J Rate National Insurance

The driver was insured by Penn National. For 2020-21 the Class 1 National Insurance threshold was 9500 a year.

:max_bytes(150000):strip_icc()/profile-EricEstevez-4439ff1611f74bbfbabfc9fa32af2072.jpg) National Insurance Contributions Nic Definition

National Insurance Contributions Nic Definition

You paid 2 on any earnings above 50000.

J rate national insurance. Class 4 Rate for tax year 2020 to 2021. National Insurance Contributions from April 2020 From 6 April 2020 the rates payable for employee and employer National Insurance Contributions NICs remain unchanged in the Isle of Man IOM. 184 to 967 a week 797 to 4189 a month.

It is mandatory to take motor insurance policy for all vehicle owners as per Motor Vehicle Act 1988It safeguard against accidental damage or theft of the vehicle and also safeguard against third party legal liability for bodily injury andor property damageIt also provides Personal Accident cover for owner driver occupants of the vehicle. A car came up over the road set back and hit my sons Jeep. Use the tables in this booklet to calculate National Insurance contributions for employees that are payable under contribution table letters A H J M and Z.

Use from 6 April 2019 to 5 April 2020 inclusive Standard Rate NICs tables CA38. Youll usually pay a reduced rate of 2 on your weekly earnings between 184 and 967 in one of your jobs instead of the standard rate of 12. National Insurance rates 2020-21.

There are no current ratings for National General Insurance Company with JD. Class 1 National Insurance rate. Use from 6 April 2017 to 5 April 2018 inclusive Standard Rate NICs tables CA38.

National Insurance Contributions from April 2019 From 6 April 2019 the rates payable for employee and employer National Insurance Contributions NICs remain unchanged in the Isle of Man IOM. But you can choose to pay voluntary National Insurance. Married Women and Widows entitled to pay reduced National Insurance.

Employees in this category defer national insurance because they are already paying contributions in another job Employees whom have more than one job. Get Free Quotation Buy Online Now. Rates allowances and duties have been.

The Lower Earnings Limit LEL increases to 118 per week the Primary and Secondary thresholds remain aligned and increase to 125 the. 9 on profits between 9501 and 50000 2 on profits over 50000. You pay mandatory National Insurance if youre 16 or over and are either.

Class 2 Rate for tax year 2020 to 2021. In the customer services ratings JD. If you earn less than this amount youll pay no National Insurance contributions.

We rarely see National Insurance category B employees. The Jeep is a 2016 with low miles and no dents. Ad Extensive Motor Insurance Policy.

The rates for most people for the 2021 to 2022 tax year are. This publication includes information about the rates payable for the different National Insurance classes for the current and previous 3 tax years. National Insurance Category Letter J.

An employee earning above 184 a week self-employed and making a profit of 6515 or more a year. Do not use this company and I hope you never get hit by someone who has their insurance. This is not straightforward see here.

Employees deferring National Insurance because they are paying it in another job. Employees under 21 deferring National Insurance because they are paying it in another job. There are times when you do not need to pay NICs or cannot qualify for NI credits.

Penn National will not cover Jeep parts. National Insurance contributions Tables A H J M and Z These tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. Get Free Quotation Buy Online Now.

If you earned more you paid 12 of your earnings between 9500 and 5000. Ad Extensive Motor Insurance Policy. The Lower Earnings Limit LEL increases to 120 per week the Primary and Secondary thresholds remain aligned and increase to 138 the.

Power Associates ranked National General Insurance Company while still GMAC Insurance with a 2 out of 5 in the category of purchase experience and with a 3 out of 5 in the category of claims satisfaction and overall customer satisfaction. National Insurance contributions Tables A H J M and Z These tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. If you are classed under category J employers will deduct from employees 0.

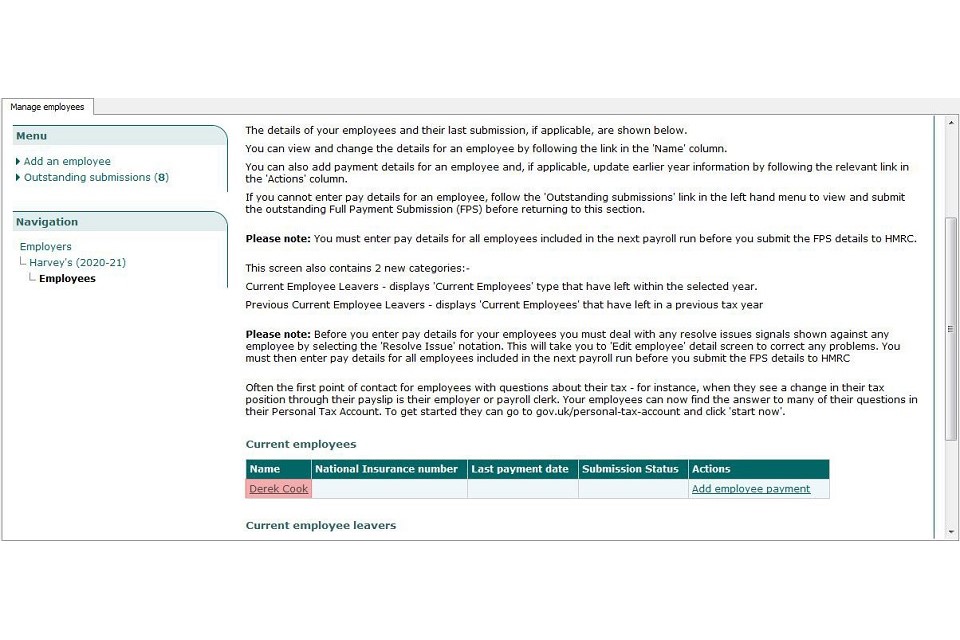

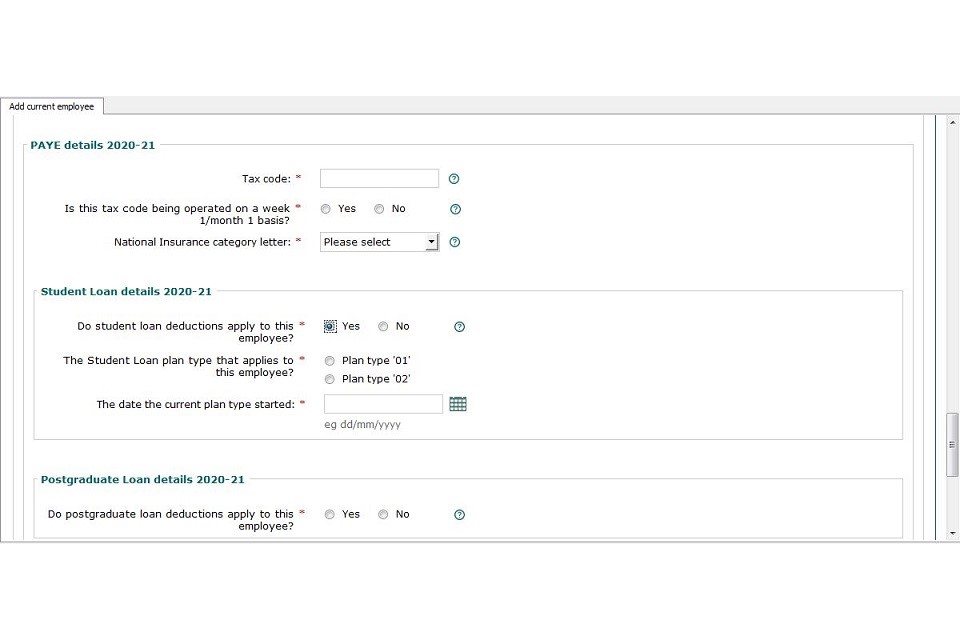

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

Life Insurance Policy For 5 Years Life Insurance Quotes Life Insurance For Seniors Life Insurance Calculator

Life Insurance Policy For 5 Years Life Insurance Quotes Life Insurance For Seniors Life Insurance Calculator

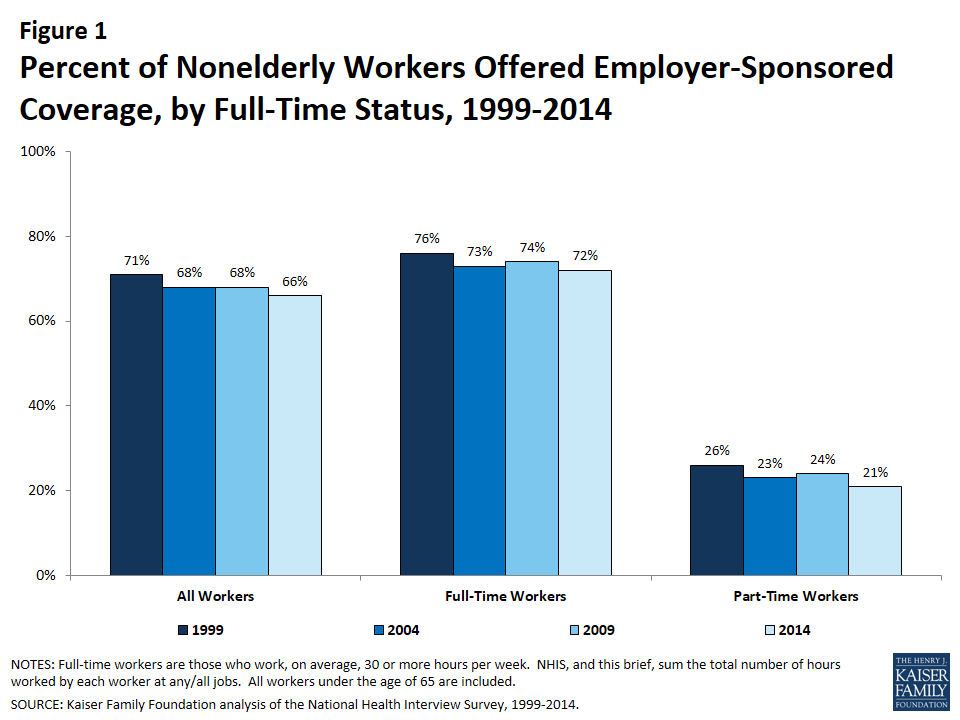

Trends In Employer Sponsored Insurance Offer And Coverage Rates 1999 2014 Kff

Trends In Employer Sponsored Insurance Offer And Coverage Rates 1999 2014 Kff

3 3 Transport Costs The Geography Of Transport Systems

3 3 Transport Costs The Geography Of Transport Systems

Key Performance Indicators Infographic Via Kpiinstitute Org Manajemen Bisnis Kepemimpinan Pendidikan Karakter

Key Performance Indicators Infographic Via Kpiinstitute Org Manajemen Bisnis Kepemimpinan Pendidikan Karakter

32 000 After Tax 2021 Income Tax Uk

32 000 After Tax 2021 Income Tax Uk

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

Cpa Cost Per Acquisition Outline Diagram Vector Illustration Sales And Marketing Selling Skills Cpa

Cpa Cost Per Acquisition Outline Diagram Vector Illustration Sales And Marketing Selling Skills Cpa

How To Avoid The 30 Tax Withholding For Non Us Self Publishers Thinkmaverick My Personal Journey Through Entrepreneursh Self National Insurance Number Tax

How To Avoid The 30 Tax Withholding For Non Us Self Publishers Thinkmaverick My Personal Journey Through Entrepreneursh Self National Insurance Number Tax

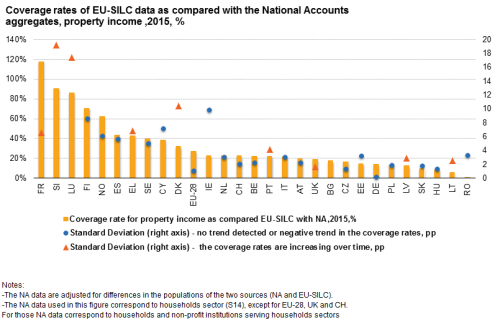

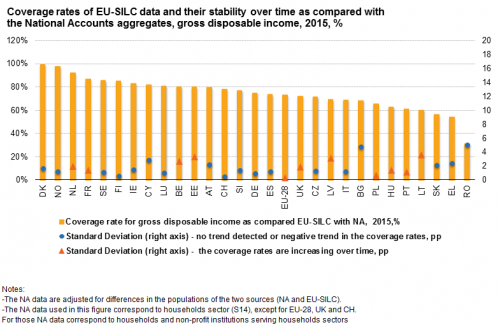

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Life Insurance Research Papers Academia Edu

Life Insurance Research Papers Academia Edu

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Concepts For Household Income Comparison Between Micro And Macro Approach Statistics Explained

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Health Insurance A Visual Glossary Infographic Infographic Health Health Insurance Health Insurance Quote

Health Insurance A Visual Glossary Infographic Infographic Health Health Insurance Health Insurance Quote

Post a Comment for "J Rate National Insurance"