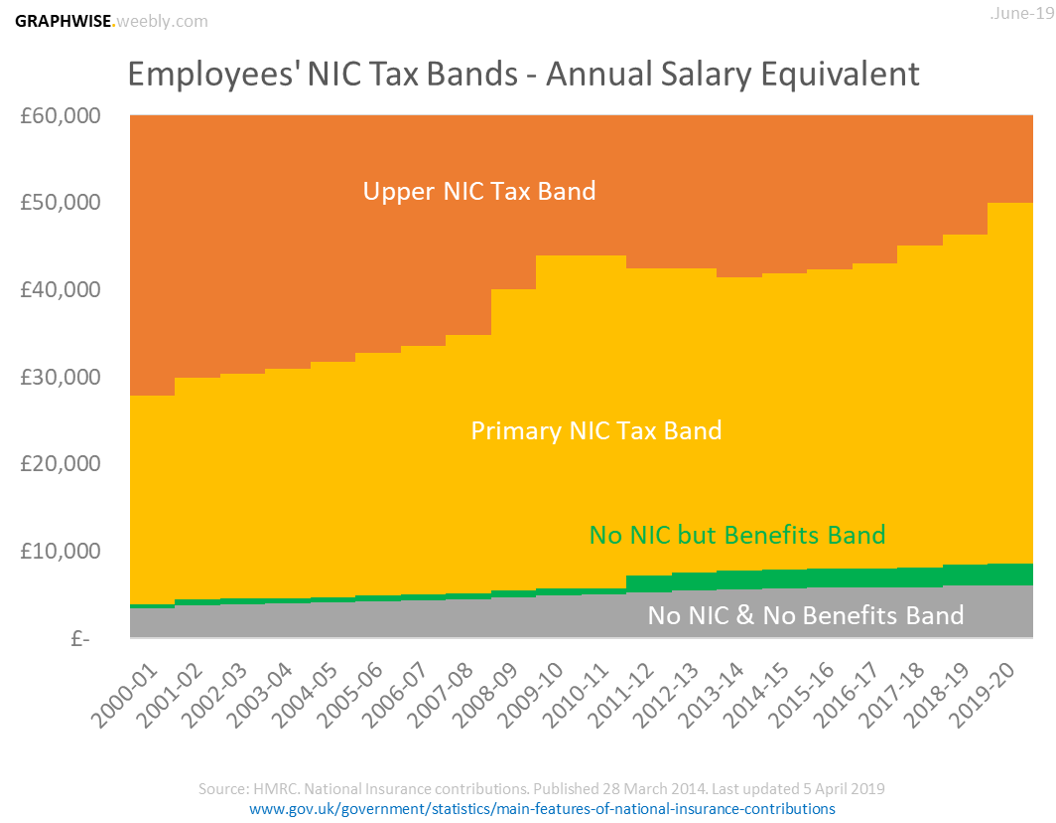

National Insurance Rates 2000/01

HM Revenue and Customs. Between 8164 - 45000 NI rate is 9 285 per week.

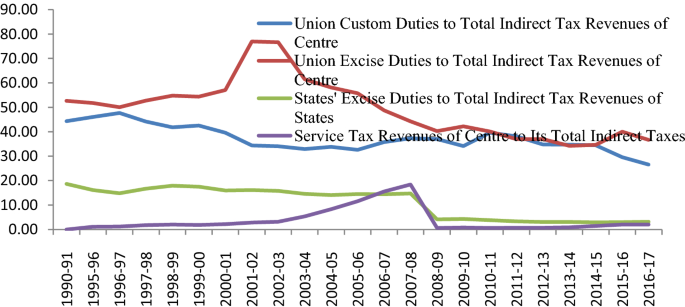

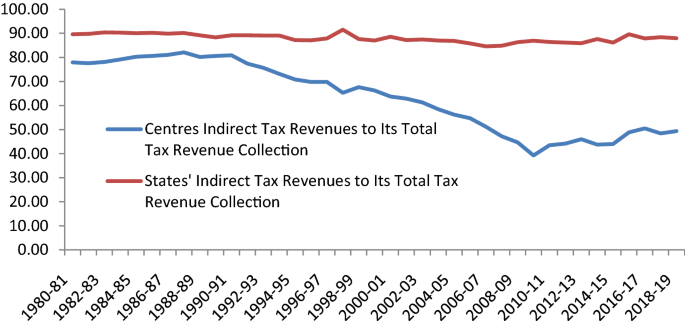

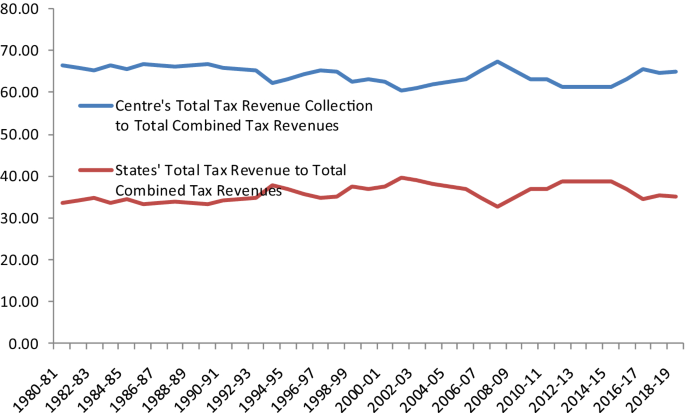

Do Governance Quality And Ict Infrastructure Influence The Tax Revenue Mobilisation An Empirical Analysis For India Springerlink

Do Governance Quality And Ict Infrastructure Influence The Tax Revenue Mobilisation An Empirical Analysis For India Springerlink

Self-employed and making a profit of 6515 or more a year.

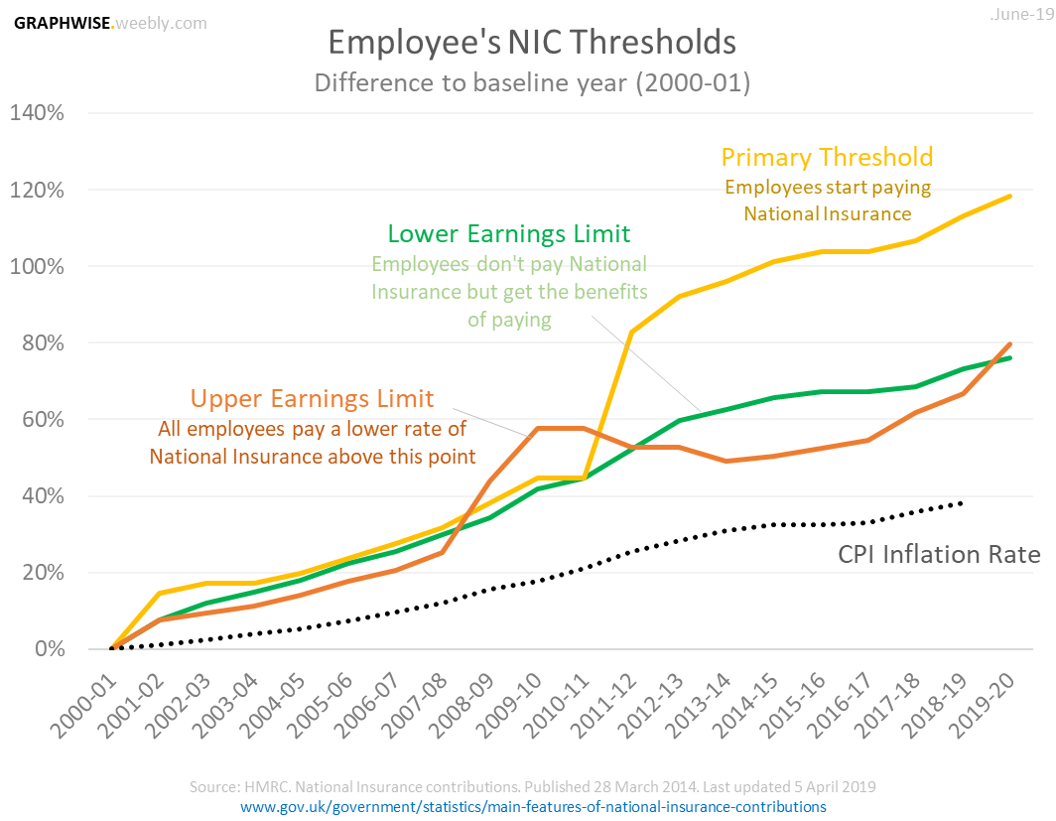

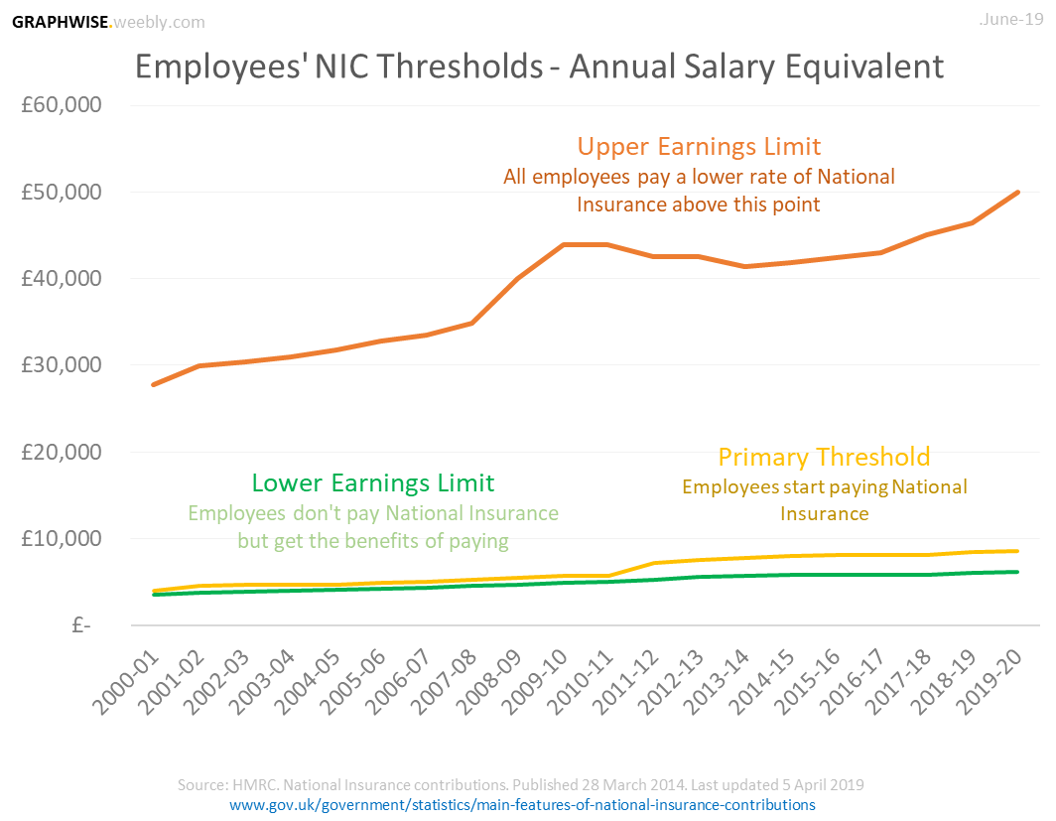

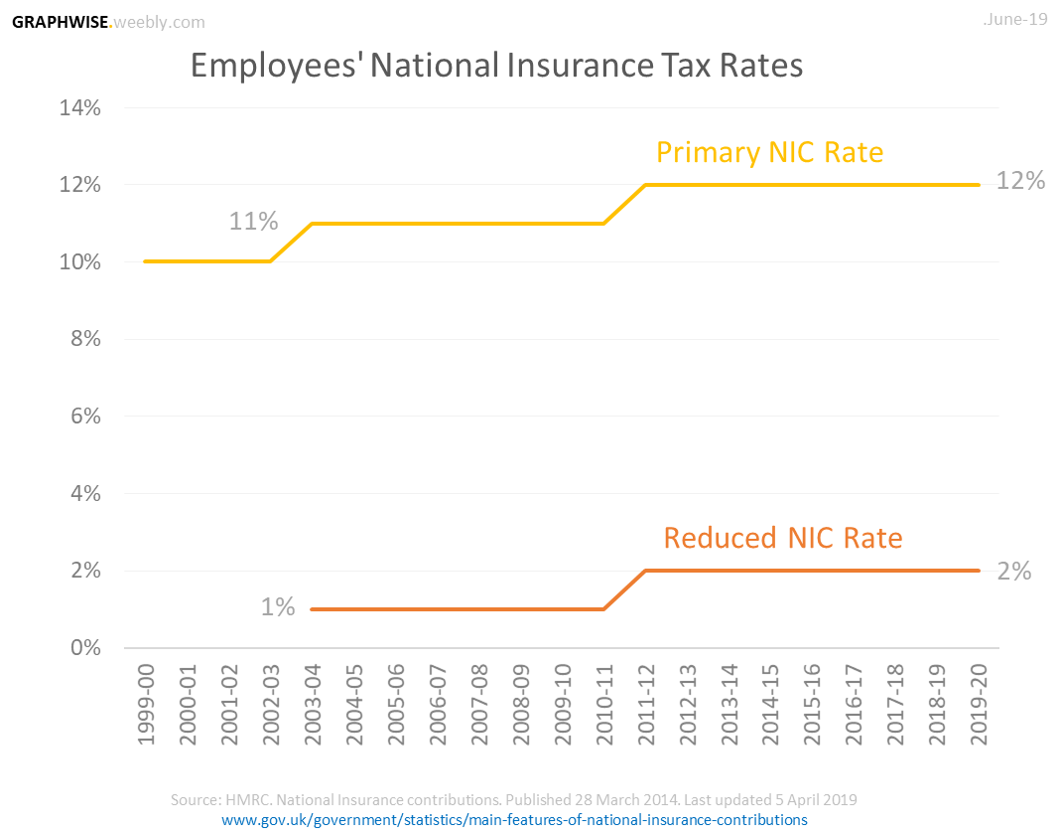

National insurance rates 2000/01. National Insurance rates and thresholds for 202122 202021 201920 201819 201718. An employee earning above 184 a week. The rates at which most employees pay National Insurance contributions are 12 from the Primary Threshold to the Upper Earnings Limit and 2 thereafter.

The contributions rate has increased from 5 to 55 effective April 1 2019 and will be increased from 55 to 6 effective April 1 2020. National Insurance is a fundamental component of the welfare state in the United Kingdom. National Insurance contributions tax receipts in the United Kingdom from 200001 to 201920 in billion GBP Chart.

You are required to pay GST at the rate of 18 for the premiums paid for National Insurance plans. Youll pay less if. There have been a large number of reforms made to the basis of National Insurance to be paid.

Employers start paying National Insurance. National Insurance Rates for the Self Employed. Shown below are the rates of National Insurance that have existed for the past 30 years.

Historic National Insurance rates. Self-employed persons are to contribute the full 55. More than 45000 NI rate is 2 285 per week.

Youre a married woman or widow. 184 to 967 a week 797 to 4189 a month 12. Upper Accrual Point UAP Employees with a contracted-out pension pay a lower rate of National Insurance up to this point.

Over 967 a week 4189 a month 2. If your earnings are less than 6025 then 0. Initially it was a contributory form of insurance.

Self-employed National Insurance rates. Comprehensive hub linking to government guidance on National Insurance including rates and categories National Insurance for the self-employed and UK National Insurance for those working outside the UK. You may be able to.

You pay National Insurance. Earlier the service tax on insurance was levied at 15. If youre self-employed you could pay two types of National Insurance.

This table shows how much employers deduct from employees pay for the 2021 to 2022 tax year. Of the 55 as of April 2019 275 is to be deducted from the employees salary and matched by the employer. National Insurance rates and thresholds Tax Class 2 Class 4 Percentage rates Year SEE LPL UPL LPL to UPL UPL 53 weeks Men Women 197576 675 241 210 1600 3600 8 - 197677 775 241 220 1600 4900 8 - 197778 875 266 255 175000 5500 8 - 197879 950 190 2000 6250 5 - 197980 1050 210 2250 7000 5 -.

Profit after allowable expenses. Self-employed workers will pay Class 2 contributions if they earn more than 6515 in addition to Class 4 if they earn more than 9568. Our risk based pricing system uses risk intelligence to deliver rates based on individual loan characteristics.

National insurance contributions are compulsory payments made by employees employers and the self-employed including partners towards certain state benefits. It is mandatory to take motor insurance policy for all vehicle owners as per Motor Vehicle Act 1988It safeguard against accidental damage or theft of the vehicle and also safeguard against third party legal liability for bodily injury andor property damageIt also provides Personal Accident cover for owner driver occupants of the vehicle. You pay Class 2 contributions if youre self-employed which are a flat rate of 305 per week in 2021-22 the same as in 2020-21.

Most notable by Nigel Lawson and Gordon Brown. National Insurance on GOVUK. This is up from 9500 in 2020-21 and 8632 in 2019-20.

It acts as a form of social security since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. You pay mandatory National Insurance if youre 16 or over and are either. For the 2021-22 tax year employees must pay National Insurance if they earn more than 9568 in the year.

Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948 the system has been subjected to numerous amendments in succeeding years. It included Basic Service Tax of 14 Swachh Bharat Cess of 05 and Krishi Kalyan Cess of 05. It offers an innovative way to get very competitive rates for your borrowers with National MIs Rate GPS.

The contributions are made at various different rates all figures quoted are for the 202021 tax year. National Insurance Calculation Example for the Self Employed. Between 6025 to 8164 NI rate is 285 per week.

Employee National Insurance rates. Product and Rates National MI is excited to bring you the latest in risk-based pricing technology Rate GPSSM. Class 1 National Insurance rate.

St Lucia St Lucia Statistical Appendix

St Lucia St Lucia Statistical Appendix

Alberta Cattle Prices Per Hundred Weight From 2000 01 Through 2015 16 Download Scientific Diagram

Alberta Cattle Prices Per Hundred Weight From 2000 01 Through 2015 16 Download Scientific Diagram

Islamic Republic Of Iran Selected Issues And Statistical Appendix Islamic Republic Of Iran Selected Issues And Statistical Appendix

Islamic Republic Of Iran Selected Issues And Statistical Appendix Islamic Republic Of Iran Selected Issues And Statistical Appendix

Islamic Republic Of Iran Selected Issues And Statistical Appendix Islamic Republic Of Iran Selected Issues And Statistical Appendix

Islamic Republic Of Iran Selected Issues And Statistical Appendix Islamic Republic Of Iran Selected Issues And Statistical Appendix

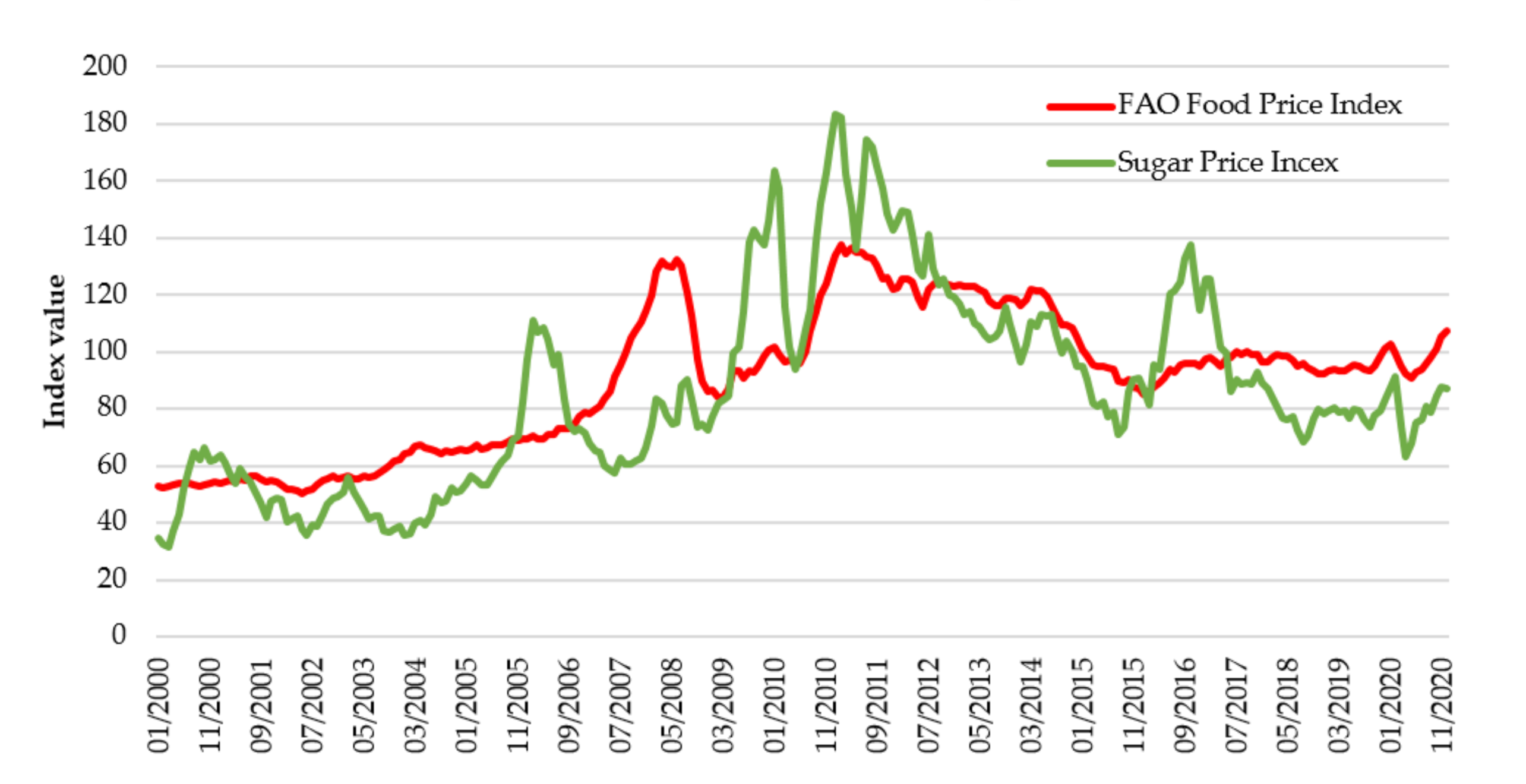

Agriculture Free Full Text Sugar Prices Vs Financial Market Uncertainty In The Time Of Crisis Does Covid 19 Induce Structural Changes In The Relationship Html

Agriculture Free Full Text Sugar Prices Vs Financial Market Uncertainty In The Time Of Crisis Does Covid 19 Induce Structural Changes In The Relationship Html

Do Governance Quality And Ict Infrastructure Influence The Tax Revenue Mobilisation An Empirical Analysis For India Springerlink

Do Governance Quality And Ict Infrastructure Influence The Tax Revenue Mobilisation An Empirical Analysis For India Springerlink

Turkey Turkey Eighth Review Under The Stand By Arrangement Staff Report Staff Statement And News Brief On The Executive Board Discussion

Turkey Turkey Eighth Review Under The Stand By Arrangement Staff Report Staff Statement And News Brief On The Executive Board Discussion

Progress And Challenges In Eliminating Illegal Fishing Vince Fish And Fisheries Wiley Online Library

Progress And Challenges In Eliminating Illegal Fishing Vince Fish And Fisheries Wiley Online Library

Miroslav Satan 38 2000 01 Upper Deck Vintage Hockey Upper Deck Hockey Hockey Cards

Miroslav Satan 38 2000 01 Upper Deck Vintage Hockey Upper Deck Hockey Hockey Cards

Do Governance Quality And Ict Infrastructure Influence The Tax Revenue Mobilisation An Empirical Analysis For India Springerlink

Do Governance Quality And Ict Infrastructure Influence The Tax Revenue Mobilisation An Empirical Analysis For India Springerlink

Colin Gordon Median Wage And Job Based Health Coverage By State 2000 And 2010 Health Job Chart

Colin Gordon Median Wage And Job Based Health Coverage By State 2000 And 2010 Health Job Chart

Customs Duty Tax Receipts Uk 2020 Statista

Customs Duty Tax Receipts Uk 2020 Statista

Republic Of Palau Republic Of Palau Recent Economic Developments

Republic Of Palau Republic Of Palau Recent Economic Developments

Omg Texting Turns Twenty Short Message Service First Text Message Texts

Omg Texting Turns Twenty Short Message Service First Text Message Texts

Post a Comment for "National Insurance Rates 2000/01"