National Insurance Qualifying Years For Full Pension

It was agreed however to give effect to the legislation by reducing civil service pensions by the whole of the 1948 flat rate national insurance pension of 6775 per year after a full 40 years service with proportional deductions for lesser service 6775 divided by 40 170 per year. If they have 35 years or more of NI contributions or credits they will get the full flat rate pension.

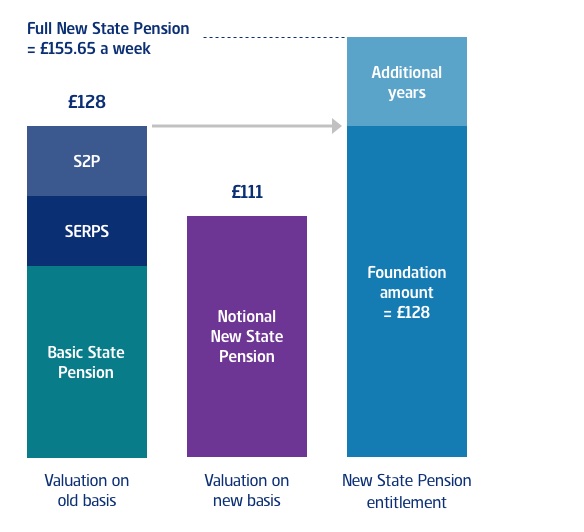

The New State Pension Your Questions Answered Royal London

The New State Pension Your Questions Answered Royal London

A minimum of 10 years will be needed to receive any income and 35 years.

National insurance qualifying years for full pension. To get any state pension you must have at least 10 qualifying years of National Insurance contributions NICs. You need to have at least ten qualifying years on your National Insurance record to get any pension at all. For a year of your working life to be a qualifying year towards your state pension you have to have paid or been credited with NI contributions on earnings equal.

As it stands you need to have a proven record of a minimum of 10 years National Insurance contributions to qualify for any form of State Pension. State pension requires at least 10 years of national insurance contributions to pay out anything. However even if you.

Under these rules youll usually need at least 10 qualifying years on your National Insurance record to get any State Pension. You can benefit from a proportion state pension if you have between 10 35 years. From April 2016 the number of qualifying years for the full state pension increased to 35 for both men and women.

Youll usually need at least 10 qualifying years on your National Insurance record to get any State Pension. Youll need 35 qualifying years to get the new full State Pension if you do not have a National Insurance record before 6 April 2016. If you reached state pension age on or after 6 April 2016.

Workers needed to have 30 years of qualifying National Insurance contributions to get the old state pension but require 35 years to get the full flat rate state pension now. But keep in mind they dont have to be 10 qualifying years. Dear Harry My most recent state pension forecast from January 2017 states that I have 38 qualifying years of national insurance contributions Nics but I will never get the full 155 a week.

To get the full basic State Pension you need a total of 30 qualifying years of National Insurance contributions or credits. People with no National Insurance record before 6 April 2016 will need 35 qualifying years to get the full amount of new State Pension when they reach State Pension age. To get the full benefit of state pension you must have at least 35 full years of National insurance contribution payments.

A minimum of 35 years will be needed to receive the full. If they have fewer years their pension will be reduced pro rata so 34 years gives you. Youll need 35 qualifying years to get the full new State Pension.

All years must be qualifying and full payments made. Any National Insurance credits youve received if gaps in contributions or credits mean some years do not count towards your State Pension they are not qualifying years if. A qualifying year is a tax year April to April during which you have paid or have been credited with enough National Insurance Contributions NICs to make that year qualify towards your.

To find out how many qualifying years youve already got you can check the situation for yourself by going to the Governments website or phoning the national insurance helpline on 0300 200 3500. State pension pays a monthly income so long as the receiver has enough national insurance contributions. How many years do I have to pay NIC to achieve a full state pension.

You will need 35 qualifying years to get the new full State Pension if you do not have a National Insurance record before 6 April 2016. Anything less than 10 years and claimants wont be. Youll need 35 qualifying years to get the full new State Pension.

The NI years needed for a full basic state pension are. This means you were either.

What Is Term Life Insurance Brightpeak Financial Life Insurance Awareness Month Life Insurance Term Life

What Is Term Life Insurance Brightpeak Financial Life Insurance Awareness Month Life Insurance Term Life

Here S How To Track Down Your Missing Pension Pot Pensions Where To Invest Leaving A Job

Here S How To Track Down Your Missing Pension Pot Pensions Where To Invest Leaving A Job

Irish Pension Transfers Eurbs European Union Retirement Benefits Scheme Avoid Irish Taxes As An Irish Expat Retirement Benefits How To Apply Retirement

Irish Pension Transfers Eurbs European Union Retirement Benefits Scheme Avoid Irish Taxes As An Irish Expat Retirement Benefits How To Apply Retirement

Nps Vs Unit Linked Plans How To Plan The Unit Link

Nps Vs Unit Linked Plans How To Plan The Unit Link

Number Spoofing Meet The Customers Who Lost Thousands Criminal Act Customer Spoofs

Number Spoofing Meet The Customers Who Lost Thousands Criminal Act Customer Spoofs

Civil Service Pensions Alpha Scheme Guide

Civil Service Pensions Alpha Scheme Guide

Check Your National Insurance Contributions Online

Check Your National Insurance Contributions Online

Early Retirement The Western Conference Of Teamsters Pension Trust

Early Retirement The Western Conference Of Teamsters Pension Trust

Invest In Nps Investing How To Get Rich How To Plan

Invest In Nps Investing How To Get Rich How To Plan

How Do I Qualify For Pension Credit To Keep My Free Tv Licence Elderly Parents Home Care Agency Sandwich Generation

How Do I Qualify For Pension Credit To Keep My Free Tv Licence Elderly Parents Home Care Agency Sandwich Generation

Will Class 2 National Insurance Contributions For The Self Employed Increase Coin Art National Insurance Coins

Will Class 2 National Insurance Contributions For The Self Employed Increase Coin Art National Insurance Coins

Nothing Precludes You From Getting Both A Pension And Social Security Benefits But The Social Security Benefits Social Security Death Benefits Social Security

Nothing Precludes You From Getting Both A Pension And Social Security Benefits But The Social Security Benefits Social Security Death Benefits Social Security

Best Pension Plan In India Policyx Hdfc Personal Pension Plus Savings Plan How To Plan Budget Planner

Best Pension Plan In India Policyx Hdfc Personal Pension Plus Savings Plan How To Plan Budget Planner

Pension Credit New Rules Coming In This May Citizens Advice

Pension Credit New Rules Coming In This May Citizens Advice

Epidoma 800 Eyrw Shmera H Prwth Dosh Dikaioyxoi Dental Business Paint By Number Uk Pension

Epidoma 800 Eyrw Shmera H Prwth Dosh Dikaioyxoi Dental Business Paint By Number Uk Pension

State Pension How A National Insurance Record Can Be Built Up Without Working In 2020 National Insurance Pensions Building Society

State Pension How A National Insurance Record Can Be Built Up Without Working In 2020 National Insurance Pensions Building Society

Post a Comment for "National Insurance Qualifying Years For Full Pension"