Category D National Insurance Contributions

Category A - based on your own National Insurance contributions. This rate of contribution entitles the contributor to pro-rata contributory benefits.

How To Check Your National Insurance Contributions Saga

How To Check Your National Insurance Contributions Saga

You may opt to do this if you have gaps in your record from previous years.

Category d national insurance contributions. You pay mandatory National Insurance if youre 16. 4 In February 2014 there were 44520 Category D state pensioners. National Insurance contributions Your National Insurance bill depends on how much you earn and how you earn it - find out who pays what.

National Insurance contributions NICs Employment Allowance From 6 April 2014 you may be eligible to claim an Employment Allowance of up to 4000. The Category D pension is non-contributory and payable when a person reaches the age of 80 satisfies certain residence contribution conditions and is not already entitled to a state pension of at least 6780 pw 201415 rates. You dont start paying National Insurance until youre over 16-years-old.

National insurance contributions are a tax on earnings. Category B - dependent on the contributions paid by a spousecivil partner. Ad Search D Insurance.

Which National Insurance contributions NICs tables to use If you employ mariners booklet CA42 National Insurance contributions for employers of foreign-going mariners and deep sea fishermen gives details of category letters rates and limits to use. Self-employed people earning profits of 9569 or more a year. As a rule National Insurance contributions for those who are self-employed are.

Category C - There are only a small number of if any Category C cases still in payment. National Insurance Contributions NIC are taxes paid by British employees and employers to fund government benefits programs including state pensions. These cost you 1540 per week in 2021-22 up from 1530 per week in 2020-21.

The White Paper The single-tier pension. Change their National Insurance category letter in your payroll software - usually to A or D. Published on 14 January 2013 sets out the Governments proposals for radical reform of the State Pension scheme to provide a simple flat-rate amount that provides clarity and confidence to better support saving for retirement.

Student National Insurance contributions. How Much is Class 2 National Insurance. This is for employees earning more.

Category D - Over 80s pension. Category A pension 13760 Category B pension based on late spouses or civil partners National Insurance contributions 13760 Category B pension based on spouses or civil partners National Insurance contributions 8245 Category D non-contributory pension 8245. Employers use an employees National Insurance category letter when they run payroll to work out how much they both need to contribute.

A simple foundation for saving 1. Contributions are taken to help build your entitlement to certain state benefits such as state pension and maternity allowance. NATIONAL INSURANCE CONTRIBUTIONS Foreword 1.

Category Description A Persons under 18 years of age earning not more than the amount indicated below. The Employment Allowance is available for businesses charities including community amateur sports clubs and certain employers of care and support workers to offset against employers. Ad Search D Insurance.

Get Results from 6 Engines at Once. Self employed with profits 9501 or more a year. National Insurance and benefits.

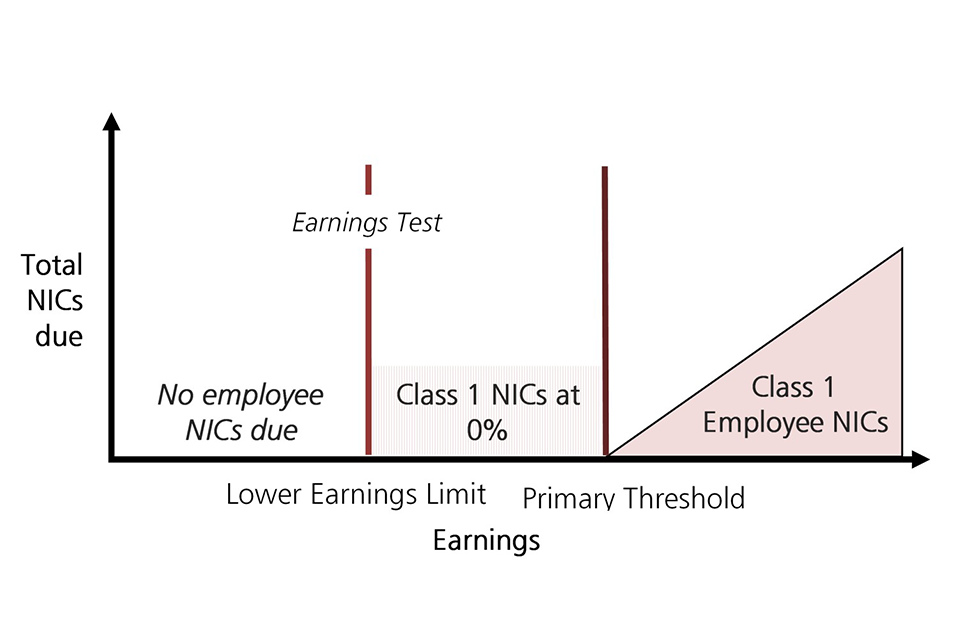

The two categories of non-contributory retirement pension are. All of the below categorys are for class 1 National Insurance contributions. Your contributions will be taken off along with your income Tax before your employer pays your wages.

Get Results from 6 Engines at Once. Class 3 National Insurance contributions are those that you can pay voluntarily. You pay National Insurance contributions to qualify for certain benefits and the State Pension.

Voluntary contributions - you can pay them to fill or avoid gaps in your National Insurance record. Self employed with profits 6475 or more a year. B Persons aged 18 and over earning not more than the amount indicated below.

NICs tables are renewed every tax year. You can work out your annual profits by deducting your total expenditure from your self-employed income.

Https Ec Europa Eu Social Blobservlet Docid 17683

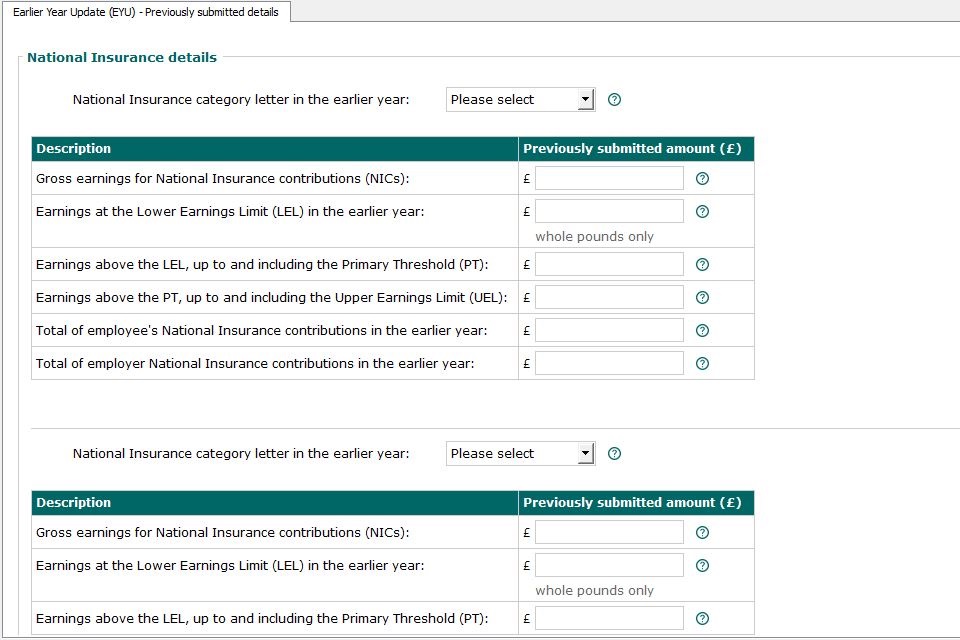

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

National Insurance How Much You Pay Gov Uk

National Insurance How Much You Pay Gov Uk

How Much Does A Phd Student Earn Comparing A Phd Stipend To Grad Salaries

How Much Does A Phd Student Earn Comparing A Phd Stipend To Grad Salaries

National Insurance Nic Guide For It Contractors Contract Eye

National Insurance Nic Guide For It Contractors Contract Eye

National Insurance Contribution Changes 2021 2022 Payadvice Uk

National Insurance Contribution Changes 2021 2022 Payadvice Uk

How Much Does A Phd Student Earn Comparing A Phd Stipend To Grad Salaries

How Much Does A Phd Student Earn Comparing A Phd Stipend To Grad Salaries

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

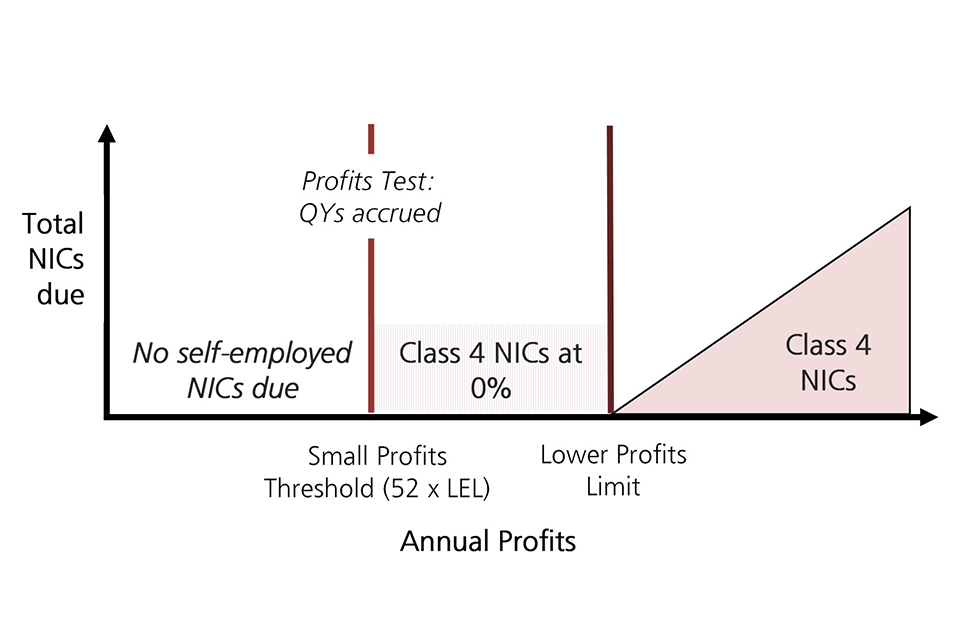

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

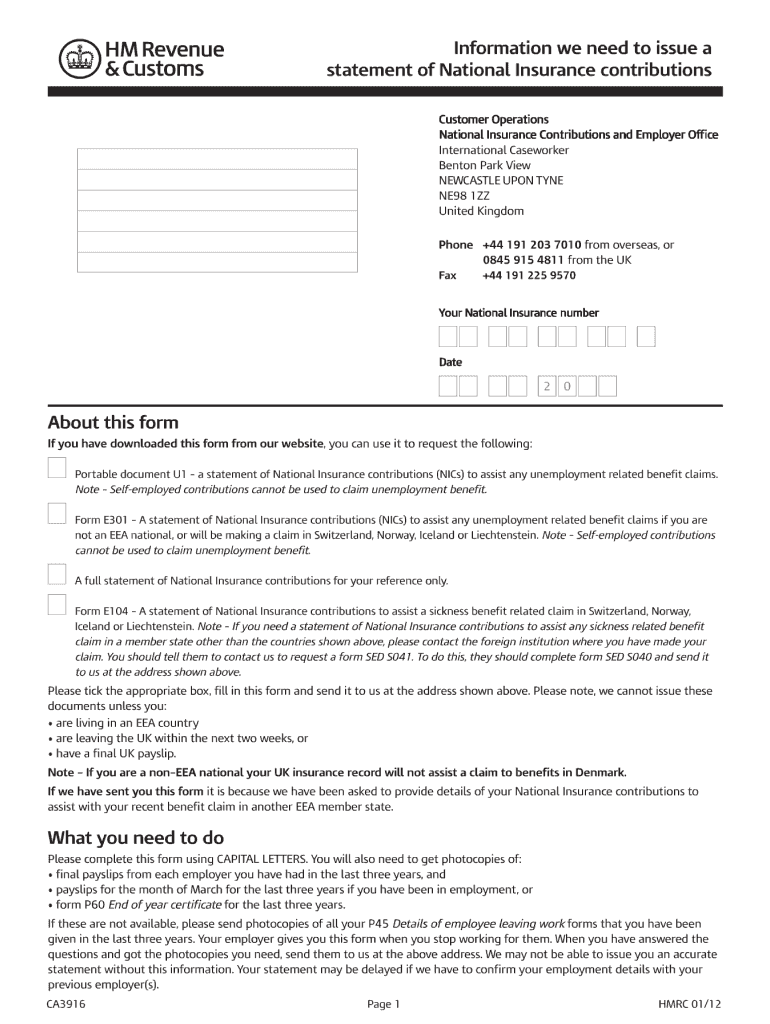

U1 Form Fill Online Printable Fillable Blank Pdffiller

U1 Form Fill Online Printable Fillable Blank Pdffiller

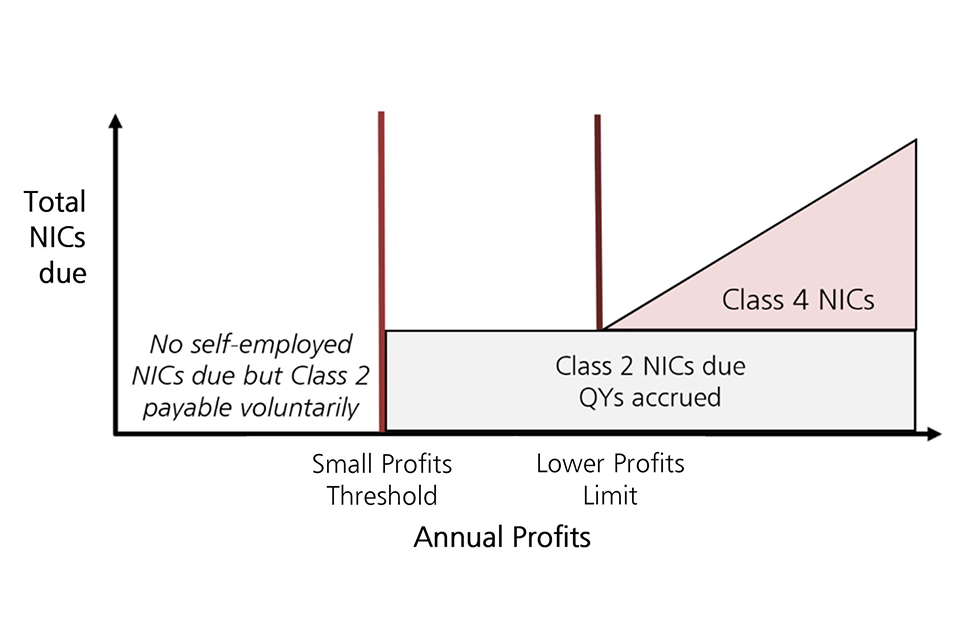

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

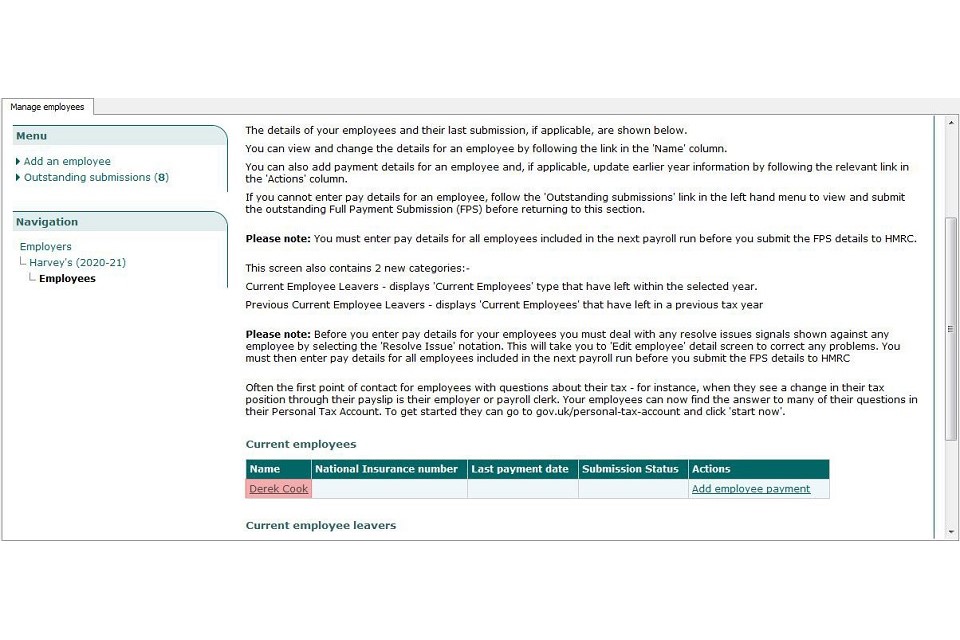

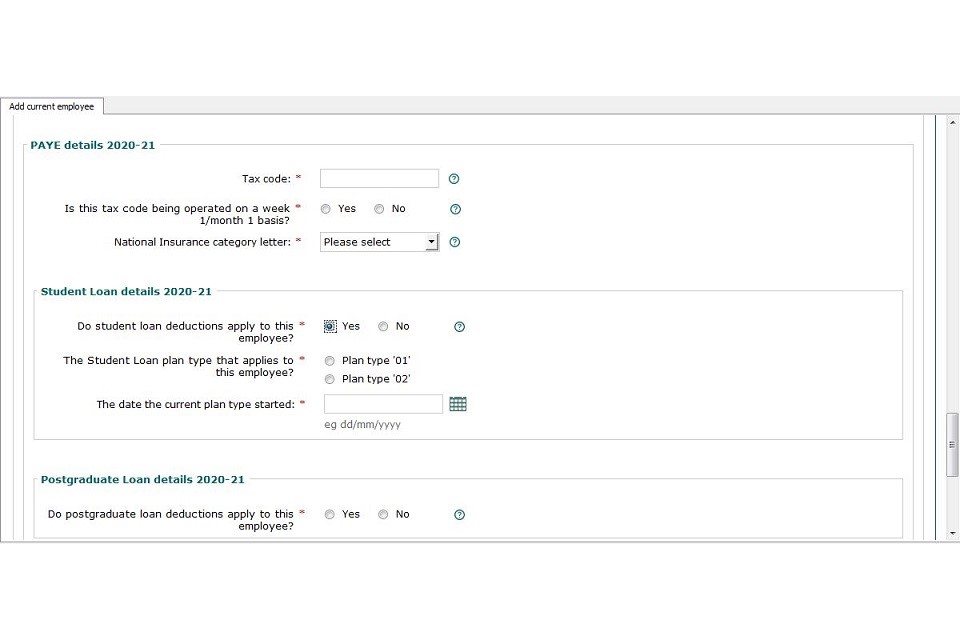

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

Post a Comment for "Category D National Insurance Contributions"