National Insurance 2021/22

This means that the basic rate limit for 202122 should be 37700 up from 37500 in 202021. Employees earning more than 162 a week and under State Pension age - theyre automatically deducted by your employer.

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

This is not unusual in the contracting industry or for self-employed individuals whose income can.

National insurance 2021/22. In addition to income tax if you pay yourself or any employees a salary through your limited company you may be subject to pay the employees national insurance. Do I need to pay National Insurance. Employees come within the ambit of Class 1 National Insurance contributions once their earnings reach the lower earnings threshold.

National Insurance Classes 202122. For the 2021-22 tax year employees must pay National Insurance if they earn more than 9568 in the year. 45 pence for all business miles.

Lower Earnings Limit as long as you pay a salary above this you are protecting your entitlement to future state pension and benefits without paying any national insurance. The rates for this year are set out below. Once an employees earnings reach the primary threshold they must start paying employee Class 1 National Insurance contributions.

If youre a business owner youve probably been eagerly awaiting news from HMRC about the 202122 thresholds for income tax statutory payments and national insurance contributions NIC. The National Insurance rates for 202122 have now been released by the HMRC. This PAYE and NI Calculator is designed for those who are paid monthly with different amounts earned each month.

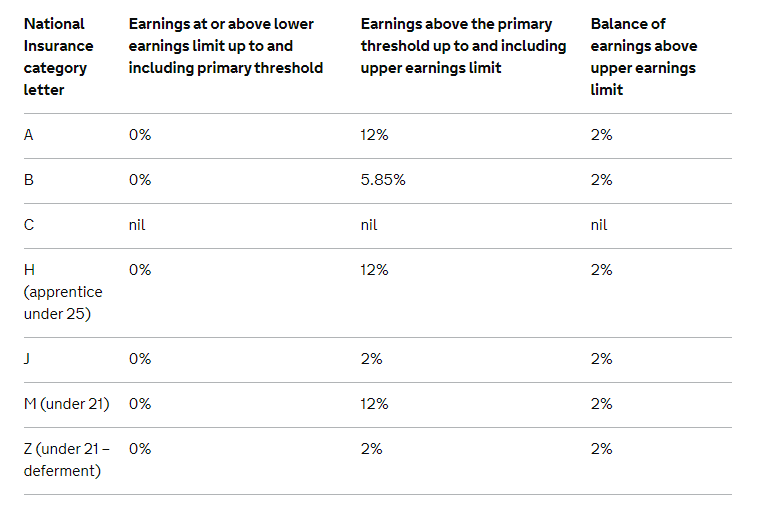

National Insurance Rates 2122. The thresholds have increased slightly meaning the new National Insurance table looks like this. Employees pay primary Class 1 National Insurance contributions on their earnings while secondary Class 1 contributions are payable by their employees.

The remaining thresholds have increased by approximately 05. Employee National Insurance rates. What are the National Insurance Thresholds for 202122.

In the report the department estimated that the effect of the measures proposed would be a decrease in contribution income in 202122. For 202122 the primary threshold is set at 184 per week 797 per month. The government made a Written Ministerial Statement that it will use the September Consumer Price Index as the basis for setting the National Insurance limits and thresholds as well as the rates of Class 2 and 3 National Insurance contributions for tax year 202122.

This remains at 120 per week for 202122 520 per month. For 2122 this is 520 per month 6240 for the year. A written ministerial statement by the Financial Secretary to the Treasury on 16 December concerning national insurance contributions NICs re-rating for the tax year 202122 confirmed that the government will use the September consumer price index CPI figure 05 as the basis for setting all national insurance limits and thresholds and the rates of Class 2 and Class 3 NICs for 202122.

National Insurance contributions for 202122. The LEL hasnt changed. For National Insurance purposes.

As in previous years the employer contribution rate of 138 has remained the same. This is a simple tool that provides emlploee NI and employers ni calculations withour the. The figure of 37700 has been confirmed in The Income Tax Indexation Order 2021 SI 2021111.

When it comes to tax efficient salary levels for 2122 there are three national insurance thresholds you need to be aware of. Class 1A or 1B. From that date new thresholds apply for National Insurance purposes.

Self-employed workers will pay Class 2 contributions if they earn more than 6515 in addition to Class 4 if they earn more than 9568. The 20212022 rates and thresholds have been announced. 120 to 184 520 to 797 a month.

For 202122 the primary threshold is set at 184 per week 797 per month. However contributions are paid at a notional zero rate between the lower earnings limit and the primary threshold. This table shows how much employers deduct from employees pay for the 2021 to 2022 tax year.

24 pence for both tax and National Insurance purposes and for all business miles. This is up from 9500 in 2020-21 and 8632 in 2019-20. The 202021 tax year starts on 6 April 2021.

Once an employees earnings reach the primary threshold they must start paying employee Class 1 National Insurance contributions. Optimum Directors Salary 202122. On 19 January 2021 the Government Actuarys Department published a report into the impact that the draft regulations would have on the National Insurance Fund.

About the Monthly Wage PAYE and NI Calculator 202122. Employers pay these directly on their employees expenses or benefits. The Employer National Insurance Contributions Calculator is updated for the 202122 tax year so that you can calculate your employer NICs due to HMRC in addition to standard payroll costs.

Theyre just a few of the things that got disrupted during what was an extraordinary 2020 and its caused some inconvenience because the thresholds and rates for NIC requirements would usually have been.

What Are National Insurance Contributions Low Incomes Tax Reform Group

What Are National Insurance Contributions Low Incomes Tax Reform Group

What Are The National Insurance Thresholds For 2021 22 Moorepay

What Are The National Insurance Thresholds For 2021 22 Moorepay

National Insurance Rates Limits And Thresholds For 2021 22 House Of Lords Library

National Insurance Rates Limits And Thresholds For 2021 22 House Of Lords Library

National Insurance Contributions And Overview Dns Associates

National Insurance Contributions And Overview Dns Associates

Noun Admission Requirement 2021 22 Updated Myschoolbeam School Certificates Admissions Agricultural Science

Noun Admission Requirement 2021 22 Updated Myschoolbeam School Certificates Admissions Agricultural Science

How Do I Calculate Income Tax On Salary With Example Life Insurance Premium Life Insurance Calculator Income Tax

How Do I Calculate Income Tax On Salary With Example Life Insurance Premium Life Insurance Calculator Income Tax

Fulbright Foreign Student Program Student Scholarships Scholarships International Students

Fulbright Foreign Student Program Student Scholarships Scholarships International Students

Hungaricum Scholarship Program 2021 22 From Bachelor To Ph D It Zone Computers Jatoi Scholarships Computer Jobs Phd

Hungaricum Scholarship Program 2021 22 From Bachelor To Ph D It Zone Computers Jatoi Scholarships Computer Jobs Phd

National Insurance Contributions And Overview Dns Associates

National Insurance Contributions And Overview Dns Associates

Nic Thresholds Rates Brightpay Documentation

Nic Thresholds Rates Brightpay Documentation

National Insurance Nic Guide For It Contractors Contract Eye

National Insurance Nic Guide For It Contractors Contract Eye

Pension Plans Rs 50 000 Additional Deduction Below Section 80ccc Tax Totally Free Annuity Portion Pensions Pension Plan Annuity

Pension Plans Rs 50 000 Additional Deduction Below Section 80ccc Tax Totally Free Annuity Portion Pensions Pension Plan Annuity

Fazaia Degree College Admissions Open 2021 22 In 2021 College Degree College Admission Admissions

Fazaia Degree College Admissions Open 2021 22 In 2021 College Degree College Admission Admissions

Do You Have A Gap In Your National Insurance Record

Do You Have A Gap In Your National Insurance Record

Australia Awards Scholarships For Development Support Partner Countries Citizens To Undertake Full Time U Scholarships Student Scholarships Developing Country

Australia Awards Scholarships For Development Support Partner Countries Citizens To Undertake Full Time U Scholarships Student Scholarships Developing Country

National Insurance Contribution Changes 2021 2022 Payadvice Uk

National Insurance Contribution Changes 2021 2022 Payadvice Uk

Applications Invited For Turkiye Burslari Scholarship 2021 Fully Funded For Bachelors Masters Phd Pro In 2021 Scholarships International Scholarships Free Tuition

Applications Invited For Turkiye Burslari Scholarship 2021 Fully Funded For Bachelors Masters Phd Pro In 2021 Scholarships International Scholarships Free Tuition

King Fahd University Scholarship 2021 For International Students Saudi Residents Fully Funded In 2021 Scholarships University Programs King Fahd

King Fahd University Scholarship 2021 For International Students Saudi Residents Fully Funded In 2021 Scholarships University Programs King Fahd

What If I Come From A Country With No Social Security Agreement With The Uk Low Incomes Tax Reform Group

What If I Come From A Country With No Social Security Agreement With The Uk Low Incomes Tax Reform Group

Post a Comment for "National Insurance 2021/22"