National Insurance Yearly Threshold

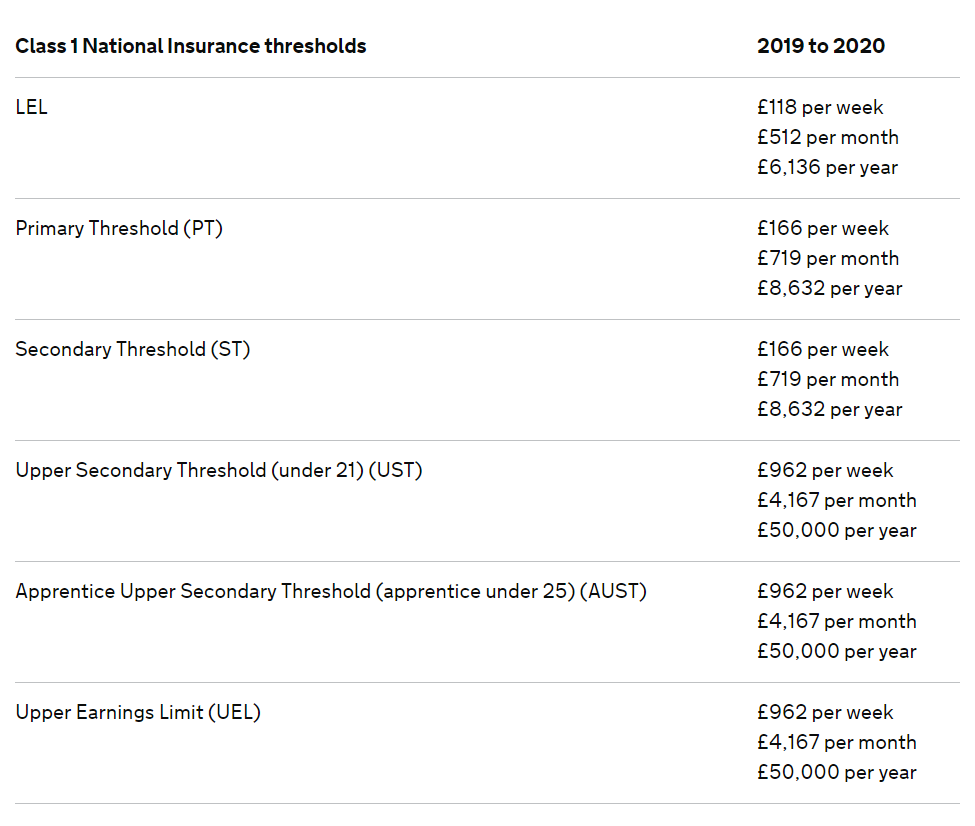

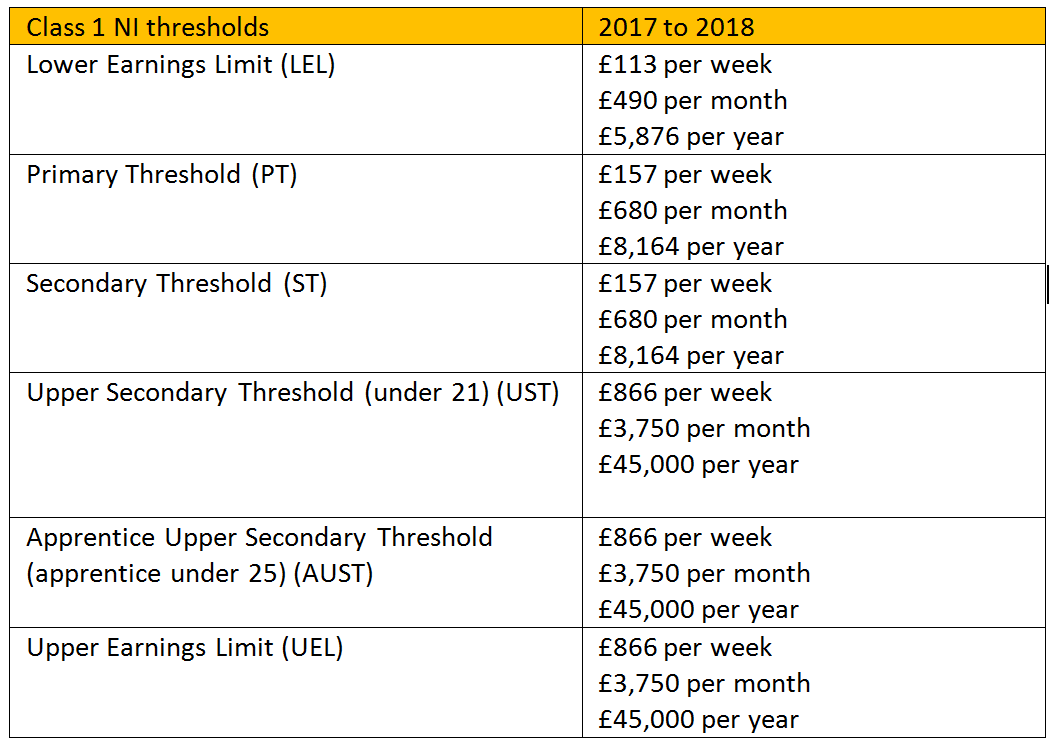

National Insurance is calculated on gross earnings before tax or pension deductions above an earnings threshold. 8632 per year Upper Secondary Threshold under 21 UST 962 per week.

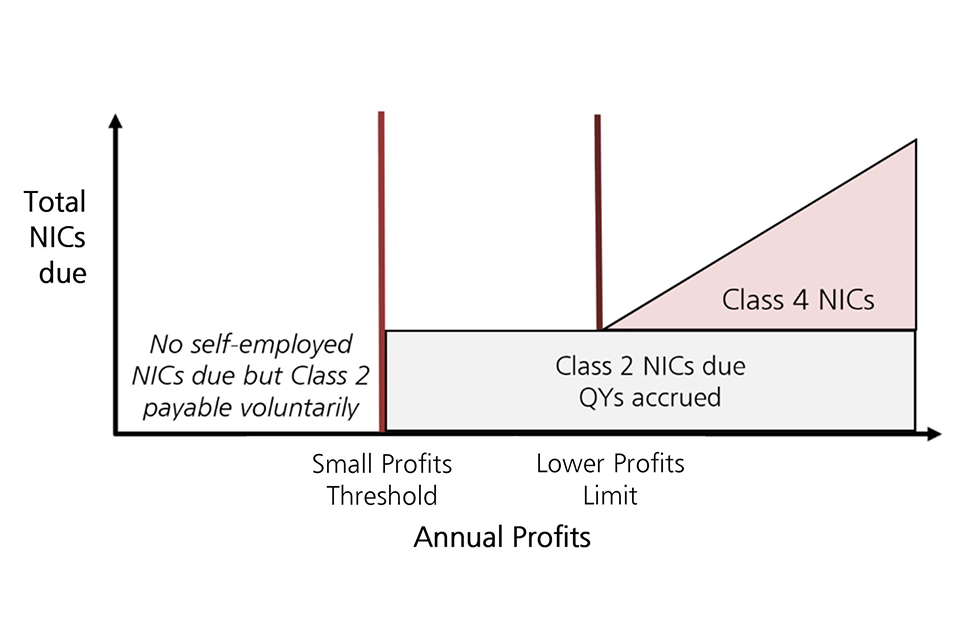

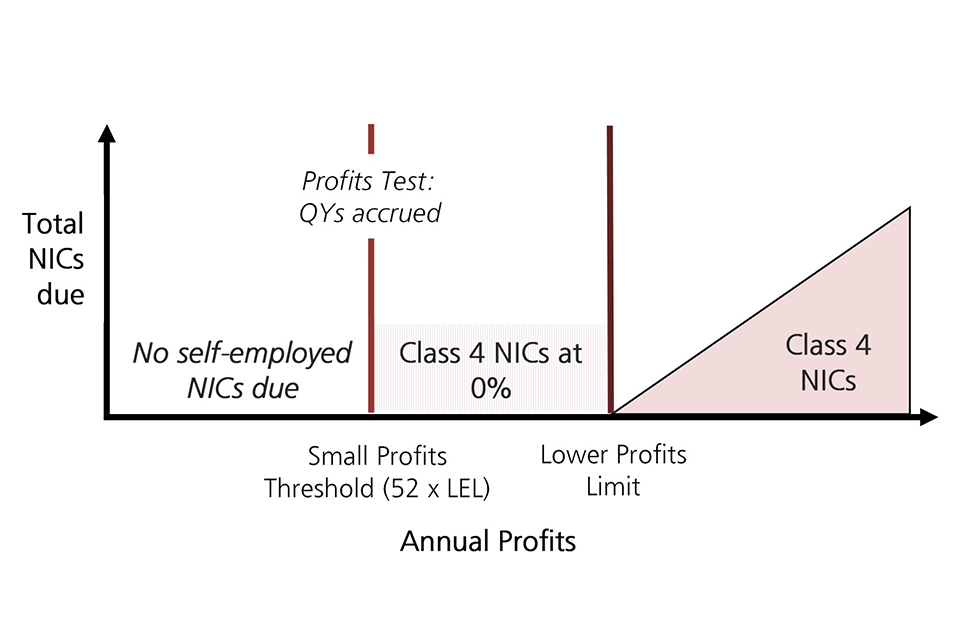

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Because it is their responsibility to pay your National Insurance NI.

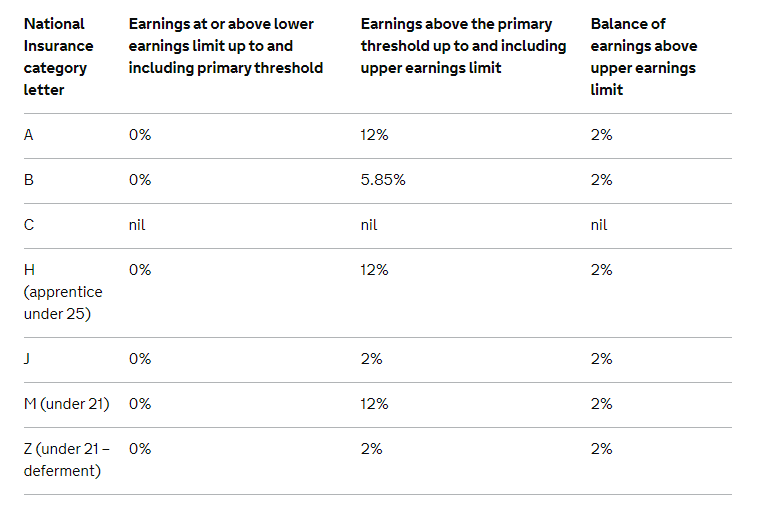

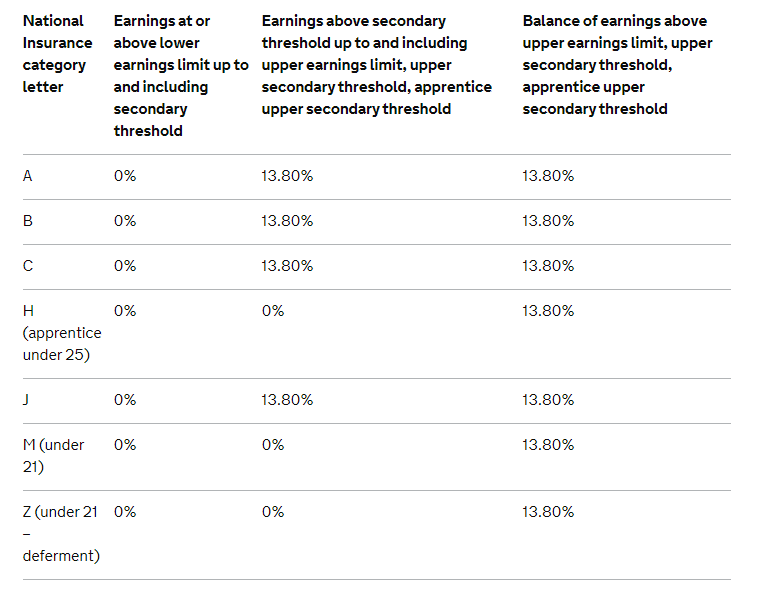

National insurance yearly threshold. If you earn any less than this then you wont pay National Insurance contributions. Employed people pay Class 1 national insurance contributions those who are self-employed come under Class 2 or 4 for their NIC. Isle of Man NI numbers will always start with the prefix MA.

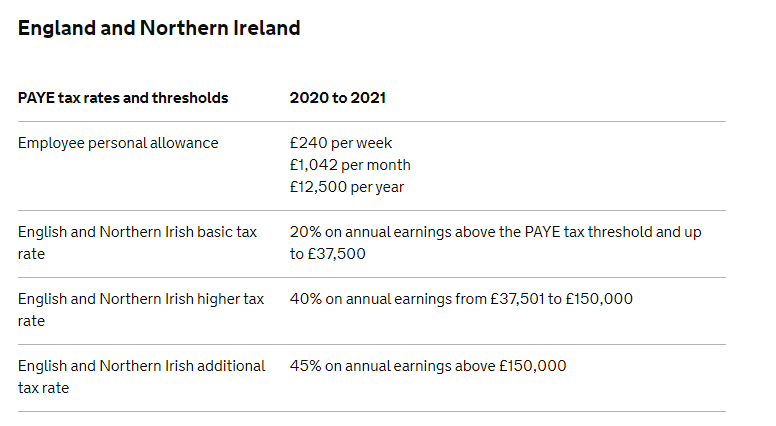

The Primary Threshold is 183 per week in 202021. This is a 100 tax cut for most people from the previous figure - but the Tories have pledged to raise the threshold to 12500 by the. National insurance on the other hand is dictated somewhat differently.

120 per week 520 per month 6240 per year. An example of a NI number is AB123456D. What are voluntary NIC.

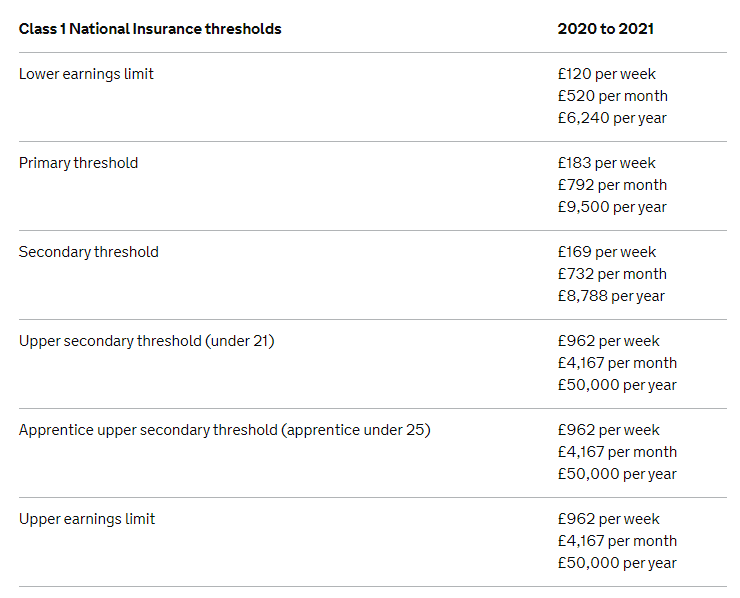

Upper earnings limit Upper secondary threshold. Class 1 National Insurance Thresholds. From 6 April 2020 this threshold will rise to 9500 a year meaning that a typical employee will save around 104 a year and the self-employed who pay a lower rate of NICs will save about 78 a year.

Currently workers start paying Class 1 National Insurance Contributions NICs once their annual earnings exceed 8628. 8632 per year Secondary Threshold ST 166 per week. For 2021-22 the Class 1 National Insurance threshold is 9568 a year.

184 per week 797 per month 9568 per year. If you earn any less than this then you wont pay National Insurance contributions. For the tax year 2020 to 2021 the Class 1 NI threshold stands of 9500 a year.

National insurance works similarly except that the threshold is calculated weekly. 170 per week 737 per month 8840 per year. For employed people National Insurance NI threshold is 8164 for the tax year 2017-18.

If you earn less than this amount you will pay no National Insurance contributions. From 2011 the HMRC no longer issue cards and where replaced with an official letter. If somebody works for one day a week for five weeks they pay less tax than somebody working for one week and then taking the next four off.

Class 1 National Insurance thresholds 2019 to 2020. It is calculated on your gross earning before deducting tax andor pension. Class 2 is a basic 3 per week if your self-employed profits are below 8632 for the year.

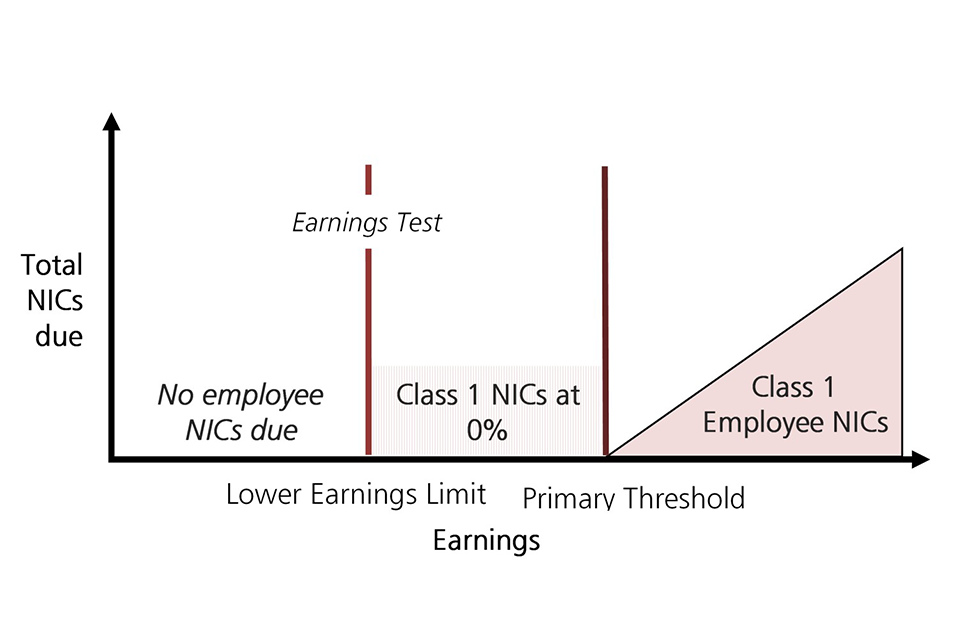

The increase in the threshold means around 31 million people have received a tax cut of 104 a year. 6136 per year Primary Threshold PT 166 per week. Once an employees earnings reach the primary threshold they must start paying employee Class 1 National Insurance contributions.

Your employer will deduct Class 1 National Insurance contributions from your. B The Primary Threshold sometimes called the Primary Earnings Threshold If you earn between the Primary Threshold and the Upper Earnings Limit then you will pay the standard rate of National Insurance 12 in 202021 on your earnings over the Primary Threshold. The threshold for National Insurance payments is 9500.

Primary Threshold PT 166 per week 719 per month 8632 per year. For the tax year 2020 to 2021 the Class 1 NI threshold stands of 9500 a year. Primary Threshold PT Employees start paying National Insurance.

Earlier this year the government set out the new National Insurance thresholds for 2020-21 with the level at which taxpayers start to pay National Insurance Contributions rising by more than 10 per cent to 9500 per year for both employed and self-employed people. For 202122 the primary threshold is set at 184 per week 797 per month. 118 per week 512 per month 6136 per year.

Maternity paternity and adoption pay. 169 per week 732 per month 8788 per year. 183 per week 793 per month 9500 per year.

The self-employed could have to pay two different types of NI depending on how much profit they make. It is an annual threshold so that you dont pay any income tax if your total earnings are below it in any tax year. National Insurance number starts with 2 letters followed by 6 numbers and are finished off with a letter A-D.

The threshold at which taxpayers start to pay National Insurance contributions has risen this year. 2019 to 2020 LEL 118 per week. Employees do not pay National Insurance but get the benefits of paying.

Ask Sage National Insurance Contributions

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Budget 2020 National Insurance Threshold To Rise From April Financial Times

Budget 2020 National Insurance Threshold To Rise From April Financial Times

Ask Sage National Insurance Contributions

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2019 20 Brightpay Documentation

Rates Thresholds 2019 20 Brightpay Documentation

Ask Sage National Insurance Contributions

Nic Thresholds Rates Brightpay Documentation

Nic Thresholds Rates Brightpay Documentation

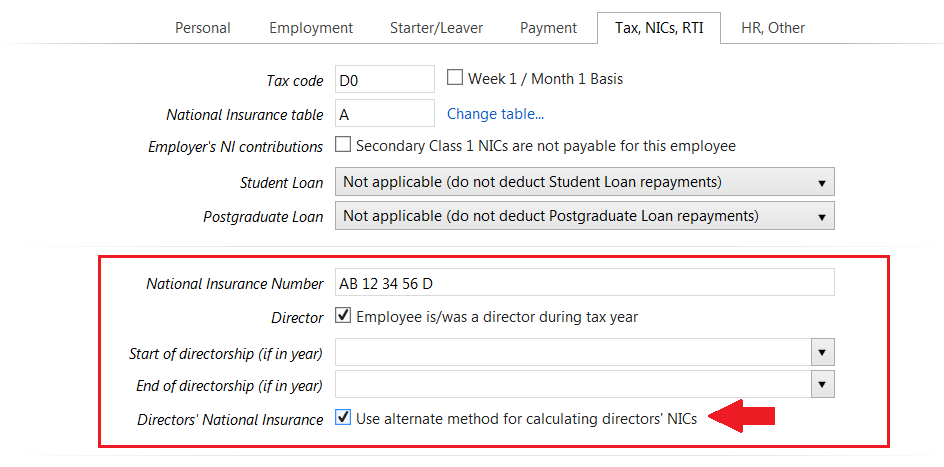

Directors Nic Brightpay Documentation

Directors Nic Brightpay Documentation

Uk Payroll And Tax Information And Resources Activpayroll

Uk Payroll And Tax Information And Resources Activpayroll

Nic Thresholds Rates Brightpay Documentation

Nic Thresholds Rates Brightpay Documentation

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

National Insurance Contribution Changes 2021 2022 Payadvice Uk

National Insurance Contribution Changes 2021 2022 Payadvice Uk

Rates Thresholds 2017 18 Brightpay Documentation

Rates Thresholds 2017 18 Brightpay Documentation

National Insurance Contribution Changes 2021 2022 Payadvice Uk

National Insurance Contribution Changes 2021 2022 Payadvice Uk

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Nic Thresholds Rates Brightpay Documentation

Nic Thresholds Rates Brightpay Documentation

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

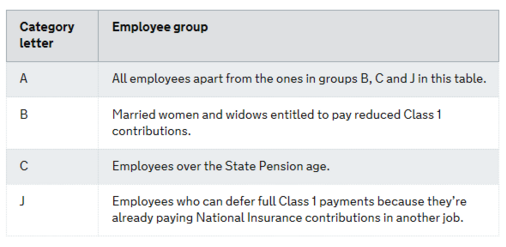

Nic Category Letters Brightpay Documentation

Nic Category Letters Brightpay Documentation

Post a Comment for "National Insurance Yearly Threshold"