Class S National Insurance

You can choose to pay them to fill or to avoid gaps in your National Insurance record Class 3A National Insurance. Youll pay less if.

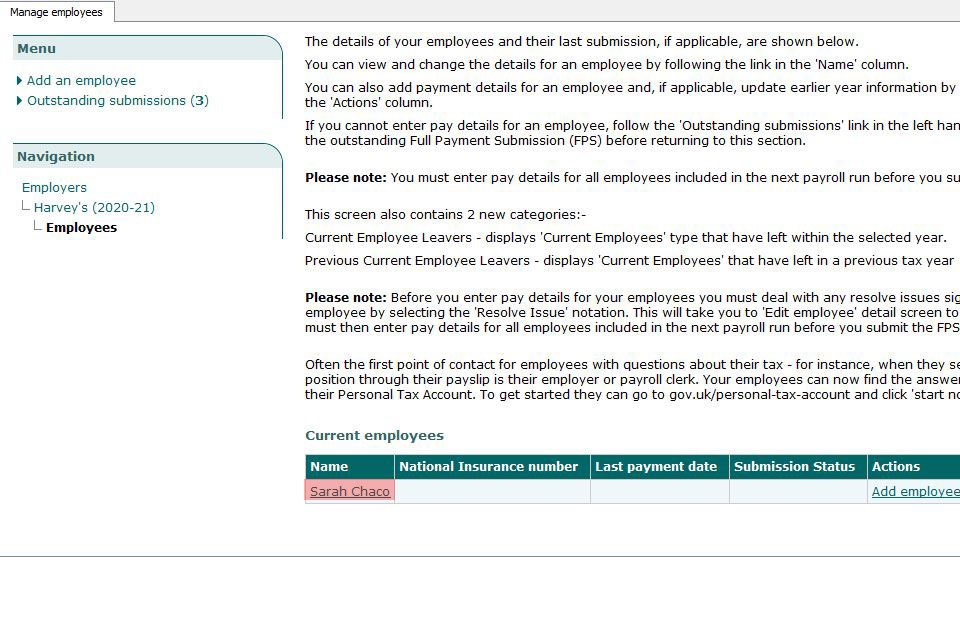

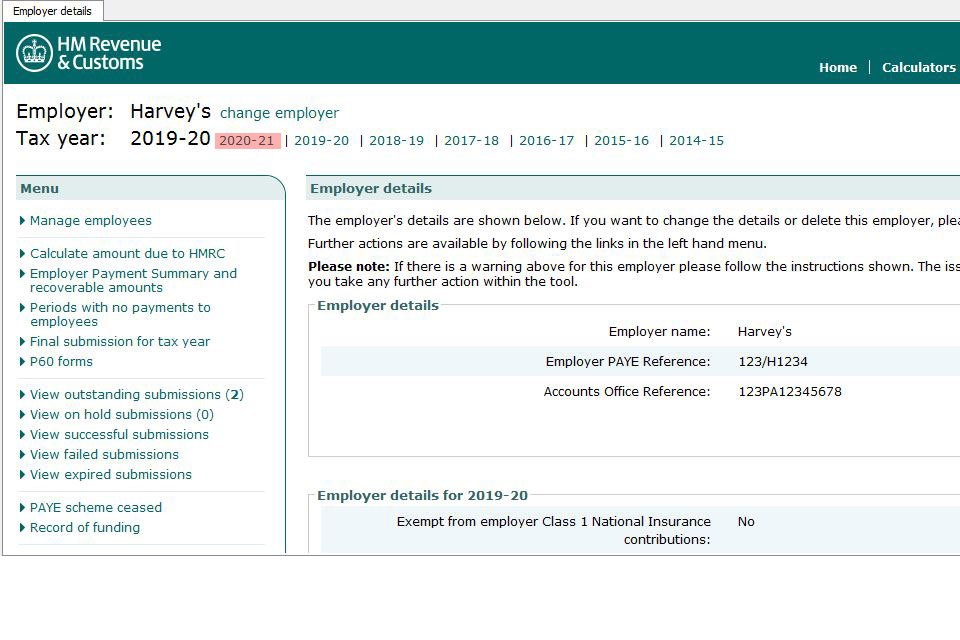

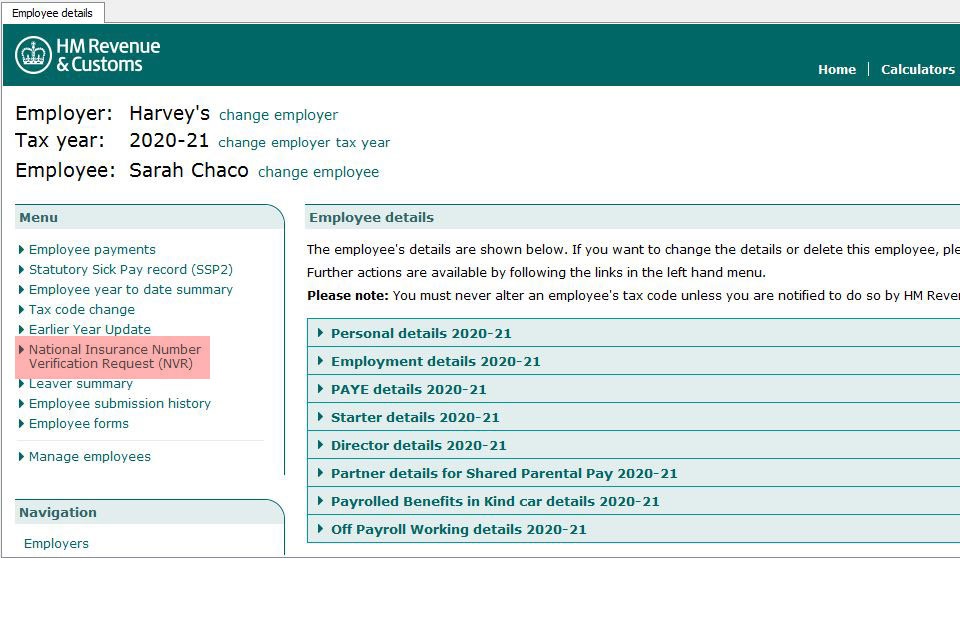

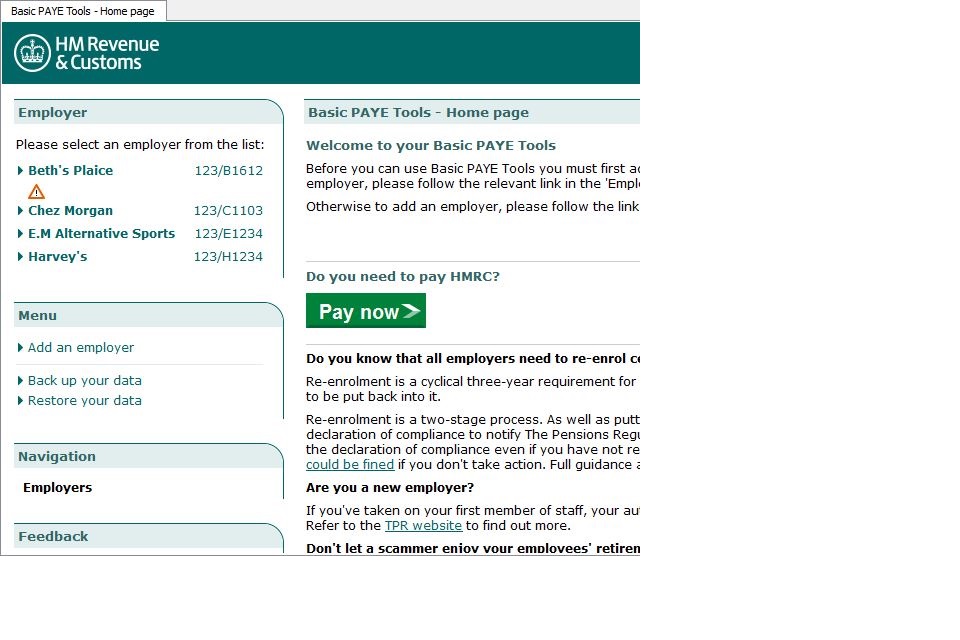

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

For the self-employed at Class S social insurance at 4 on all reckonable income Employees covered under Classes A B C D E and H with reckonable earnings of not more than 352 in a week do not pay PRSI for that week.

Class s national insurance. Self-employed people not compulsory if you earn less than 6475 a year but you can make voluntary contributions Class 3 Voluntary Contributions. Over 967 a week 4189 a month 2. NI Credit counts only towards the State Pension.

National insurance contributions are a tax on earnings. National Insurance unlike income tax is only payable by people who are aged 16 years or over and are below the state pension retirement age. Class 2 NICs are payable if you earn net profits of over 6475 per year and these are currently set at a rate of 305 per week.

Class 1A National Insurance contributions on 12 - the benefit of the laundry charge. Ad Extensive Motor Insurance Policy. Ad Easy Online Application Affordable International Student Insurance.

Contributions are taken to help build your entitlement to certain state benefits such as state pension and maternity allowance. People who pay Class S include farmers professional people certain company directors people in business on their own or in partnerships and people with income from investments rents or. Class 2 National Insurance.

Ad Easy Online Application Affordable International Student Insurance. If your net profits exceed 9500 per year you will need to pay Class 4 NICs instead currently you will need to pay 9 on all profits between 9500 and 50000. Class 1A or 1B.

Employee National Insurance rates. Youre a married woman or widow. Class 1 National Insurance contributions on 20 - the total of cash and non-cash voucher elements.

Class 1A or 1B National Insurance. Get Free Quotation Buy Online Now. Employees earning more than 184 a week and under State Pension age - theyre automatically deducted by your employer.

103 if your total Class 1 National Insurance for the previous tax year is 45000 or lower Statutory Sick Pay SSP The same weekly SSP rate applies to all employees. This table shows how much employers deduct from employees pay for the 2021 to 2022 tax year. Running and reporting payroll is the first step but actually paying employers National Insurance to HMRC is a separate process.

Employees may make additional voluntary payments to. All of the below categorys are for class 1 National Insurance contributions. Employers pay these contributions directly on the expenses or benefits of their employees.

PRSI for self-employed people was introduced in 1988. Get Free Quotation Buy Online Now. You pay employers National Insurance to HMRC along with Income Tax deducted from staff wages under PAYE and employees National Insurance.

If you are self-employed you pay Class S PRSI. How Do I Check My National Insurance Credits. You can see how much Class 1 and Class 1B National Insurance your business owes by logging in to your online PAYE account.

NI Credit counts towards several benefits including bereavement benefits JSA and your State Pension. Class 1 National Insurance rate. National Insurance class Who pays.

This is for employees earning more than. When youre employed either through your own limited company as a director or more commonly as an employee of a larger company your employment taxes are deducted at source ie before it reaches your pay packet through the Pay As You Earn PAYE stem. 184 to 967 a week 797 to 4189 a month 12.

Your contributions will be taken off along with your income Tax before your employer pays your wages. Those who are eligible will get one of these two types of National Insurance credits. National Insurance is an umbrella term for universal health care the public pension program and unemployment benefits.

Ad Extensive Motor Insurance Policy.

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

Buy Real Us Visa Online Visa Online Passport Services Passport Online

Buy Real Us Visa Online Visa Online Passport Services Passport Online

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

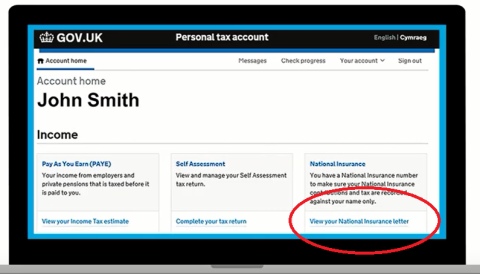

How To Find Your National Insurance Number Nino Low Incomes Tax Reform Group

How To Find Your National Insurance Number Nino Low Incomes Tax Reform Group

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Buy Legal Visa Online Visa Online Travel Visa National Insurance Number

Buy Legal Visa Online Visa Online Travel Visa National Insurance Number

Visa Du Lịch La Gi Visa Online Visa Passport Number

Visa Du Lịch La Gi Visa Online Visa Passport Number

National Insurance Buy Renew Policy Online Check Reviews

National Insurance Buy Renew Policy Online Check Reviews

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

P45 Vs P60 What S The Difference Revolut

P45 Vs P60 What S The Difference Revolut

Why Am I Paying Employers National Insurance As An Umbrella Contractor It Contracting

Why Am I Paying Employers National Insurance As An Umbrella Contractor It Contracting

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

How To Find Your National Insurance Number Nino Low Incomes Tax Reform Group

How To Find Your National Insurance Number Nino Low Incomes Tax Reform Group

P45 Vs P60 What S The Difference Revolut

P45 Vs P60 What S The Difference Revolut

Post a Comment for "Class S National Insurance"