Class D National Insurance

For 2020-21 class 2 National Insurance. NI Credit counts only towards the State Pension.

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

Employees earning more than 184 a week and under State Pension age - theyre automatically deducted by your employer.

Class d national insurance. National Insurance rates self-employed Class 2 NICs is paid monthly the payment varies depending on the amount of weeks that fall in the month. National insurance contributions are a tax on earnings. How Much is Class 2 National Insurance.

The termination award consists of 40000 I. Living abroad and paying voluntary Class 2 contributions. This is for employees earning more than.

9 on profits between 9501 and 50000 2 on profits over 50000. All of the below categorys are for class 1 National Insurance contributions. In some case you may wish to voluntarily pay class 2 National Insurance.

Permanent and pensionable employees in the public service other than those mentioned in Classes B and C recruited prior to 6 April 1995. National Insurance is an umbrella term for universal health care the public pension program and unemployment benefits. When goods are transported by mail or courier shipping insurance is.

National Insurance class Who pays. You may need to consider making a voluntary payment of class 2 National Insurance in advance even where your profits are over the Small Profit Threshold. Class 1A or 1B.

Cards were exchanged every twelve months and because of the very large numbers of. Self-employed National Insurance rates. A minister of religion who does not receive a salary or stipend.

Class 1 National Insurance contributions are due on the 25000 earnings E plus F. It covers only a limited number of social insurance payments. Class 2 contributions 3 Flat rate 240 250 265 270 275 Small earnings exception limit 5075 5315 5595 5725 5885 Class 3 contributions Voluntary contributions 1205 1260 1325 1355 1390 Class 4 contributions Rate 8 9 9 9 9.

There are times when you do not need to pay NICs or cannot qualify for NI credits. NI Credit counts towards several benefits including bereavement benefits JSA and your State Pension. This table shows how much employers deduct from employees pay for the 2021 to 2022 tax year.

Contributions are taken to help build your entitlement to certain state benefits such as state pension and maternity allowance. Class H applies to NCOs and enlisted personnel of the Defence Forces. Until 1975 the suffixes A B C and D at the end of the NI number signified the period of validity of the National Insurance cards originally used to collect National Insurance contributions NICs.

The Class 2 National Insurance contribution is a fixed amount of 305 a week and its only charged if your annual profits are 6475 or more. Employee National Insurance rates. Class 4 National Insurance contributions are only charged if your profits are above 9500 a yearThe rate is nine per cent of profits between 9501.

A person who makes investments - but not as a business and without. Cargo insurance is the sub-branch of marine insurance though Marine insurance also includes Onshore and Offshore exposed property container terminals ports oil platforms pipelines Hull Marine Casualty and Marine Liability. PRSI Class D Rates.

You pay mandatory National Insurance if youre 16 or over and are either. Employees may make additional voluntary payments to. An employee earning above 184 a week self-employed and making a profit of 6515 or more a year.

Class 4 Rate for tax year 2020 to 2021. 120 to 184 520 to 797 a month. Class 2 and Class 4 NICs are charged at different rates.

Your contributions will be taken off along with your income Tax before your employer pays your wages. Class D Permanent and pensionable employees in the public service other than those mentioned in Classes B and C recruited before 6 April 1995. How Do I Check My National Insurance Credits.

It covers only a limited number of social insurance benefits. Class D applies to permanent and pensionable employees in the public service other than those mentioned in Classes B and C recruited before 6 April 1995. This can be done on the self-assessment tax return.

Class 2 Rate for tax year 2020 to 2021. PRSI Class D People within CLASS D. This is likely to apply if you want to claim Maternity Allowance before the usual self-assessment payment date for the tax year.

Those who are eligible will get one of these two types of National Insurance credits.

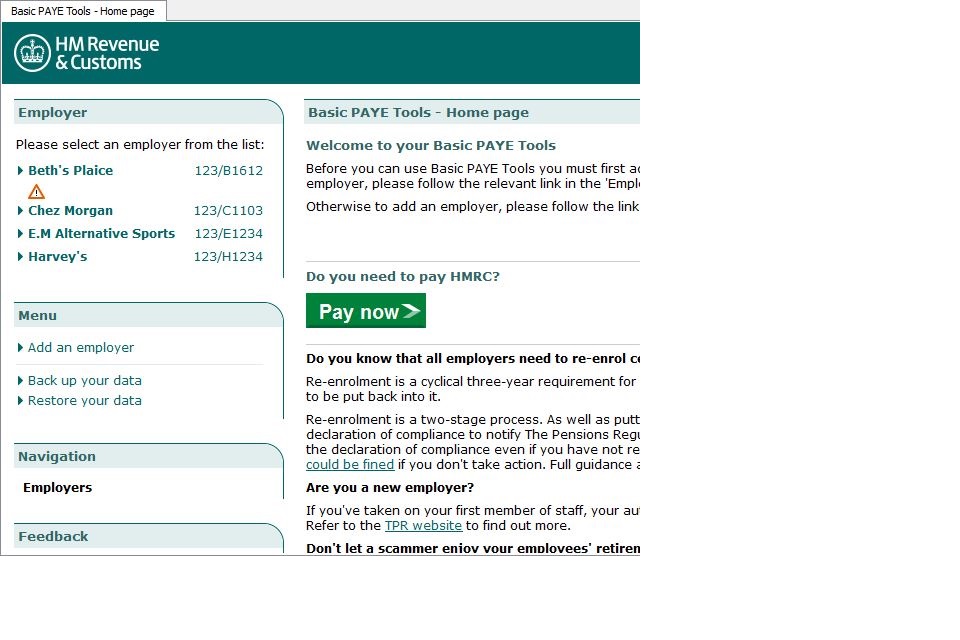

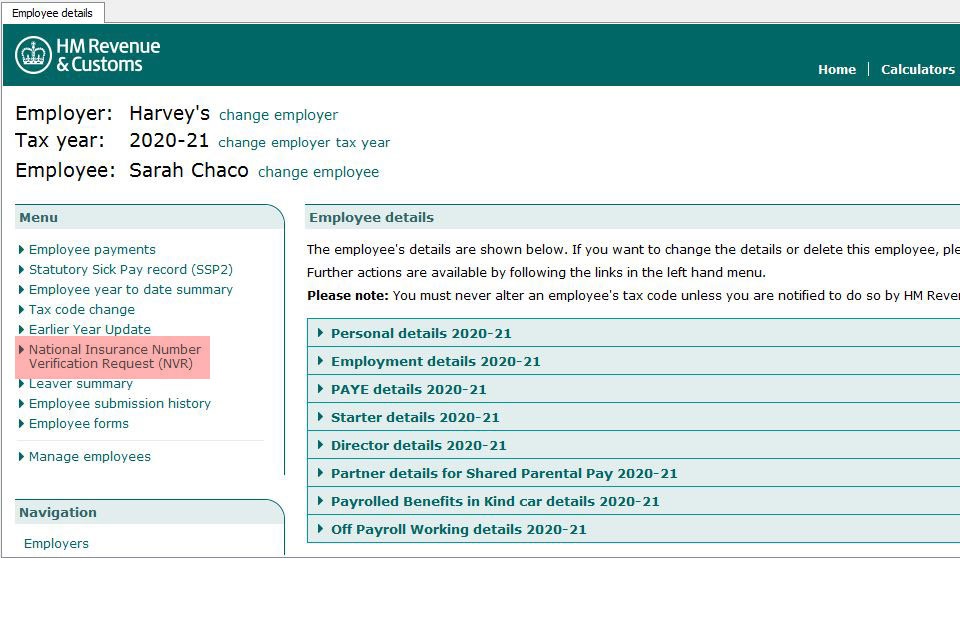

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

How To Register As Self Employed In The Uk A Simple Guide

How To Register As Self Employed In The Uk A Simple Guide

National Insurance How Much You Pay Gov Uk

National Insurance How Much You Pay Gov Uk

Employer S National Insurance Contributions Money Donut

Employer S National Insurance Contributions Money Donut

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

Pin By Chad King On Garret Visa Card Numbers Drivers License Passport Online

Pin By Chad King On Garret Visa Card Numbers Drivers License Passport Online

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

P45 Vs P60 What S The Difference Revolut

P45 Vs P60 What S The Difference Revolut

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

P45 Vs P60 What S The Difference Revolut

P45 Vs P60 What S The Difference Revolut

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

How To Get A National Insurance Card 9 Steps With Pictures

How To Get A National Insurance Card 9 Steps With Pictures

Post a Comment for "Class D National Insurance"