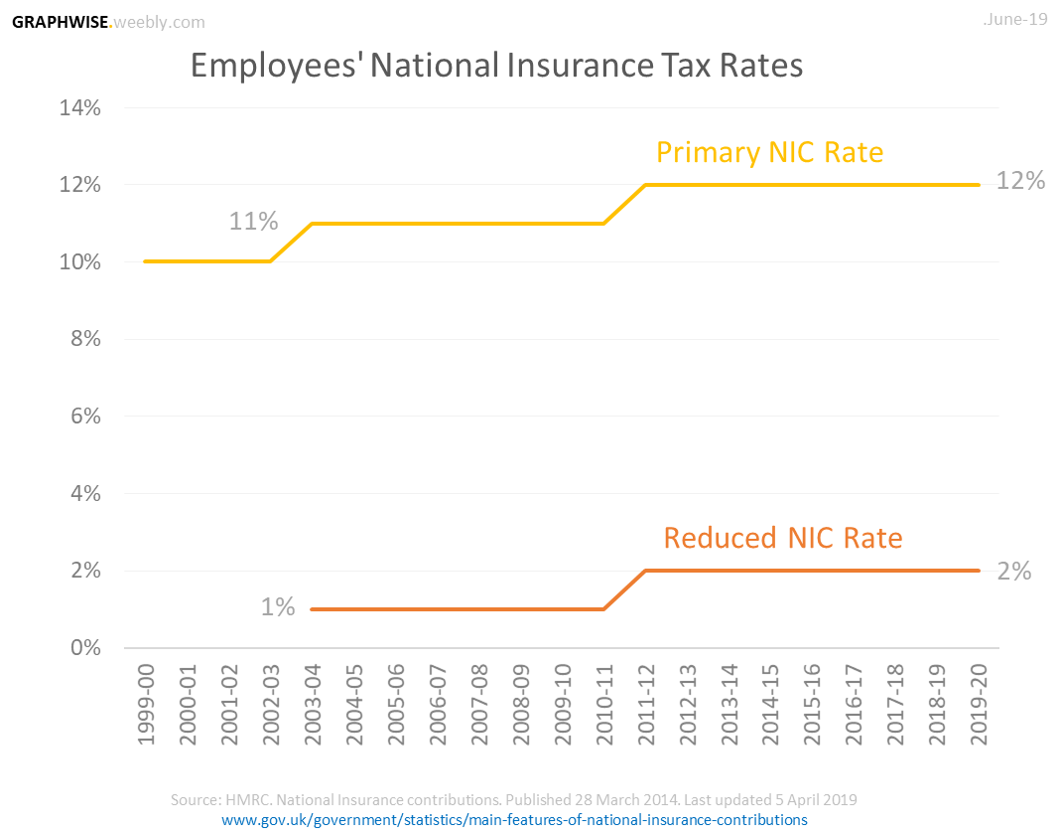

Employees rate contracted out 840. 184 to 967 a week 797 to 4189 a month 12. For those earning between 82 per week and 630 per week employers receive a rebate of 10 on contracted out money purchase schemes or 35 on contracted out final salary schemes and employees a rebate of 16 for either scheme.

If your earnings are less than 6025 then 0. Youll pay less if. Employees rate contracted in 10.

The contributions rate has increased from 5 to 55 effective April 1 2019 and will be increased from 55 to 6 effective April 1 2020. Upper Accrual Point UAP Employees with a contracted-out pension pay a lower rate of National Insurance up to this point. Initially it was a contributory form of insurance.

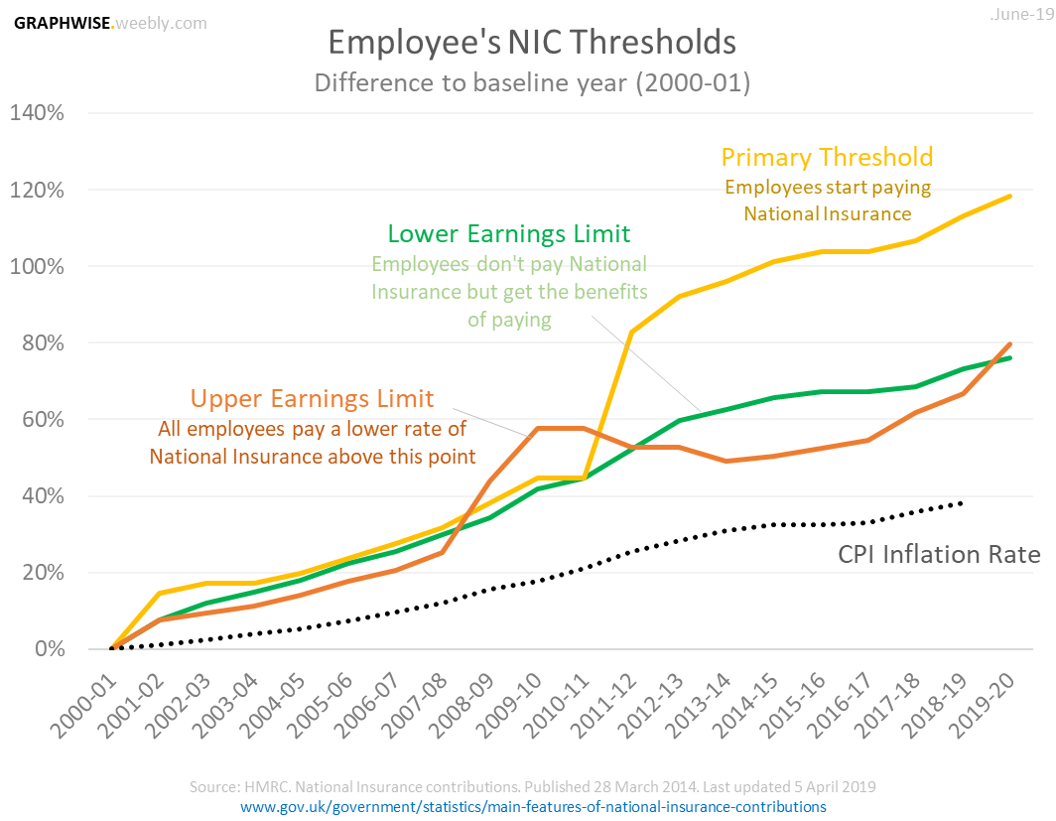

Rate in Rate in Rate in Rate in Rate in Rate in Rate in Rate in Rate in Rate in 1999-2000 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 Class 1 Lower earnings limit LEL a week 66 67 72 75 77 79 82 84 87 90 Primary threshold PT a week - 76 87 89 89 91 94 97 100 105. The rapid industrialization of our country has led to increasing use of machines in industryThough use of machinery results in increased production capacities in the event of accident and breakdowns they can be potential sources of financial loss and could even result in the closure of businessIn spite of proper care and maintenance of machinery mishap may yet occurSometimes the extent of damage may be. Employers start paying National Insurance.

Between 6025 to 8164 NI rate is 285 per week. Get Results from 6 Engines at Once. Between 8164 - 45000 NI rate is 9 285 per week.

Over 967 a week 4189 a month 2. National Insurance rates and thresholds Tax Class 2 Class 4 Percentage rates Year SEE LPL UPL LPL to UPL UPL 53 weeks Men Women 197576 675 241 210 1600 3600 8 - 197677 775 241 220 1600 4900 8 - 197778 875 266 255 175000 5500 8 - 197879 950 190 2000 6250 5 - 197980 1050 210 2250 7000 5 -. Ad Better Health Insurance for student Start at just 099day Save Money.

Ad Better Health Insurance for student Start at just 099day Save Money. Ad Search Rates Insurance. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948 the system has been subjected to numerous amendments in succeeding years.

Profit after allowable expenses. Get Free Quotation Buy Online Now. Get Free Quotation Buy Online Now.

National Insurance Calculation Example for the Self Employed. National Insurance is a fundamental component of the welfare state in the United Kingdom. 120 to 184 520 to 797 a month 18401.

An insurance holder that is a higher-rate taxpayer 40 in 2005-06 or ends up being one with the deal should pay tax obligation on the gain at the distinction in between the higher and the reduced price. Ad Extensive Motor Insurance Policy. Self-employed persons are to contribute the full 55.

National Insurance Rates for the Self Employed. Employee National Insurance rates. Get Results from 6 Engines at Once.

This publication includes information about the rates payable for the different National Insurance classes for the current and previous 3 tax years. This table shows how much employers deduct from employees pay for the 2021 to 2022 tax year. It acts as a form of social security since payment of NI contributions establishes entitlement to certain state benefits for workers and their families.

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

The Average First Time Full Time Tuition Discount Rate Edged Even Closer To 50 Percent In 2016 17 As Net Tuition Rev Tuition Colleges And Universities College

The Average First Time Full Time Tuition Discount Rate Edged Even Closer To 50 Percent In 2016 17 As Net Tuition Rev Tuition Colleges And Universities College

The Insurance Industry Has Been Turned Upside Down By Catastrophe Bonds Insurance Industry Insurance Turn Ons

The Insurance Industry Has Been Turned Upside Down By Catastrophe Bonds Insurance Industry Insurance Turn Ons

Pdf A Survey Of The Uk Tax System

Pdf A Survey Of The Uk Tax System

Hotel Housekeeping Resume Example In 2021 Job Resume Samples Resume Examples Resume Cover Letter Template

Hotel Housekeeping Resume Example In 2021 Job Resume Samples Resume Examples Resume Cover Letter Template

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Housing Ends Slide But Faces A Long Bottom Real Estate Infographic The New Normal Long Bottom

Housing Ends Slide But Faces A Long Bottom Real Estate Infographic The New Normal Long Bottom

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Papua New Guinea Selected Issues And Statistical Appendix Papua New Guinea Selected Issues And Statistical Appendix

Post a Comment for "National Insurance Rates 2005/06"