Class 2 National Insurance Abolished

The government has announced that Class 2 National Insurance contributions NIC will not be abolished in the current parliament. Get Free Quotation Buy Online Now.

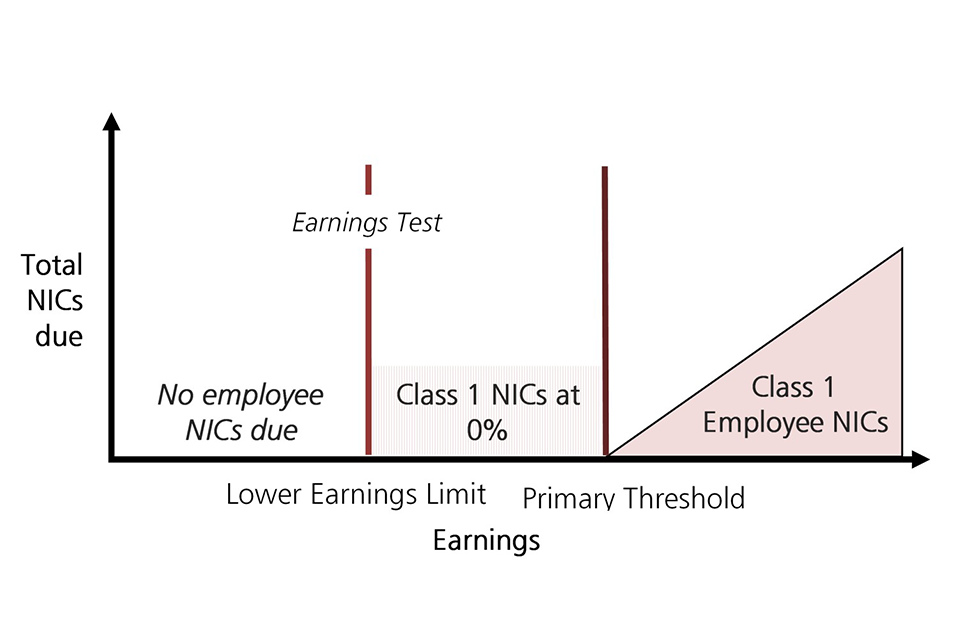

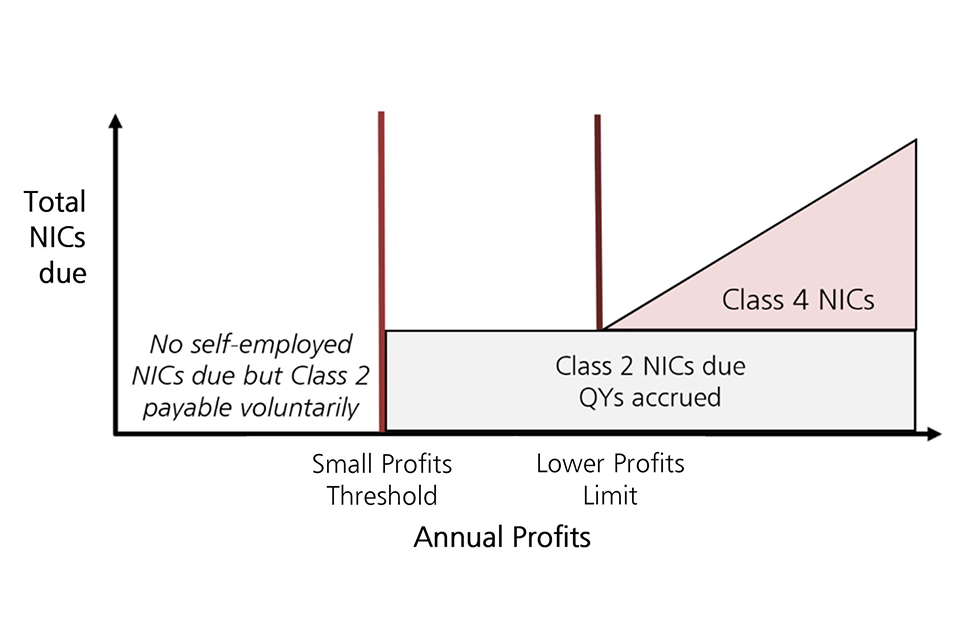

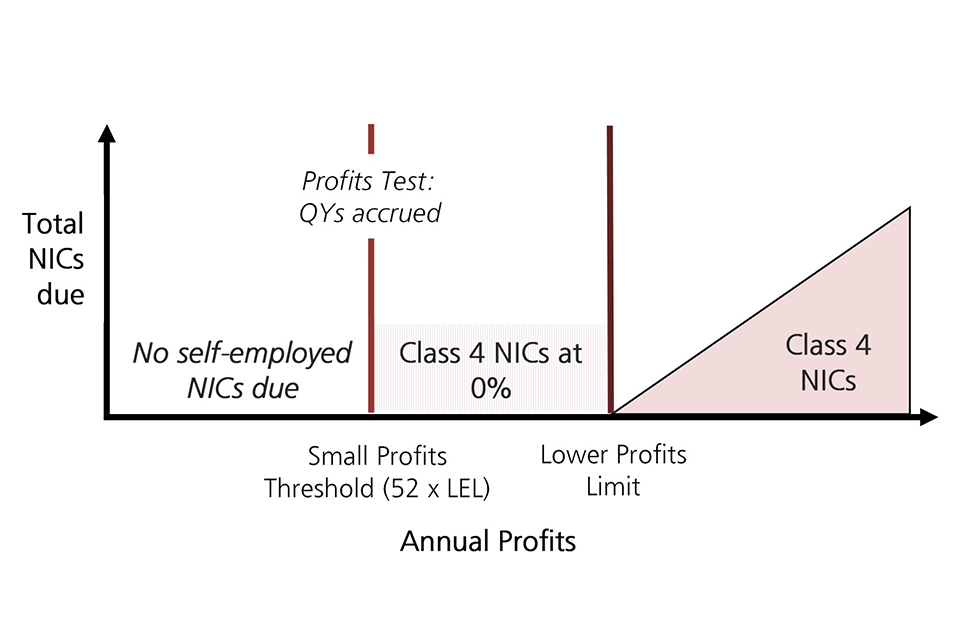

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

They were originally due to be abolished in April 2018 but the plans were delayed for a year until April 2019.

Class 2 national insurance abolished. Ad Extensive Motor Insurance Policy. National Insurance NI is a fundamental component of the welfare state in the United KingdomIt acts as a form of social security since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. 7 Sep 2018.

The government has announced that it is not going to proceed as planned with the abolition of Class 2 national insurance contributions NICs which was originally scheduled for April 2018 then delayed to April 2019. The two classes 2 and 4 are paid on different bands of income and at different rates. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948 the system has been subjected to numerous amendments.

It had been due to be abolished in April 2019. In a surprise announcement on 6 September the Treasury confirmed that class 2 NIC would not be abolished from 6 April 2019 as had been on the cards since 2017. National insurance contributions NIC for the self-employed are unreasonably complicated.

The Chancellor George Osborne is abolishing Class 2 National Insurance Contributions NIC in a bid to support the self employed and reform the Class 4 National Insurance contributions. At Autumn Statement 2016 the Chancellor confirmed that Class 2 contributions would be abolished from 6 April 2018 and published a response to the. Class 2 NICs are the tax you have to pay if youre self-employed and making more than 5885 profit a year.

The government has scrapped its plans to abolish Class 2 national insurance contributions NICs. Canning the NIC change will save the government 360m a year. Class 2 NICs are currently paid at a rate of 295 per week by self-employed individuals with profits of 6205 or more per year.

Ad Find Life Insurance Australia and Related Articles. Class 2 NIC is payable on self-employed profits currently at the rate of 295 per week. The government has decided not to proceed with plans to abolish Class 2 National Insurance Contributions NICs from April 2019.

Plans to abolish Class 2 NIC from April 2019 have been cancelled at least for the term of the current Parliament provoking headlines such as Philip Hammond scraps 150-a-year tax cut for self-employed. What are Class 2 NICs. Class 2 NICs are payable at a rate of 275 per week if you are self employed however those with profits below 5885 a year can apply for a small earnings.

Get Free Quotation Buy Online Now. Ad Find Life Insurance Australia and Related Articles. The government has now announced that Class 2 NICs will not be abolished.

It had been due to be abolished in April 2019. Ad Extensive Motor Insurance Policy. Class 2 National Insurance NIC Abolition Cancelled.

The Government is abolishing Class 2 National Insurance Contributions NICs after Chancellor George Osborne announced the changes as part of his Budget 2015 statement for the next parliament. Class 2 NIC is payable at a weekly fixed rate by the self employed. The Governments decision to go back on its proposal to abolish Class 2 national insurance contributions for the self-employed while prompting calls for a review of the national insurance system has also saved the self employed over 600 per annum.

Class 2 NI contributions will continue in 2019 Posted on September 11 2018 The government has announced that Class 2 National Insurance contributions NIC will not be abolished in the current parliament. Posted by Tax Guide 10 Sep 2018 Features 0.

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Join 5 People Right Now At Santander 123 Lite Offers 5 Cashback On Mobile Payments Car Lease Mobile Payments Lease

Join 5 People Right Now At Santander 123 Lite Offers 5 Cashback On Mobile Payments Car Lease Mobile Payments Lease

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

What Are Ins And Outs Of Two Wheeler Insurance Claim Process In March 2020 Insurance Claim Insurance Wheeler

What Are Ins And Outs Of Two Wheeler Insurance Claim Process In March 2020 Insurance Claim Insurance Wheeler

Racial Hierarchy In Philippines Hierarchy Racial Philippines

Racial Hierarchy In Philippines Hierarchy Racial Philippines

News Article Leks Co Lawyers Law Firm Jakarta Lawyer Indonesia Indonesia Law Office Jakarta Lawyer Law Firm Indonesia

News Article Leks Co Lawyers Law Firm Jakarta Lawyer Indonesia Indonesia Law Office Jakarta Lawyer Law Firm Indonesia

Government Delay To Nics Changes For Self Employed Welcomed National Insurance The Guardian

Government Delay To Nics Changes For Self Employed Welcomed National Insurance The Guardian

Pin By Advertisemant Com On News Indirect Tax National Independence Day

Pin By Advertisemant Com On News Indirect Tax National Independence Day

Universal Basic Income Pros And Cons Worst Idea Ever Basic Income

Universal Basic Income Pros And Cons Worst Idea Ever Basic Income

Changing Profession In Qatar Id Card Cards Renew Professions

Changing Profession In Qatar Id Card Cards Renew Professions

Government Scraps National Insurance Tax Cut For Uk Self Employed Mileiq Uk

Government Scraps National Insurance Tax Cut For Uk Self Employed Mileiq Uk

Self Employed Class 2 National Insurance Will Not Be Scrapped

Self Employed Class 2 National Insurance Will Not Be Scrapped

Last Chance To Increase Your Uk State Pension At Lower Class 2 Rates Mckinley Plowman

Last Chance To Increase Your Uk State Pension At Lower Class 2 Rates Mckinley Plowman

What Were The Reasons For The Abolition Of Slave Trade In Africa Quora

Pdf Abolish All Direct And Indirect Taxes

Pdf Abolish All Direct And Indirect Taxes

Read Why Was Slavery Abolished Three Theories Article Khan Academy

Read Why Was Slavery Abolished Three Theories Article Khan Academy

What Is The England Wales And Northwestern Europe Dna Ethnicity On Ancestry England Germany Wales England Northwestern

What Is The England Wales And Northwestern Europe Dna Ethnicity On Ancestry England Germany Wales England Northwestern

Post a Comment for "Class 2 National Insurance Abolished"