D Rate National Insurance

Class 2 Rate for tax year 2020 to 2021. NICL was nationalized after 66.

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Salary Calculator Salary Net Income

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Salary Calculator Salary Net Income

If the director works for less than 12 months of the year the annual allowance is reduced accordingly.

D rate national insurance. In the United Kingdom UK rates of National Insurance have remained static for 201415. But have we ensured that the huge investments made is protected with adequate insurance. Insurers offering DO insurance face challenges including the increasingly complex and interconnected business environment as well as emerging exposures such as.

Today British employees pay the National Insurance rate from age 16 through the official retirement age which is age 65 for most but is being gradually increased to age 67. 12 of your weekly earnings between 184 and 967 2021-22 2 of your weekly earnings above 967. For example if they are under 16 years of age.

If your income is less than 8164 you are exempted from National Insurance contributions. Repeal of certain Class 4 NICs reliefs Rates and thresholds for employers 2019 to 2020 Rates and thresholds for employers 2020 to 2021. National Insurance is a system of contributions paid to qualify for certain benefits including the State Pension.

Although both Employee and Employer NICs are deducted directly from wages only the employee portion of the NICs payment is eligible for tax relief. National Insurance Category Letter X. Rate on earning above the upper earnings limit 1 2 2 2 2 Earnings threshold secondary for employers 110 136 144 148 153 Employers - on earnings over the earnings threshold 2 128 138 138 138 138 Class 2 contributions 3 Flat rate 240 250 265 270 275.

This does not depend on the frequency with which they are paid. National Insurance Company was set up largely on the nationalism principles of Swaraj self-government. Specific National Insurance rates vary depending on the amount of money you earn.

They must also pay Class 1A on some other lump sum payments for example redundancy payments. It was established on 5th December 1906 at Kolkata. Excel Help - Information on downloading and using Microsoft.

From January the salary in excess of the threshold will be subject to 12 and 138 for employee and employer NI respectively. The primary employee and secondary employer thresholds have been realigned and increased to 153 per week. As a director you will pay National Insurance if youre.

An employee or director earning above the earnings threshold 183 a week for 202021. Class 4 Rate for tax year 2020 to 2021. But you can choose to.

9 on profits between 9501 and 50000 2 on profits over 50000. The National Insurance rate you pay depends on how much you earn. But if your income is between 8164 and 45000 you are required to pay 12 of your earnings as National Insurance Contributions NIC.

Category letter X is used for employees who do not have to pay national insurance. There is no tax relief afforded to employer National Insurance Contributions. Historical Rates Prior Rule - Excel.

There are times when you do not need to pay NICs or cannot qualify for NI credits. An employer must choose the appropriate National Insurance contribution category letter to have the exemption applied. The LEL has increased to 111 per week.

1 From 6 April 2015 employers with employees under 21 years old do not pay Class 1 secondary National Insurance contributions NICs on earnings up to the Upper Secondary Threshold UST for those employees. National Insurance Company Limited NICL is the oldest non-life general insurance company of India. Prior Rule beginning May 28 2009 2021 Rates through 03312021 2020 Rates.

Class 4 National Insurance contributions NICs. NICs SFSP policy is a comprehensive policy available at low cost to indemnify the financial loss in the event of damage to buildings and contents within. The UAP remains fixed at 770 and the UEL has increased to.

Your National Insurance contributions will be taken off along with Income Tax before your employer pays your wages. National insurance for employees and employers Some married women and widows pay a reduced rate of class 1 National Insurance as employeesof 585 rather than the full rate. National Rates and Rate Caps Previous Rates Revised Rule beginning April 1 2021 April 1 2021.

Each year the full rates and thresholds change so we would recommend checking for any updates. Employers pay Class 1A and 1B National Insurance on expenses and benefits they give to their employees. National Insurance Rates for the Employed.

There is always a chance of these precious investments being damaged by unfortunate and unexpected events like fire explosions natural calamities or riots etc. Anything above 45000 is 2 of your earnings towards National Insurance.

P45 Vs P60 What S The Difference Revolut

P45 Vs P60 What S The Difference Revolut

:max_bytes(150000):strip_icc()/profile-EricEstevez-4439ff1611f74bbfbabfc9fa32af2072.jpg) National Insurance Contributions Nic Definition

National Insurance Contributions Nic Definition

Blue Payslip Design 2 Digital Only Copy Year Of Dates Unit Rate Bank Statement

Blue Payslip Design 2 Digital Only Copy Year Of Dates Unit Rate Bank Statement

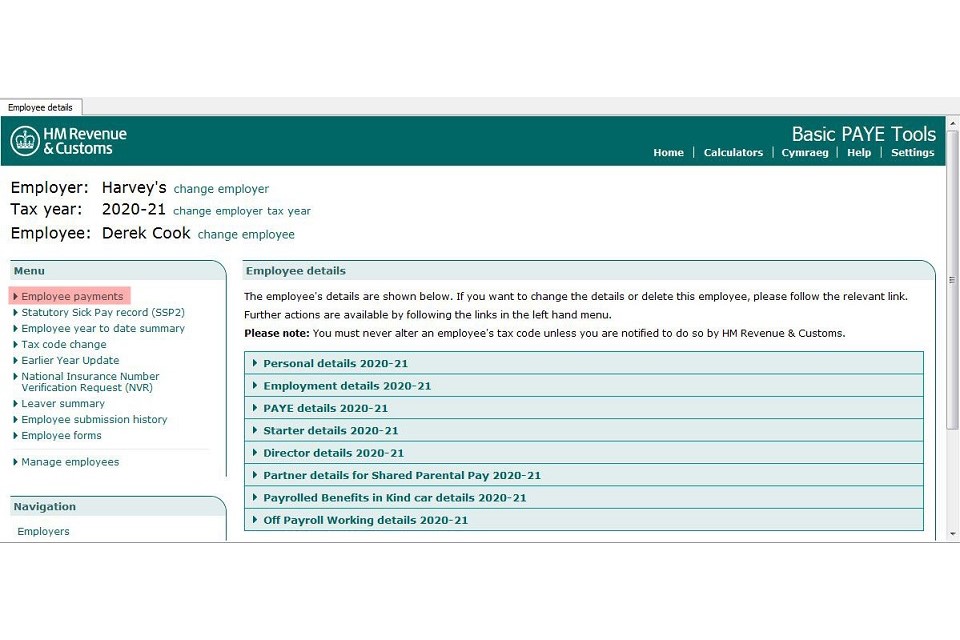

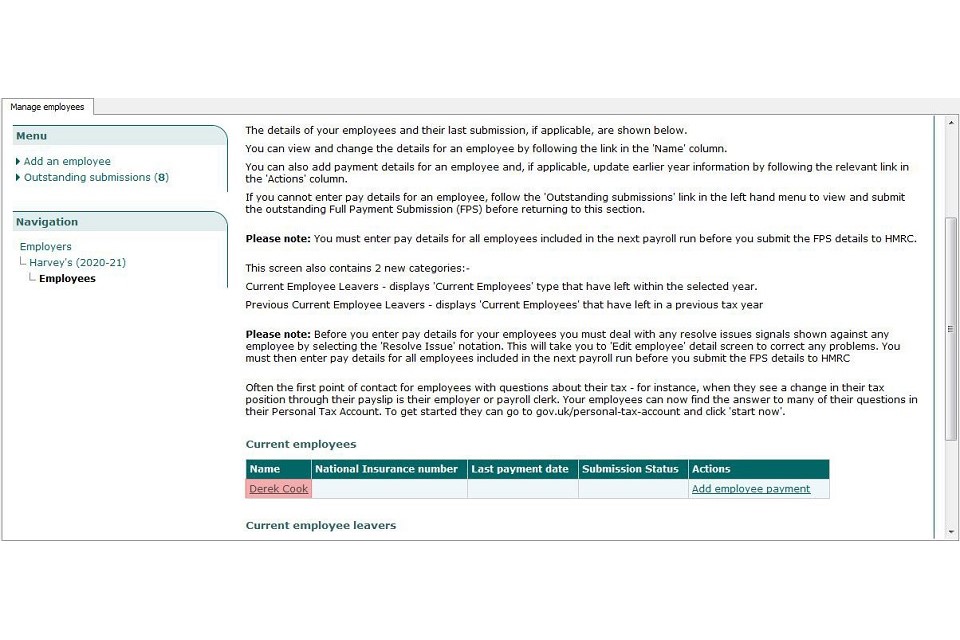

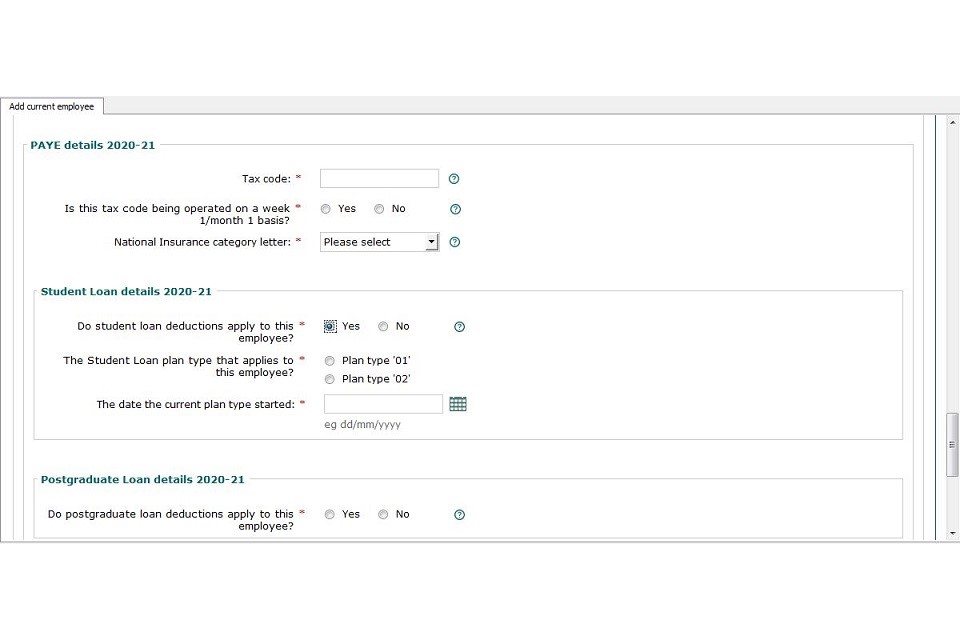

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

National Insurance How Much You Pay Gov Uk

National Insurance How Much You Pay Gov Uk

P45 Vs P60 What S The Difference Revolut

P45 Vs P60 What S The Difference Revolut

How Do I Opt Out Nest Member Help Centre

How Do I Opt Out Nest Member Help Centre

Home Loan Interest Rate Loan Interest Rates Loan Rates Loan

Home Loan Interest Rate Loan Interest Rates Loan Rates Loan

National Insurance How Much You Pay Gov Uk

National Insurance How Much You Pay Gov Uk

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Progressive Insurance Review Valuepenguin

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

Why Am I Paying Employers National Insurance As An Umbrella Contractor It Contracting

Why Am I Paying Employers National Insurance As An Umbrella Contractor It Contracting

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Key Performance Indicators Infographic Via Kpiinstitute Org Manajemen Bisnis Kepemimpinan Pendidikan Karakter

Key Performance Indicators Infographic Via Kpiinstitute Org Manajemen Bisnis Kepemimpinan Pendidikan Karakter

State Pension How A National Insurance Record Can Be Built Up Without Working In 2020 National Insurance Pensions Building Society

State Pension How A National Insurance Record Can Be Built Up Without Working In 2020 National Insurance Pensions Building Society

Https Thepeloton Co Uk Wp Content Uploads 2019 06 Understanding Your Payslip Employee Guide Pdf

Post a Comment for "D Rate National Insurance"