Who Is Exempt From National Insurance Contributions

Under 16 years old those who are still working in the tax year after the tax year in which you reach State Pension. These payments are earnings derived.

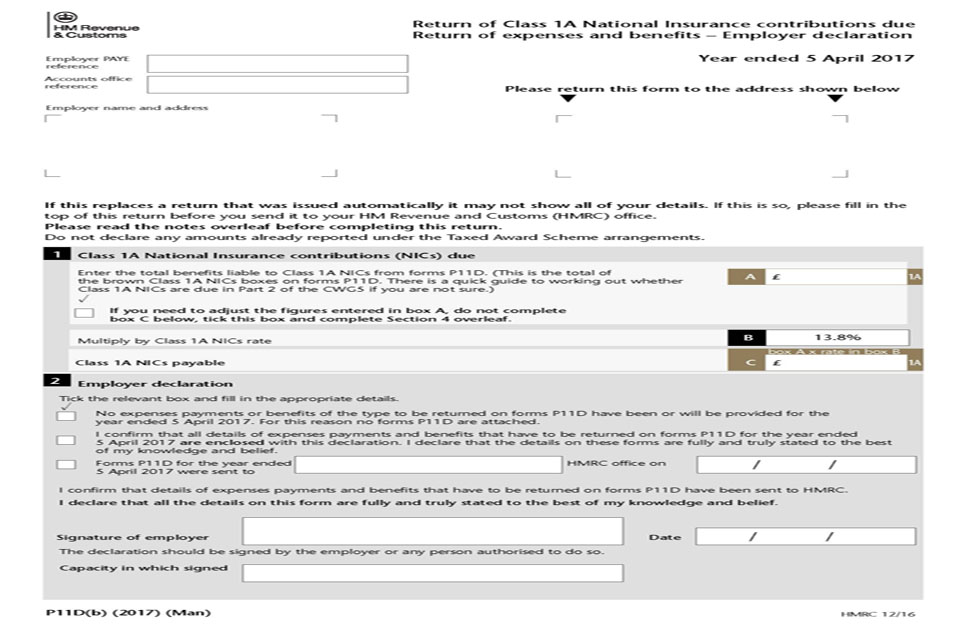

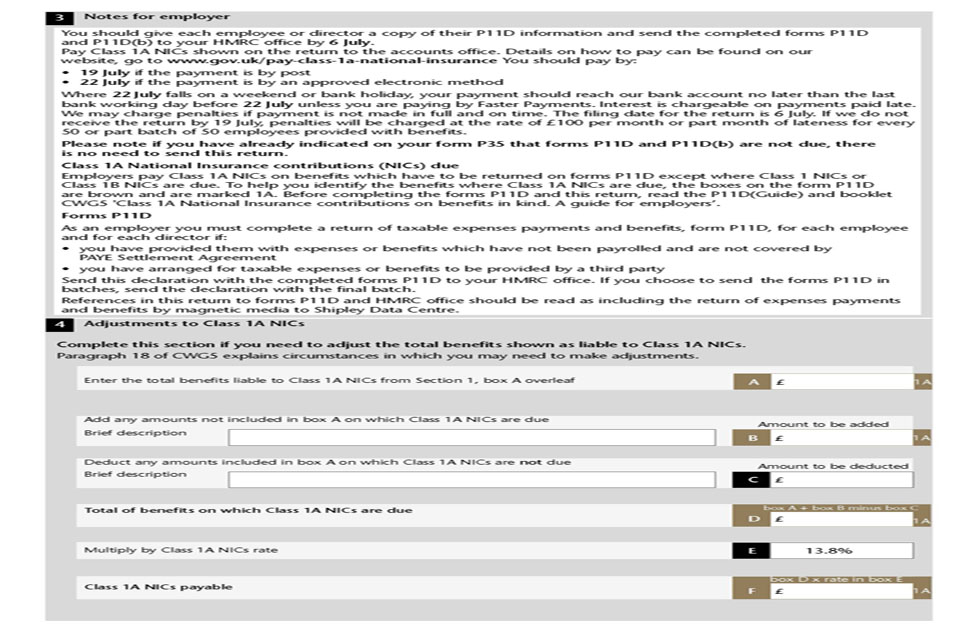

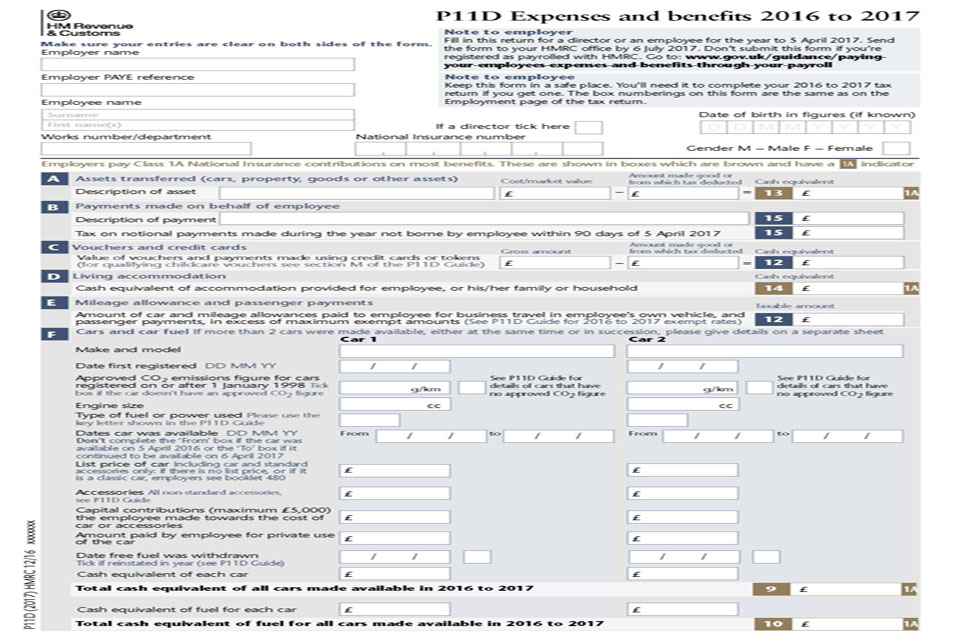

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

The corresponding National Insurance contributions disregard is contained within schedule 3 of the Social Security Contributions Regulations.

Who is exempt from national insurance contributions. You stop paying Class 4 contributions at the end of the tax year in. In 2021-22 you pay 12 on earnings between 9568 and 50270 and 2 on anything more. There are exceptions from the rule in the case of the people who have to pay Class 4 National Insurance contributions including.

General Disability Pension recipients who have no other income or for whom the degree of incapacity has been established to be at least 75 for one year or more are exempt from paying National Insurance contributions as long as they are eligible to receive the pension. Most employers and employees over 16 years of age and under 66 pay social insurance PRSI contributions into the national Social Insurance Fund. Is Employer National Insurance payable on expenses.

Reimbursed expenses are exempt from tax and NICs providing they are costs that have actually been incurred by the employee such as. Ad Search Compare Insurances near you. A person who turned 18 years old and will enlist in IDF or national or civil service before the age of 21 - will be exempt from payment of health insurance contributions for the period between his 18th birthday and the start of military national or civil service.

The Class 1 and employer only 1A National Insurance contributions exemption is being introduced as a consequence of payments made under the. Employees and most agency workers make Class 1 contributions collected via PAYE together with their income tax. These expenses are also exempt from HMRC reporting requirements.

Ad Extensive Motor Insurance Policy. The Class 1 and employer only Class 1A National Insurance contributions exemption is being introduced as a consequence of payments made under both schemes. You may be exempt from Class 2 NICs for any contribution week due to various circumstances such as being in receipt of Sickness Benefit Invalidity Benefit or Employment Support Allowance for the whole week.

Those aged at least 18 who did enlist in the army or serve in national or civil service before age 21 are exempt from paying insurance contributions from the age of 18 until the start of their service in the army or national service before age 21. Class 2 Contributions give entitlement to all benefits with contribution conditions except contribution-based Jobseekers Allowance. National Insurance contributions for employees.

Work-related travel and subsistence. You do not pay National Insurance after you reach State Pension age - unless youre self-employed and pay Class 4 contributions. Get Free Quotation Buy Online Now.

Get Free Quotation Buy Online Now. Once you reach state pension age you wont need to pay National Insurance at all. Ad Extensive Motor Insurance Policy.

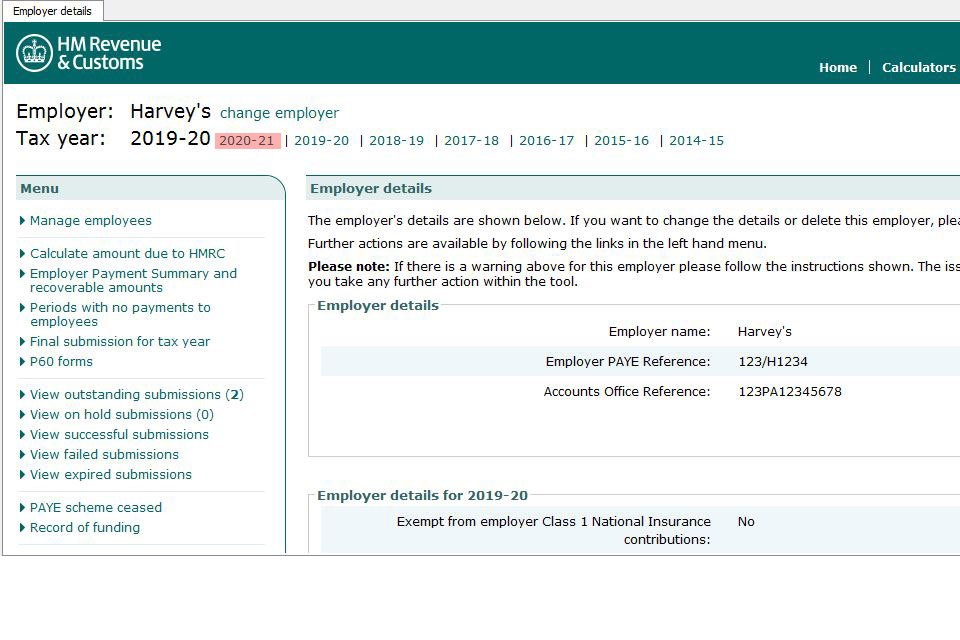

There is a threshold called the primary threshold and if as an employee your income falls below this you do not need to pay any contributions. In general the payment of social insurance is compulsory. Ad Search Compare Insurances near you.

The term insurable employment is used to describe employment that is liable for social insurance contributions. For 202021 this threshold is.

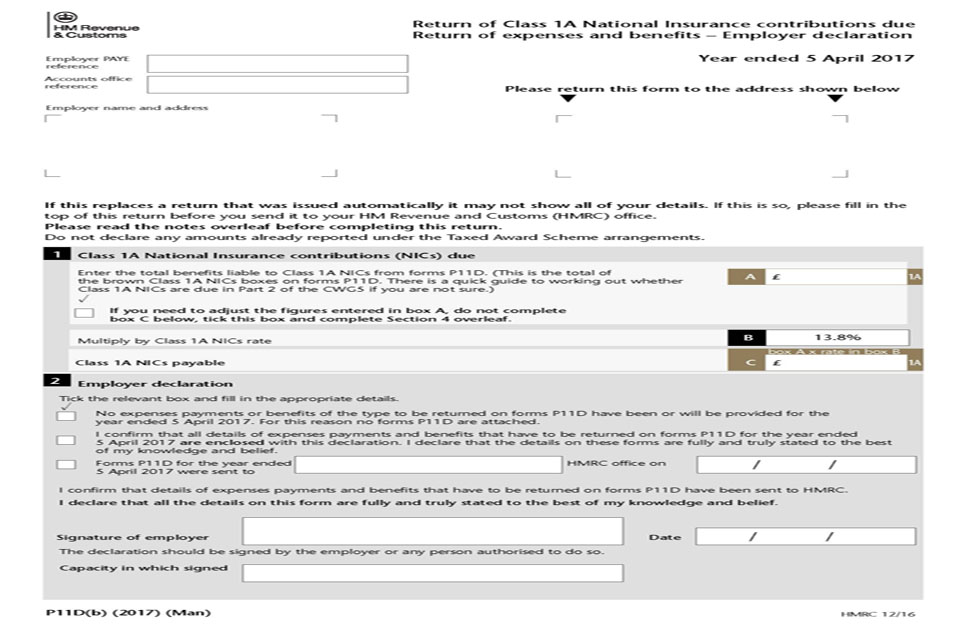

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

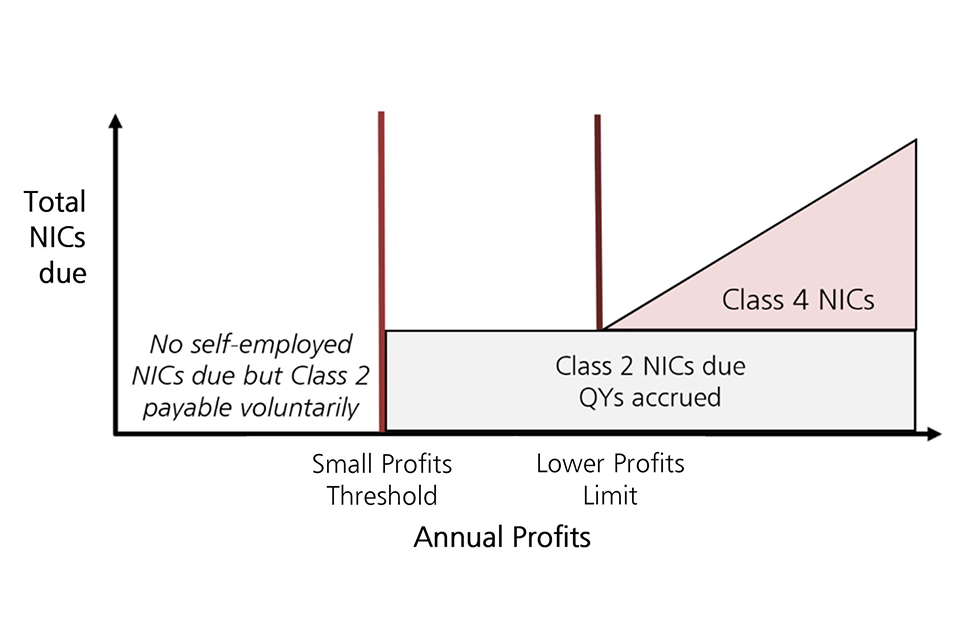

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Https Www Pwc Com Gx En Services People Organisation Publications Assets Pwc 52 Week Nic Exemption Extended To Certain Individuals Pdf

Ask Sage National Insurance Contributions

What Your National Insurance Category Letter Means Class 1

What Your National Insurance Category Letter Means Class 1

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Budget 2020 National Insurance Threshold To Rise From April Financial Times

Budget 2020 National Insurance Threshold To Rise From April Financial Times

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

How To Check Your National Insurance Contributions Saga

How To Check Your National Insurance Contributions Saga

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

What Is National Insurance And What Is It Used For Openlearn Open University

What Is National Insurance And What Is It Used For Openlearn Open University

What Are National Insurance Contributions Low Incomes Tax Reform Group

What Are National Insurance Contributions Low Incomes Tax Reform Group

Ask Sage National Insurance Contributions

How Employees Can Reduce National Insurance

How Employees Can Reduce National Insurance

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

What Are National Insurance Contributions Low Incomes Tax Reform Group

What Are National Insurance Contributions Low Incomes Tax Reform Group

Ask Sage National Insurance Contributions

Post a Comment for "Who Is Exempt From National Insurance Contributions"