Income Tax V National Insurance

Calcutta High Court 3 Aug 1977 3 Aug 1977. However the amount youll have to pay is fixed and you might want a reduction.

P45 Vs P60 What S The Difference Revolut

P45 Vs P60 What S The Difference Revolut

This means if you earn extra in one month youll pay extra National Insurance but you wont be able to claim the extra back even if your pay is lower during the other months of the tax year.

Income tax v national insurance. Whether on the facts and in the circumstances of the case the Tribunal was justified in holding that the provision of pension of Rs. Here youll find all that you should know about tax and national insurance. Chancellor Rishi Sunak announced both the personal allowance and higher-rate thresholds along with National Insurance thresholds will increase by 05 from 6 April 2021.

This is just a simple set of questions with varying levels of difficulty. Unlike Income Tax National Insurance is not an annual tax. The idea of merging income tax and national insurance NI has reared its head again recently but the effect on pensioners makes the issue a political hot potato.

Income Tax and National Insurance questions 2020-2021 December 14 2020. Your annual bonus if you get one is treated as if its part of your normal wages. Theres nothing particularly special about the questions but they are up to date and just provide more practice.

1996 221 ITR 778 Cal. It applies to your pay each pay period which might be monthly weekly or some other period depending on your employers arrangements. 2005-062006-07 DCIT Circle-6 -versus- National Insurance CoLtd.

Understanding personal taxes - income tax and national insurance. Shri Niraj Kumar CITDR For the Respondent. 20 Up to 37 500 Higher.

The amount of income tax and national insurance you pay depends on how much you earn. Income Tax and National Insurance practice questions Income Tax 2020-2021 Everyone in the UK has a personal allowance. There are two main types of personal tax that you may have to pay on what you earn.

Commissioner Of Income-Tax vs National Insurance Co. 131279 represented on accrued liability and was an admissible deduction in computing the profits of the assessee-company for the assessment year 1972-73 The assessee was a foreign company carrying on insurance. 1 IN THE INCOME TAX APPELLATE TRIBUNAL BENCH B KOLKATA Before Honble Shri NVVasudevan JM Shri MBalaganesh AM ITA Nos606675Kol2012 Assessment Years.

40 Over 37 500 and up to 150 000 National Insurance 2020-2021 Percentage NI due Min weekly income Max weekly income. Income tax and National Insurance thresholds to rise in 2021-22 but will remain frozen until 2026 according to todays Budget speech. Who is Liable to Pay Income Tax.

Income tax is the governments main source of income making up 30 of all money generated in the country. Act 1961 the following question has been referred to this court. It pays for the NHS education roads defence and infrastructure among other things.

On 21 April 1995. National insurance is a way to make sure that you can avail of various types of government benefits when you need them. K Agarwal M G Mukherji.

A recent case in Israel in the Haifa Region Labor Court dealt with a head-on conflict between Israels income tax and national insurance rules Hausa Gas Station Ltd David Kahana Uri Katz v. Youll pay tax and National Insurance on it through PAYE in the usual way. As announced at Spending Review 2020 the government will increase the income tax Personal Allowance and higher rate threshold and all National Insurance contributions NICs thresholds for 2021.

Different to national insurance income tax is money taken from your salary and other income to pay for the country as a whole. If you get money through your job thats not part of your usual wages like an annual bonus or tips from customers youll have to pay tax on it and usually National Insurance too. In this reference under s.

Ive slightly adapted two old past paper questions to go with 5 Ive made up. Commissioner Of Income-Tax West Bengal v. 2561 of the I.

This is their annual amount of tax-free income. National Insurance is a tax on your earnings including salary and self-employed profits that gets added to the National Insurance Fund and helps pay for certain benefits including the state pension statutory sick pay and maternity leave. Tax and national insurance are deducted from your wages by your employer and sent to HM Revenue and Customs HMRC the government tax department.

Income Tax which is a tax on what you earn from employment self-employment investments etc. The standard personal allowance for 2020-2021 is 12 500 Rate Taxable Income Basic. Kolkata Kolkata PANAAACN 9967E Appellant Respondent For the Appellant.

This is a reference made at the instance of the Commissioner of Income-tax West Bengal Calcutta referring the following. National Insurance is a significant contributor to UK government revenues with contributions estimated to comprise 18 of total income in the 20192020 financial year. If youre employed then your employer takes care of all this.

Hmrc P60 Digital Copy National Insurance Number Number Words Tax Credits

Hmrc P60 Digital Copy National Insurance Number Number Words Tax Credits

P60 Replacement P60 Online Importantdocuments P60 Is The Most Important Document That Employe Need Financial Problems National Insurance Number Number Words

P60 Replacement P60 Online Importantdocuments P60 Is The Most Important Document That Employe Need Financial Problems National Insurance Number Number Words

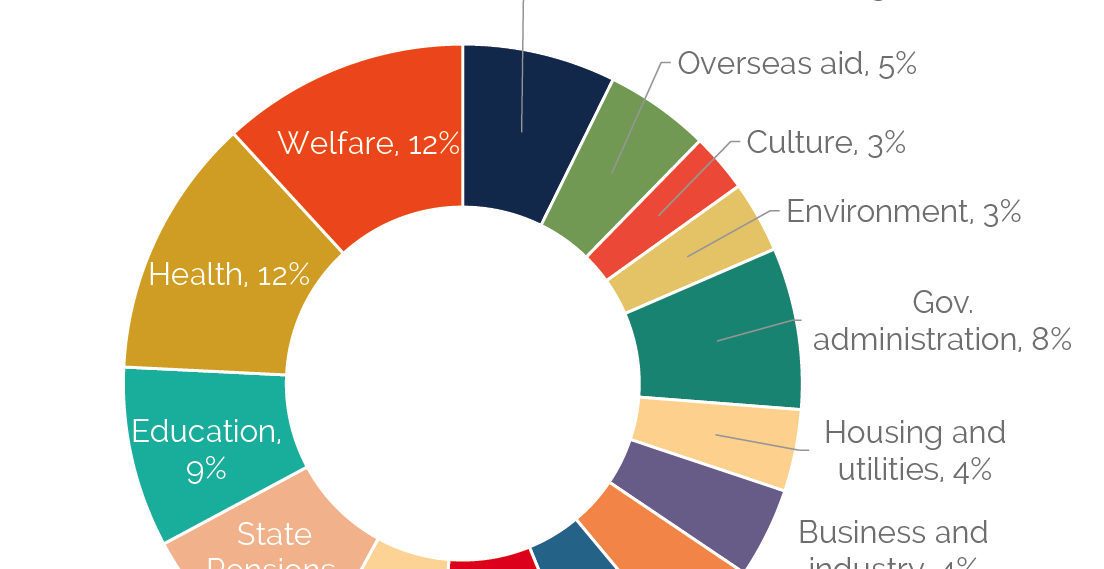

Perceptions Of How Tax Is Spent Differ Widely From Reality Yougov

Section 80d Deduction Deduction For Medical Insurance Health Checkup

Section 80d Deduction Deduction For Medical Insurance Health Checkup

Pin By Hasif Abdul Hamid On Powerpoint Templates Clay Tiles Metal Deck Metal Roof

Pin By Hasif Abdul Hamid On Powerpoint Templates Clay Tiles Metal Deck Metal Roof

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Iom Tin Pdf

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Iom Tin Pdf

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Coronavirus Problems Getting A National Insurance Number Low Incomes Tax Reform Group

Coronavirus Problems Getting A National Insurance Number Low Incomes Tax Reform Group

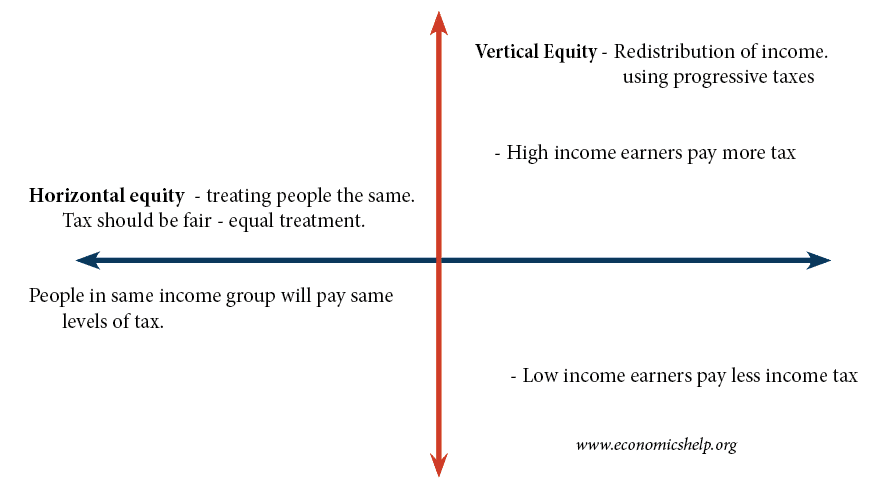

Horizontal And Vertical Equity Definition Economics Help

Horizontal And Vertical Equity Definition Economics Help

Perceptions Of How Tax Is Spent Differ Widely From Reality Yougov

What Is National Insurance Number 2020 Temporary Number 2020 National Insurance Number National Insurance National

What Is National Insurance Number 2020 Temporary Number 2020 National Insurance Number National Insurance National

45 000 After Tax 2021 Income Tax Uk

45 000 After Tax 2021 Income Tax Uk

Philip Hammond Defends Scrapping National Insurance Rise For The Self Employed Philip Hammond The Guardian

Philip Hammond Defends Scrapping National Insurance Rise For The Self Employed Philip Hammond The Guardian

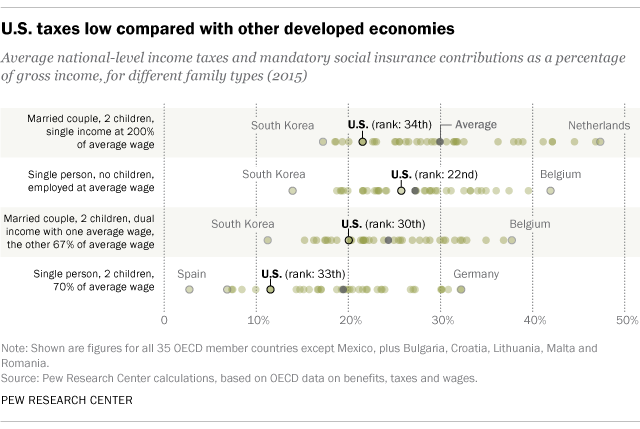

Americans Tax Bills Are Below Average Among Developed Nations Pew Research Center

Americans Tax Bills Are Below Average Among Developed Nations Pew Research Center

Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 838130 Taxation And Life Events Oct 2019 Pdf

Government Revenue Taxes Are The Price We Pay For Government

Government Revenue Taxes Are The Price We Pay For Government

Perceptions Of How Tax Is Spent Differ Widely From Reality Yougov

Perceptions Of How Tax Is Spent Differ Widely From Reality Yougov

Post a Comment for "Income Tax V National Insurance"