What Are The Minimum National Insurance Contributions

There is no upper limit on employers National Insurance NI payments. The rules for state pensions changed in 2016 meaning that the old rules no longer apply.

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

Ad Extensive Motor Insurance Policy.

What are the minimum national insurance contributions. National Insurance rates - what youll be charged in 2021-22. Accumulating 35 years of NI contributions means that you will qualify for a full state pension at the time of updating this article May 2020 currently set at 17520 per week. For 2021-22 the Class 1 National Insurance threshold is 9568 a year.

In 2021-22 you pay Class 2 contributions if you earn more than 6515 charged at 305 a week. To get the full State Pension. State Pension before 6 April 2016.

Paying voluntary National Insurance contributions If you have fewer than 30 qualifying years your basic State Pension will be less than 13425 per week but you might be able to top up by paying. If you earn less than this you wont pay National Insurance contributions. Ad Extensive Motor Insurance Policy.

You pay National Insurance contributions to qualify for certain benefits and the State Pension. The actual amount of Class 1 NIC you pay depends on what you earn up to the upper earnings limit which is 962 per week or 4167 per month for 202021. Over 967 a week 4189 a month 2.

You pay National Insurance contributions if you earn more than 184 a week for 202122. A minimum amount of contributions or credits is required for a year to count as a qualifying year towards your overall contributions record. 184 to 967 a week 797 to 4189 a month 12.

Self-employed National Insurance contributions. For 202021 the weekly rates of Class 1. An employee earning above.

You will need to show at least 10 years of National Insurance contributions to access any form of State. You may still get a qualifying year if you earn between 120 and 183 a week from one employer. If you are entitled to the new State Pension you need to have a set number of years on your National Insurance record to get the full amount.

If you earn at least 120 a week 6240 a year or are receiving working tax credit youll be making National Insurance contributions to the state pension. In addition your employer will be required to make a secondary contribution of 138 of earnings above 166 a week. Youll pay less if.

It currently costs 15 a week to make class three contributions. Or youre self-employed and paying whats known as Class 2 National Insurance contributions. You might not pay National Insurance contributions because youre earning less than 183 a week.

If you earn more youll pay 12 of your earnings between 9568 and 50270. If youre not working. A minimum of 10 years is required to receive a pro-rata portion of that full state pension.

Your National Insurance contributions are paid into a fund from which some state benefits are paid. Youll pay 2 on any earnings above 50270. For the current tax year which ends today it costs 3 a week for voluntary class two contributions.

Youre a married woman or widow. National Insurance Contributions. National insurance contributions Note 2010-11 2011-12 2012-13 2013-14 2014-15 Class 1 contributions Per week Per week Per Week Per Week Per Week Lower earnings limit 97 102 107 109 111 Earnings threshold primary for.

Get Free Quotation Buy Online Now. Class 1 National Insurance rate. You pay mandatory National Insurance if youre 16 or over and are either.

National Insurance is a tax on your earnings. For 202021 this threshold is 183 a week or 792 a month. Get Free Quotation Buy Online Now.

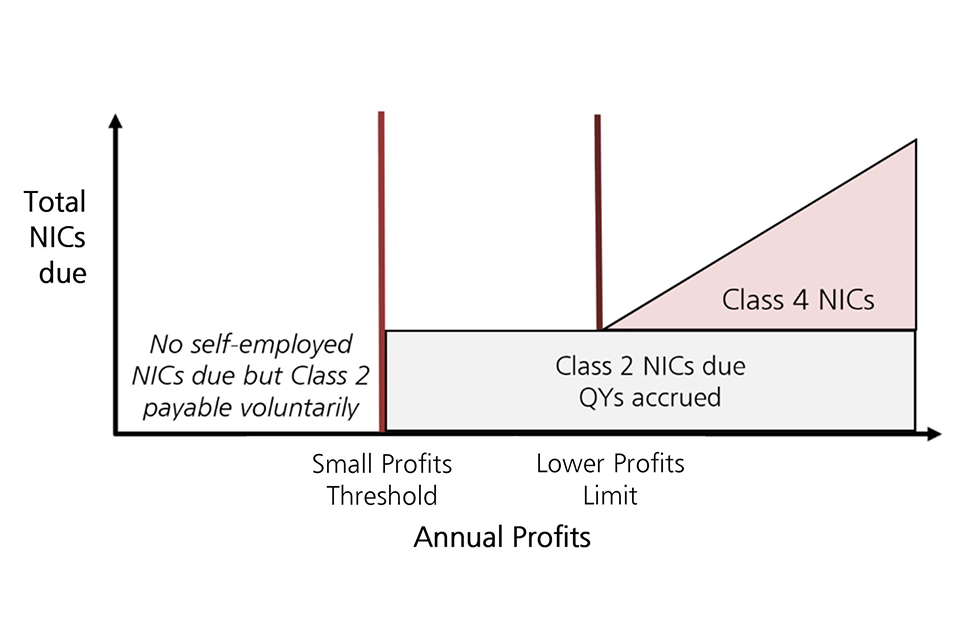

It is possible to backdate. If youre self-employed youll often pay Class 2 National Insurance contributions and Class 4 NICs as well. Your record comprises National Insurance Contributions paid or credited to you in each tax year.

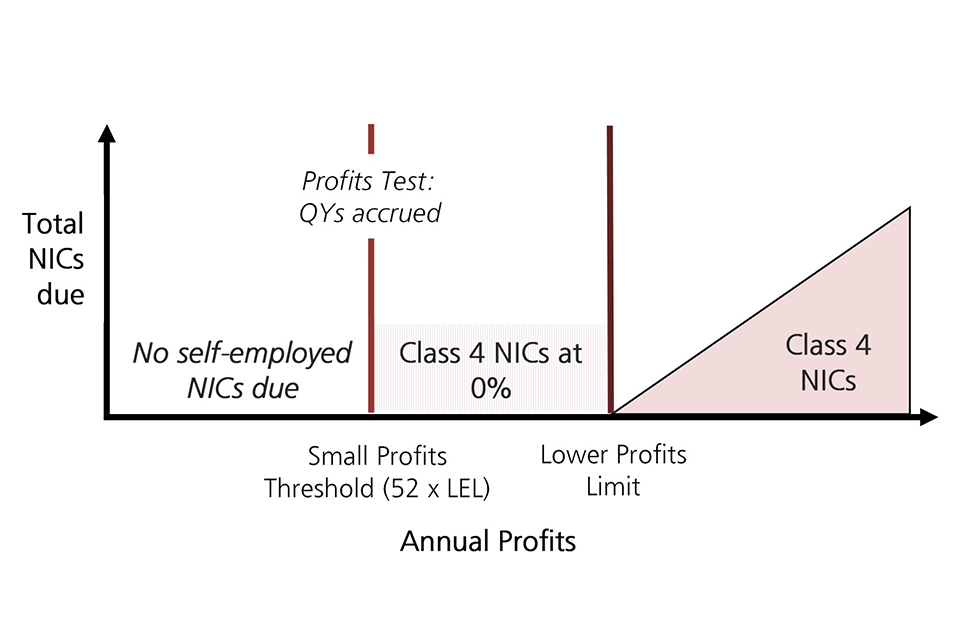

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

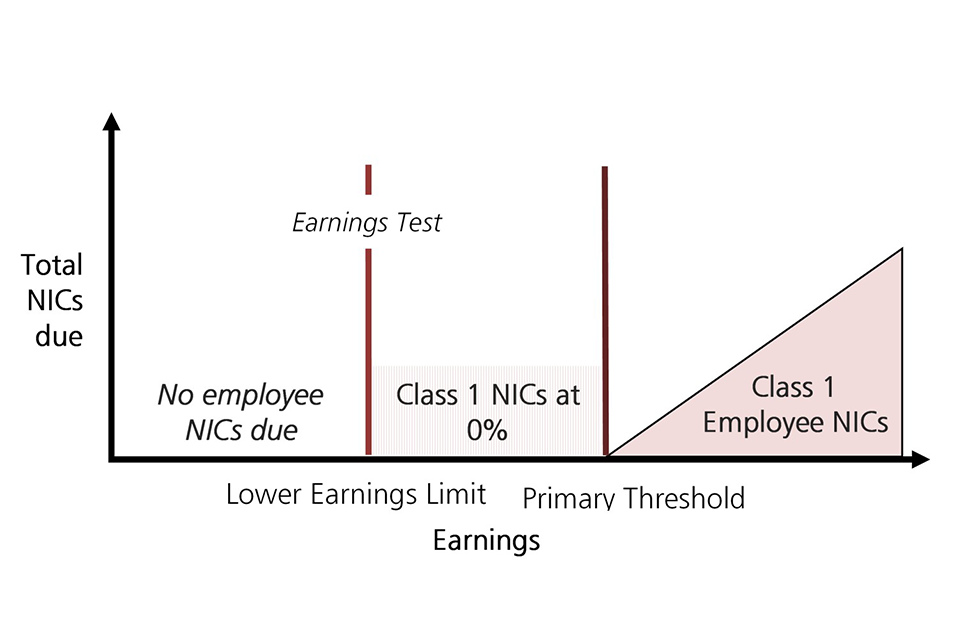

National Insurance How Much You Pay Gov Uk

National Insurance How Much You Pay Gov Uk

How Do I Get A National Insurance Number Low Incomes Tax Reform Group

How Do I Get A National Insurance Number Low Incomes Tax Reform Group

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

National Insurance Statement Of National Insurance Contributions Ca3916 Gov Uk National Insurance Statement National

National Insurance Statement Of National Insurance Contributions Ca3916 Gov Uk National Insurance Statement National

:max_bytes(150000):strip_icc()/profile-EricEstevez-4439ff1611f74bbfbabfc9fa32af2072.jpg) National Insurance Contributions Nic Definition

National Insurance Contributions Nic Definition

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Have You Lost Your P60 Get Replacement P60 On Original P60 Form We Provide Genuine Payslips Printe National Insurance Number Payroll Software Number Words

Have You Lost Your P60 Get Replacement P60 On Original P60 Form We Provide Genuine Payslips Printe National Insurance Number Payroll Software Number Words

How To Check Your National Insurance Contributions Saga

How To Check Your National Insurance Contributions Saga

National Insurance Nic Guide For It Contractors Contract Eye

National Insurance Nic Guide For It Contractors Contract Eye

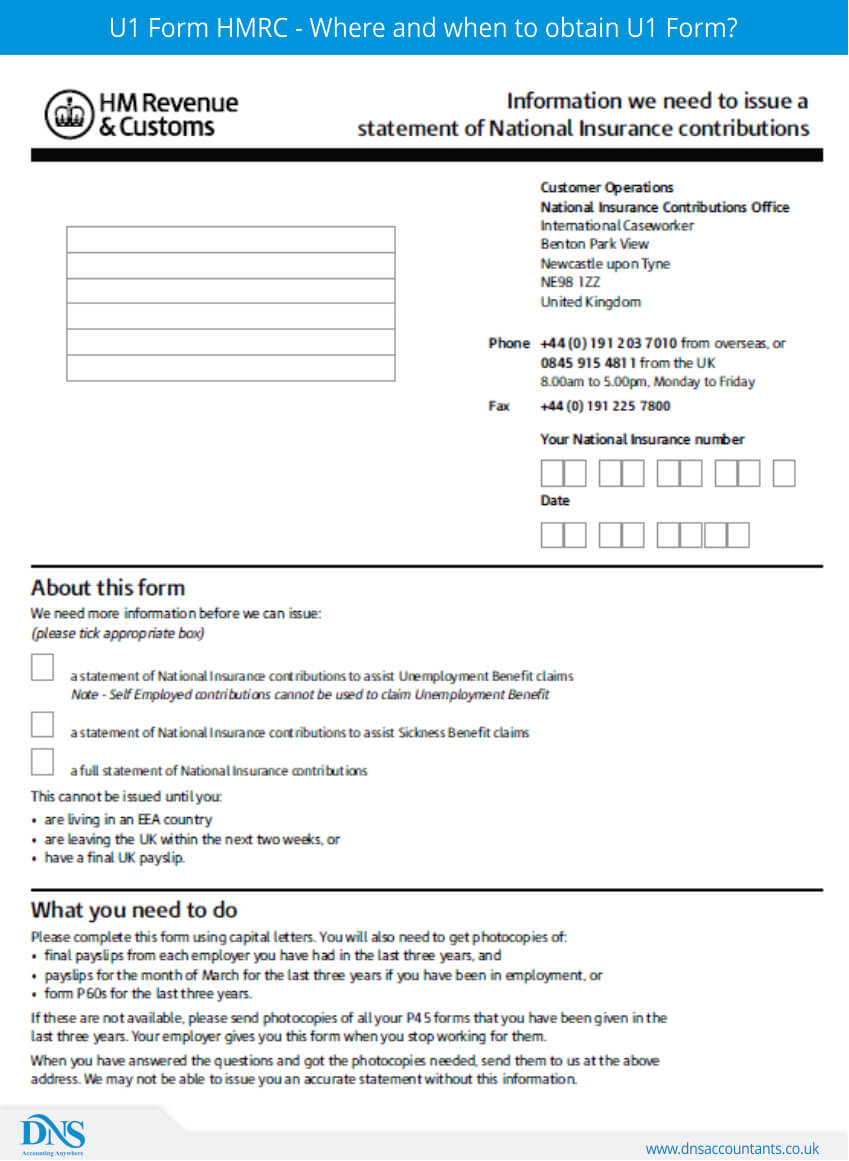

Where And When To Obtain U1 Form Use Of U1 Form Dns Accountants

Where And When To Obtain U1 Form Use Of U1 Form Dns Accountants

Will Class 2 National Insurance Contributions For The Self Employed Increase Coin Art National Insurance Coins

Will Class 2 National Insurance Contributions For The Self Employed Increase Coin Art National Insurance Coins

You Need To Know About Form P9d Which Designed Particularly Those People Who Earn Less Then 8 500 In A Year They Are National Insurance Contribution National

You Need To Know About Form P9d Which Designed Particularly Those People Who Earn Less Then 8 500 In A Year They Are National Insurance Contribution National

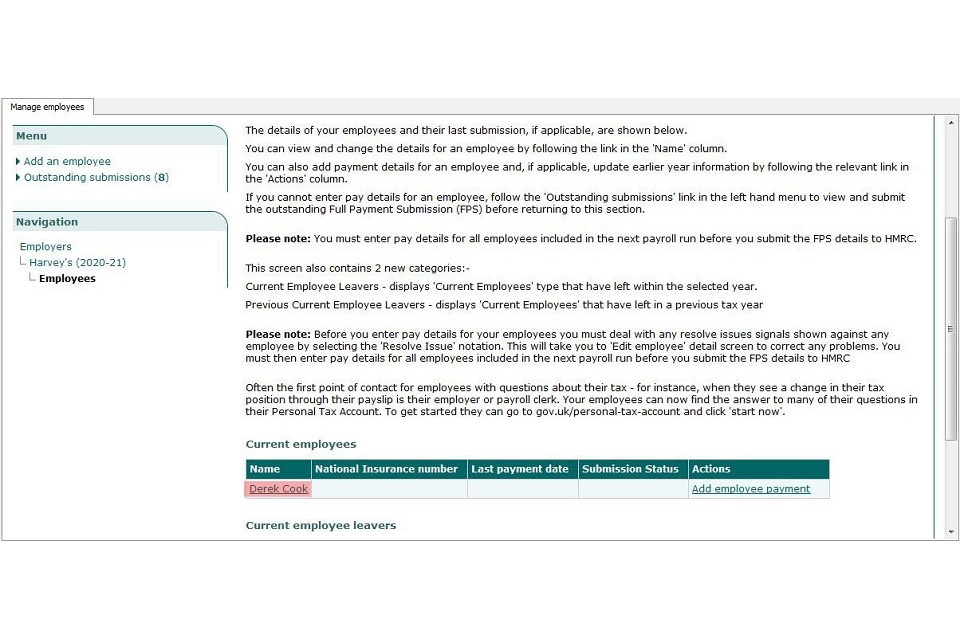

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Post a Comment for "What Are The Minimum National Insurance Contributions"