Category M National Insurance Contributions

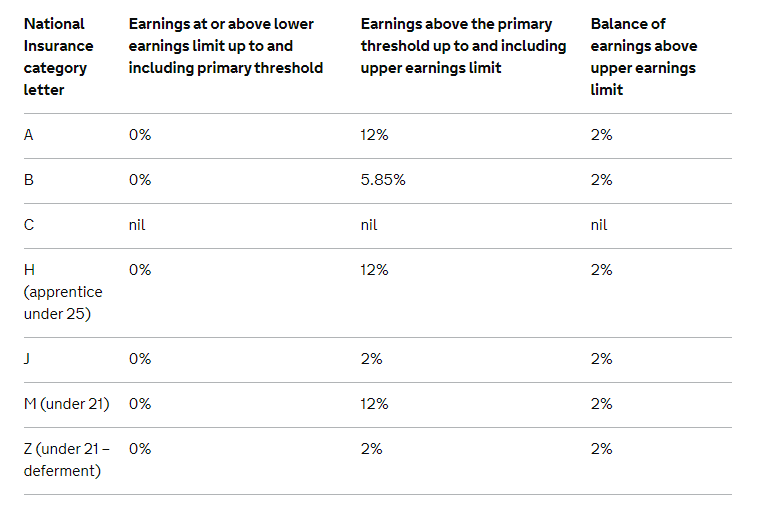

Self-employed people earning profits of 9569 or more a year. If you are classed under category M employers will deduct from employees 0 from between 503 702 a month.

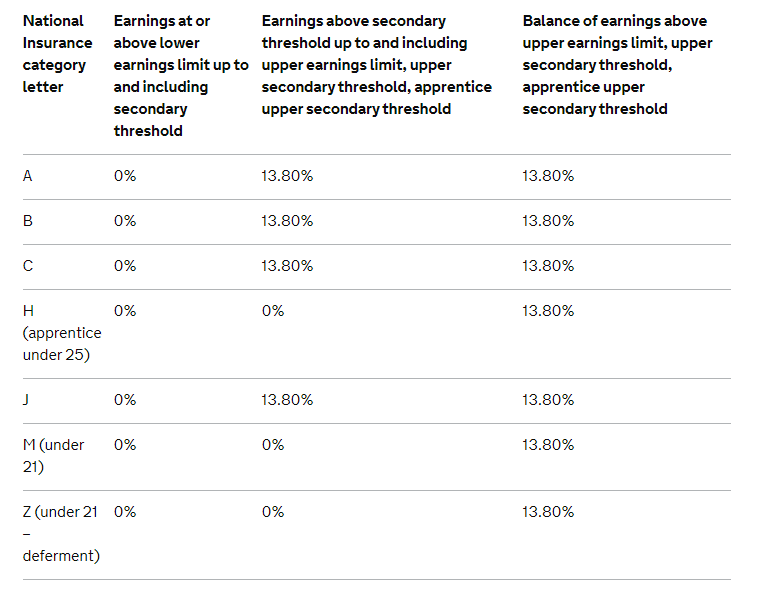

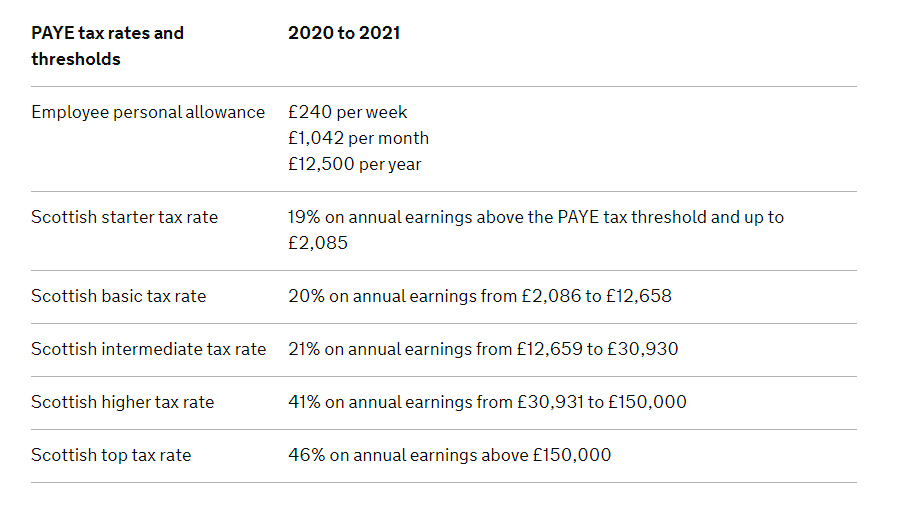

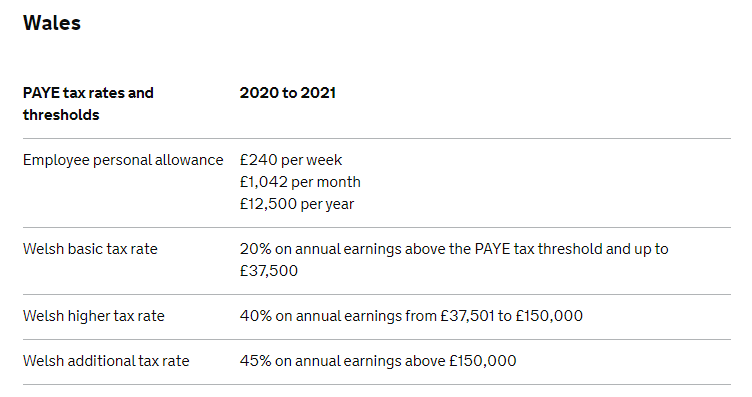

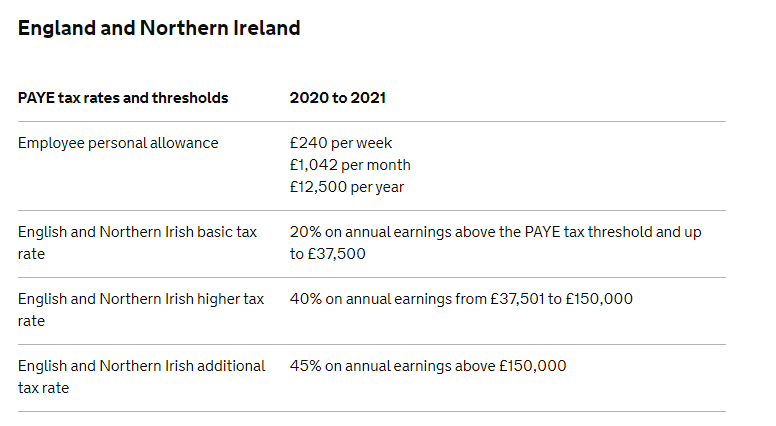

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

If you are the under age of 21 year you will be in category M.

Category m national insurance contributions. Mariners not contracted-out standard rate contributions for employees under 21. National Insurance contributions NICs Employment Allowance Apprenticeship Levy The levy is charged at a rate of 05 of an employers annual pay bill. If you have fewer than 35 qualifying years your basic State Pension will be less than 17520 per week but you might be able to top up by paying voluntary National Insurance contributions.

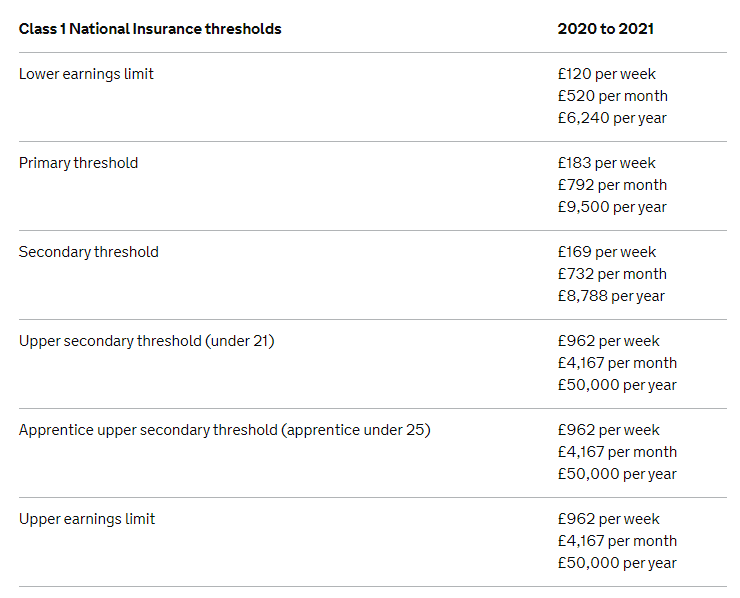

Deferred rate contributions for employees under 21 who arent in contracted-out employment. National Insurance contributions Tables A H J M and Z These tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. Over 967 a week 4189 a month 2.

Self employed with profits 6475 or more a year. 184 to 967 a week 797 to 4189 a month 12. National Insurance number and where known address and date of birth under 25check you have entered the correct category of NIC for employees who are aged 21 or over this is usually either A B C H or J.

As a rule National Insurance contributions for those who are self-employed are. Class 1 National Insurance rate. If there is no employer National Insurance contributions due then the amount of the grant towards employer National Insurance contributions is zero.

Get Free Quotation Buy Online Now. For employees who are under the age of 21 this is usually either M or Z. Apprentices under 25 category H employees under 21 category M.

No employer National Insurance contributions due. Currently the rules state that. Use from 6 April 2020 to 5 April 2021 inclusive Standard Rate NICs tables CA38.

If you earn between 120 and 184 a week your contributions are treated as having been paid to protect your National Insurance record. Youll pay less if. Category Description Replaces category.

If you earn over this amount you will be deducted at 12 on your earnings between the amounts of 70201 3863 a month. Ad Extensive Motor Insurance Policy. To get the full basic State Pension you need a total of 35 qualifying years of National Insurance contributions or credits.

Voluntary contributions - you can pay them to fill or avoid gaps in your National Insurance record. Self employed with profits 9501 or more a year. Get Free Quotation Buy Online Now.

Category letter Description. How Much is Class 2 National Insurance. This could be the case for.

In 2019-20 you paid 12 on earnings between 8632 and 50000 and 2 on anything more. 92 if your total Class 1 National Insurance both employee and employer contributions is above 45000 for. In 2020-21 you pay 12 on earnings between 9500 and 50000 and 2 on anything more.

National Insurance Category Letter M. Ad Extensive Motor Insurance Policy. You can work out your annual profits by deducting your total expenditure from your self-employed income.

Not contracted-out deferred rate contributions for employees under 21. Mariners not contracted-out deferred rate contributions for employees under 21. Employees under 21 who can defer National Insurance because theyre already paying it in another job.

Contracted-out salary related standard rate contributions for employees under 21. National Insurance contributions for employees Employees and most agency workers make Class 1 contributions collected via PAYE together with their income tax. Pay bill is defined as earnings Introduction 1 About this booklet.

Youre a married woman or widow with a valid. Not contracted-out standard rate contributions for employees under 21. SMP SPP ShPP SAP or SPBP proportion of your payments you can recover from HMRC.

National Insurance contributions Tables A H J M and Z These tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. Standard rate contributions for employees under 21 who arent in contracted-out employment. Use from 6 April 2019 to 5 April 2020 inclusive Standard Rate NICs tables CA38.

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

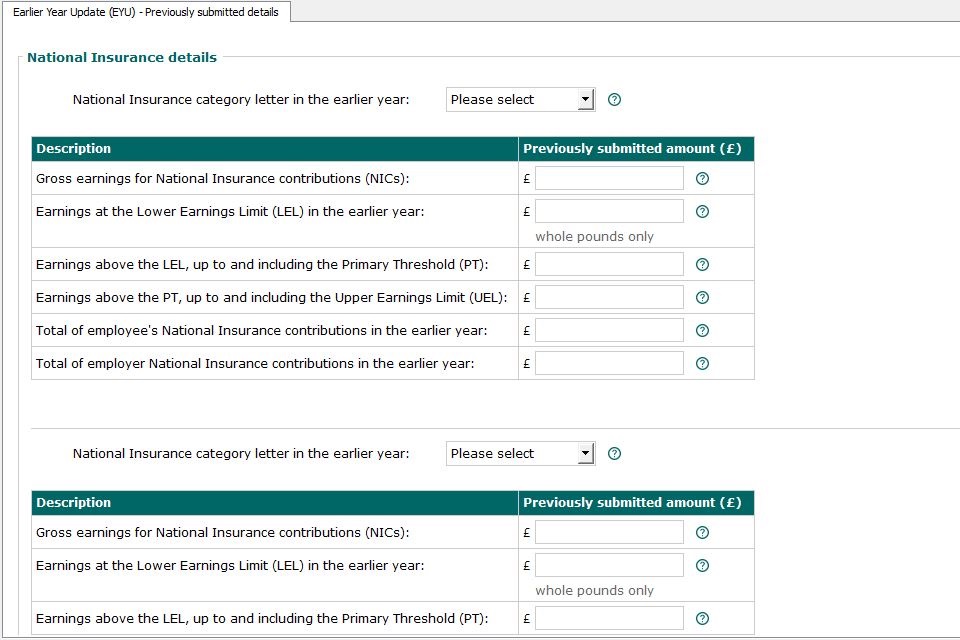

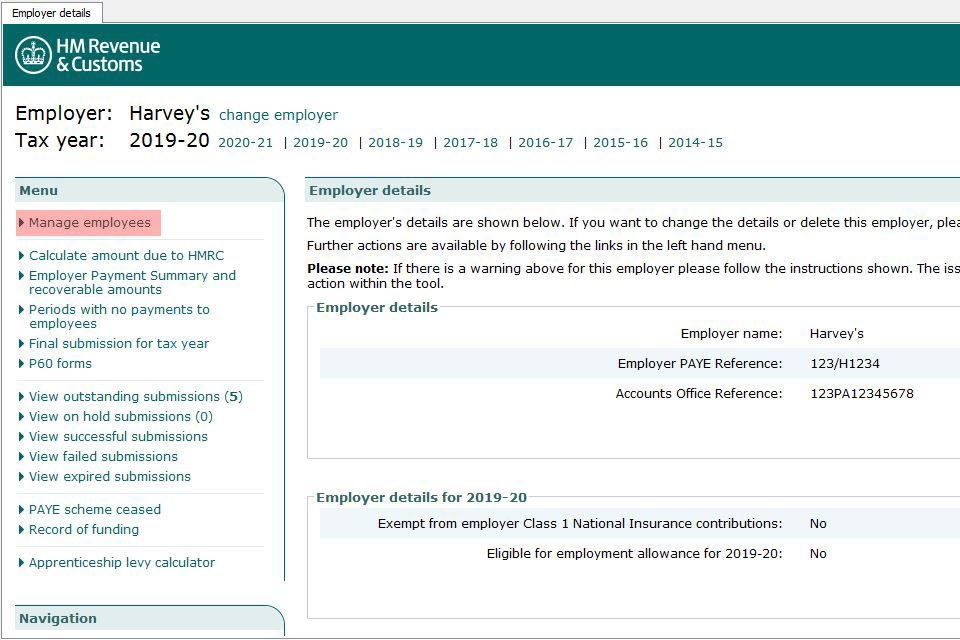

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

How Much Does A Phd Student Earn Comparing A Phd Stipend To Grad Salaries

How Much Does A Phd Student Earn Comparing A Phd Stipend To Grad Salaries

How To Check Your National Insurance Contributions Saga

How To Check Your National Insurance Contributions Saga

Contribution High Resolution Stock Photography And Images Alamy

Contribution High Resolution Stock Photography And Images Alamy

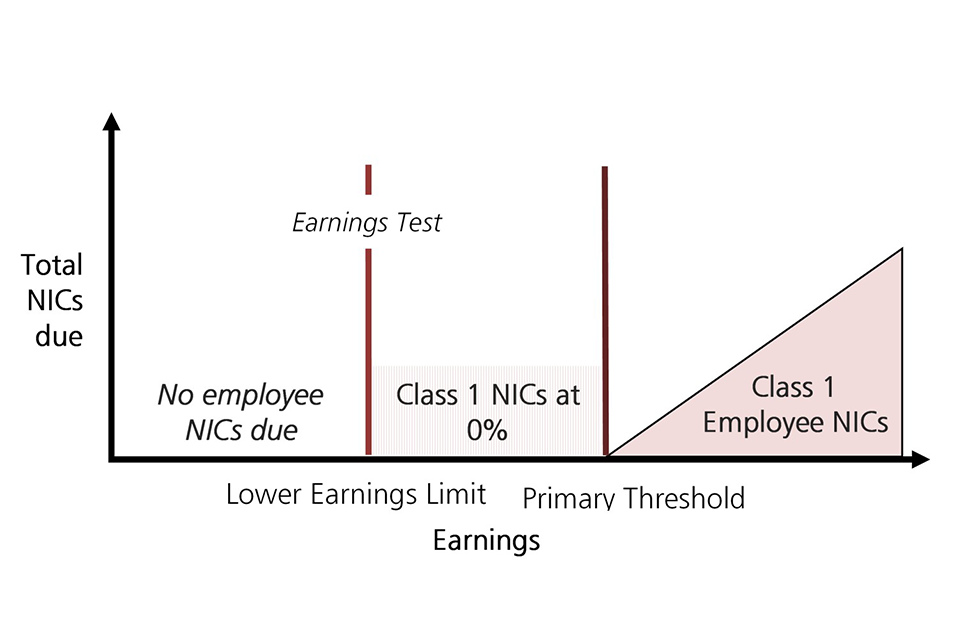

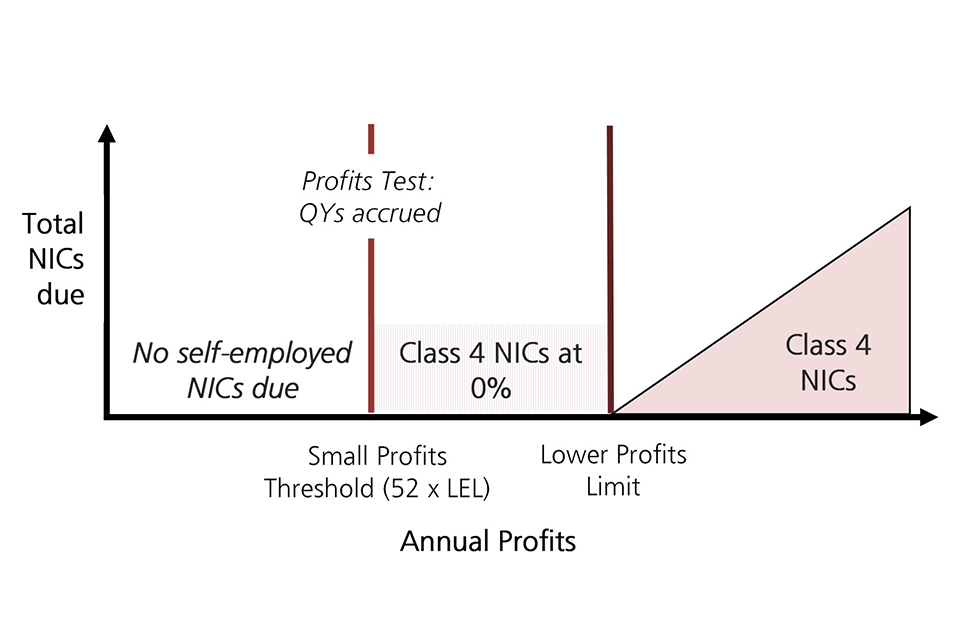

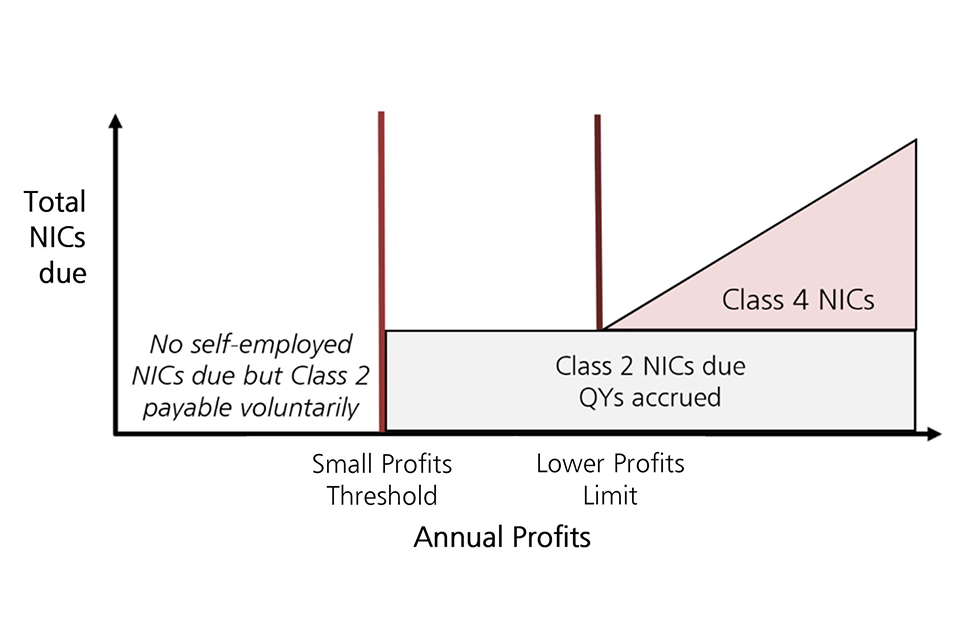

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

National Insurance What It Is How It S Calculated Who Has To Pay It

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

National Insurance How Much You Pay Gov Uk

National Insurance How Much You Pay Gov Uk

National Insurance What It Is How It S Calculated Who Has To Pay It

National Insurance What It Is How It S Calculated Who Has To Pay It

Post a Comment for "Category M National Insurance Contributions"