National Insurance 1a

Class 1A National Insurance contribution liabilities arising on the provision of a company car in the 20202021 and 20212022 tax years must be paid and reported through the P11Db process. Exclusions from the class 1a charge.

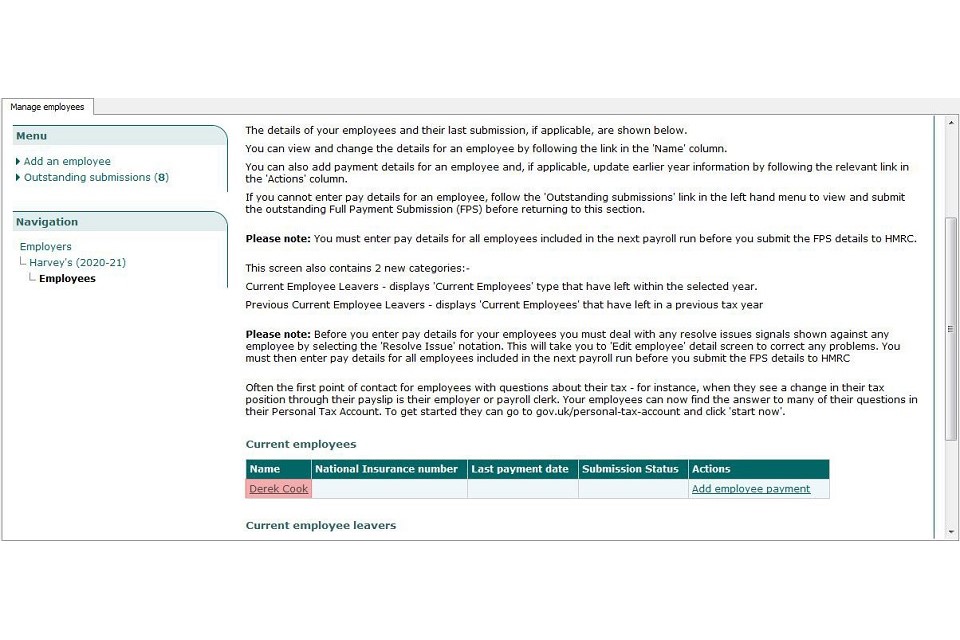

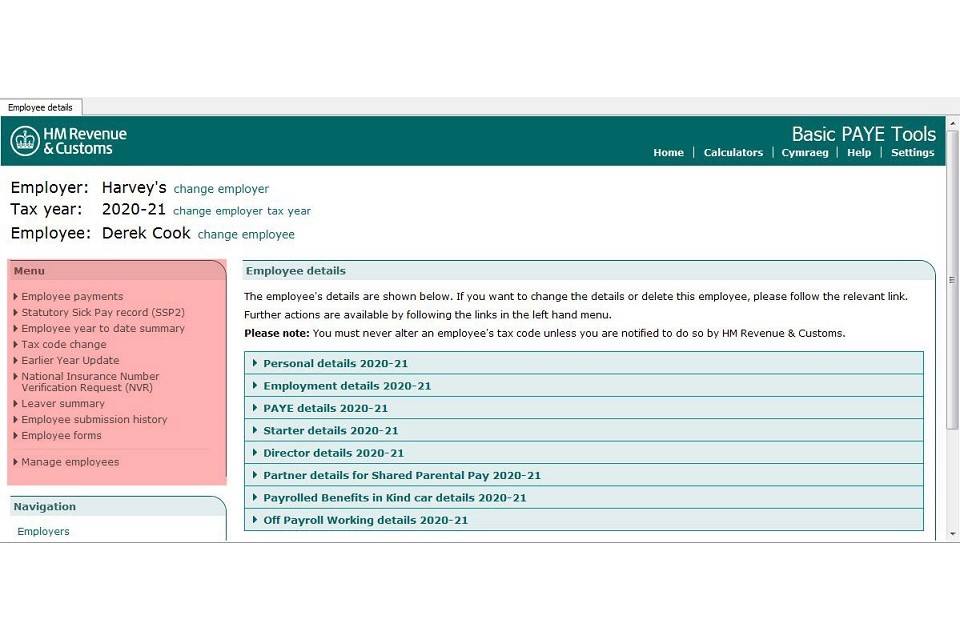

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

The 2021-22 employer guide to Class 1A National Insurance Contributions NICs on benefits in kind termination payments and sporting testimonial payments has been published on GOVUK.

National insurance 1a. Calculating the class 1a charge. Class 1 National Insurance. Employers pay these contributions directly on the expenses or benefits of their employees.

Class 1A is paid by employers. Note that you may have to calculate the monetary value of the benefits and then calculate the Class 1 A NIC payable based on the benefits monetary value. CWG52015 Class 1A NICs on benefits in kind is the main guide about Class 1A NICs on benefits.

Class 1A NIC is paid by employers on behalf of the benefits provided to employees. What benefits are liable for Class 1A NICs when liability for Class 1A. Employees earning more than 166 a week and under State Pension age -.

Class 1 Class 2 Class 3 and Class 4. What benefits are liable for Class 1A NICs when liability for Class 1A. Employers pay Class 1A and 1B National Insurance on expenses and benefits they give to their employees.

You must pay Class 1A National Insurance contributions on work benefits you give to your employees such as a company mobile phone. The class of National Insurance applicable to you very much depends on your working practices. Overview of class 1a national insurance contributions.

Class 1A National Insurance contributions are due on the amount of termination awards paid to employees which exceed 30000 and on the amount of. Benefits provided by a third party. These are the four classes of National Insurance.

Class 1A National Insurance contributions NICs are due on most taxable benefits including car and fuel benefits. Find out more about National Insurance on our accounting glossary. Class 1A is paid by employers.

Benefits including car and fuel benefits. Ad Extensive Motor Insurance Policy. CWG52013 Class 1A NICs on benefits in kind is the main guide about Class 1A NICs on benefits.

Ad Extensive Motor Insurance Policy. Liability to class 1a national insurance contributions. Employers National Insurance is a type of Class 1 National Insurance that employers have to pay to HMRC in respect of their employees wages.

National Insurance Class Who Should Pay National Insurance Contributions. From this date a new Class 1A NIC liability is introduced on non-contractual cash or cash equivalent taxable termination awards over a 30000 threshold which have not already incurred a Class 1 NIC liability as earnings. Class 1A NIC is paid by employers on behalf of the benefits provided to employees.

Employees who earn over 183 a week and under State Pension age NI is automatically deducted by your employer Class 1A or 1B National Insurance. Class 1A National Insurance is 138 of the end of your taxable benefit total. Effect of method of providing benefits on liability.

Get Free Quotation Buy Online Now. Class 1A National Insurance contributions NICs are due on most taxable. Get Free Quotation Buy Online Now.

For example if you have provided 12000 of private medical insurance for the tax year that tax is due to be paid by way of P11D or payrolling benefits. They must also pay Class 1A on some other lump sum payments for example redundancy payments. Collection of class 1a national insurance contributions.

Liability to class 1a national insurance contributions. Benefits provided by a third party. The guide explains what employers need to know in relation to Class 1A NICs and details when Class 1A NICs are due alongside how they are calculated reported and paid.

Note that you may have to calculate the monetary value of the benefits and then calculate the Class 1 A NIC payable based on the benefits monetary value. Collection of class 1a national insurance contributions. Calculating the class 1a charge.

One recent change effective from 6 April 2020 is in respect of a Class 1A NIC on Termination Awards. Effect of method of providing benefits on liability. Exclusions from the class 1a charge.

For full details of how employers should pay towards all employees National Insurance including rebates and special rates check the HMRC website. Overview of class 1a national insurance contributions.

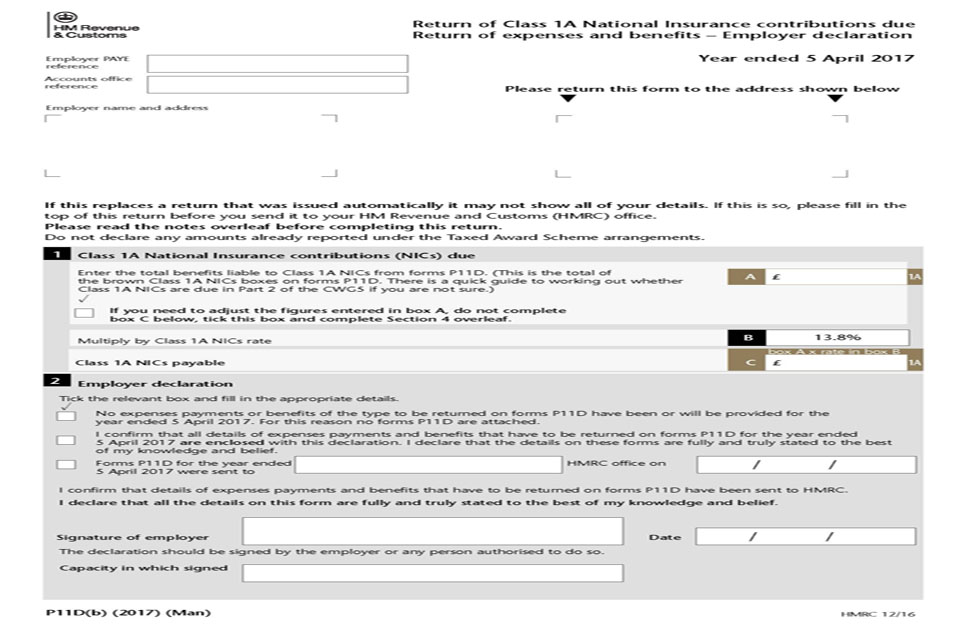

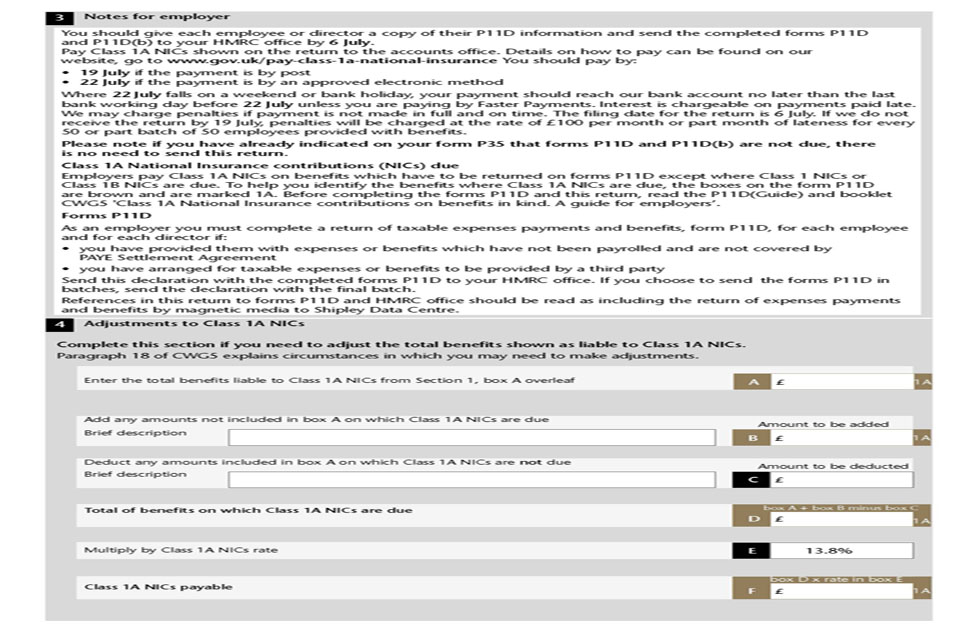

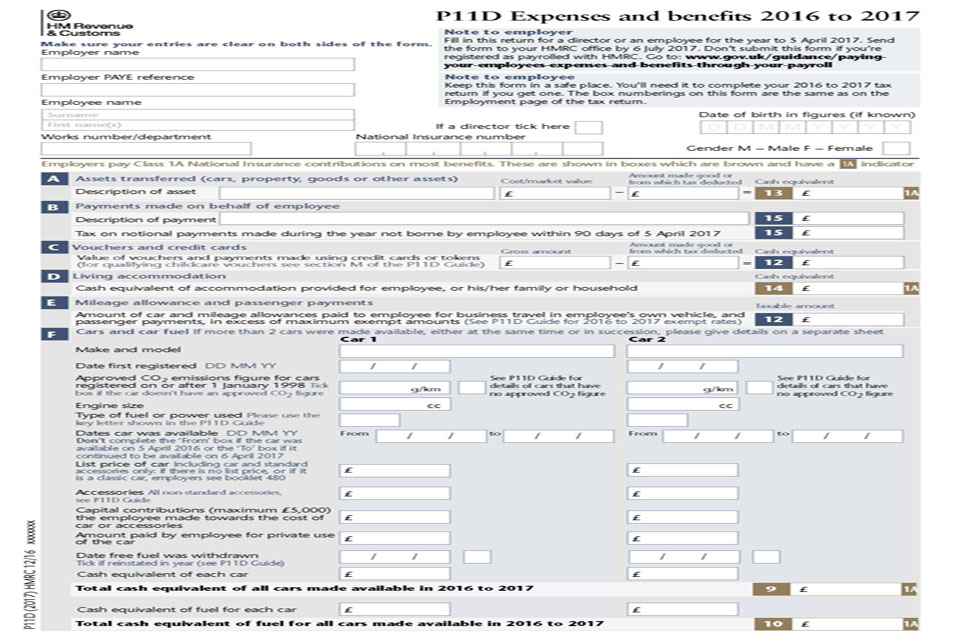

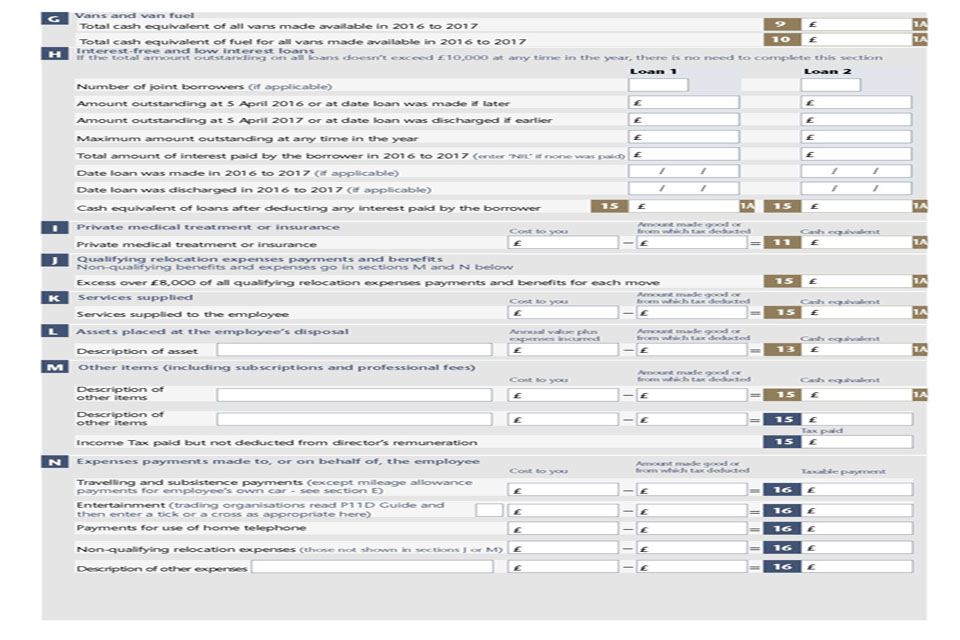

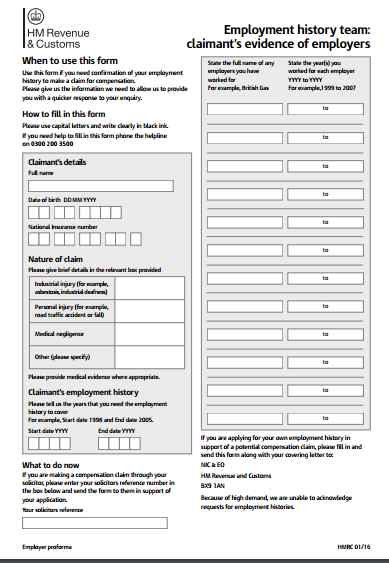

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

National Insurance Contributions And Overview Dns Associates

National Insurance Contributions And Overview Dns Associates

What Are National Insurance Contributions Informi

What Are National Insurance Contributions Informi

Employer Costs For Company Car Tax Enhanced Capital Allowance

Employer Costs For Company Car Tax Enhanced Capital Allowance

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

What Is An A1 Certificate Finnish Centre For Pensions

What Is An A1 Certificate Finnish Centre For Pensions

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

National Insurance Contributions And Overview Dns Associates

National Insurance Contributions And Overview Dns Associates

P11d B Form Return Of Class 1a National Insurance Contributions

P11d B Form Return Of Class 1a National Insurance Contributions

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

National Insurance Contributions And Overview Dns Associates

National Insurance Contributions And Overview Dns Associates

You Need To Know About Form P9d Which Designed Particularly Those People Who Earn Less Then 8 500 In A Year They Are National Insurance Contribution National

You Need To Know About Form P9d Which Designed Particularly Those People Who Earn Less Then 8 500 In A Year They Are National Insurance Contribution National

Vacant Position Of Manager Audit In National Insurance Company Limited Nicl Karachi Jobs 2020 In 2020 National Insurance Insurance Company Management

Vacant Position Of Manager Audit In National Insurance Company Limited Nicl Karachi Jobs 2020 In 2020 National Insurance Insurance Company Management

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Post a Comment for "National Insurance 1a"