National Insurance Qualifying Year Threshold

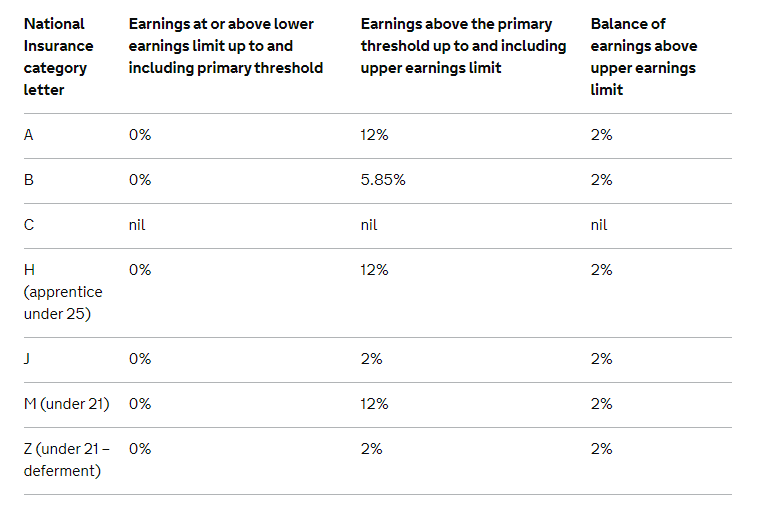

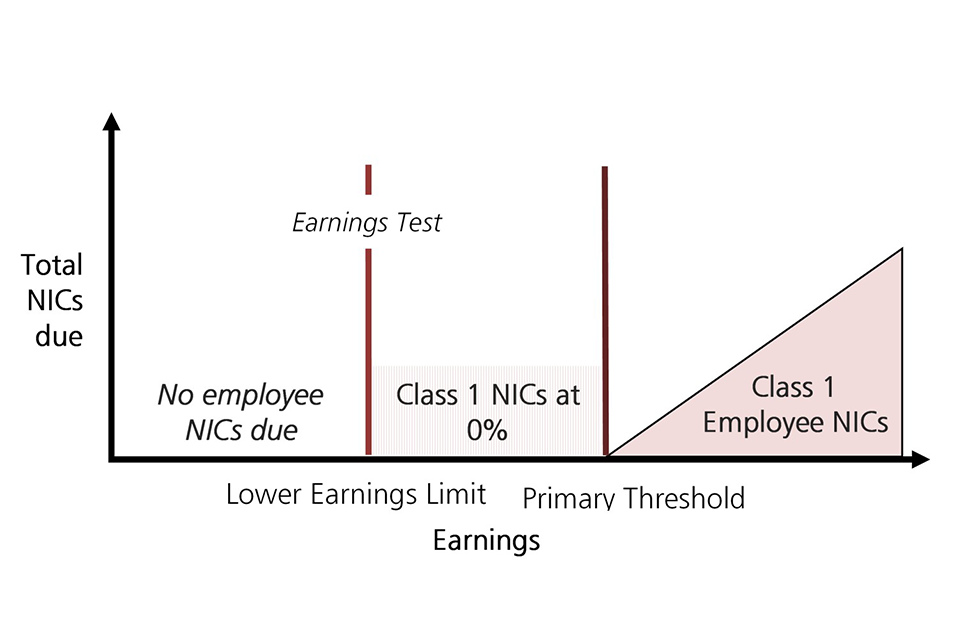

However contributions are paid at a notional zero rate between the lower earnings limit and the primary threshold. This threshold of 8632 is known as the primary threshold.

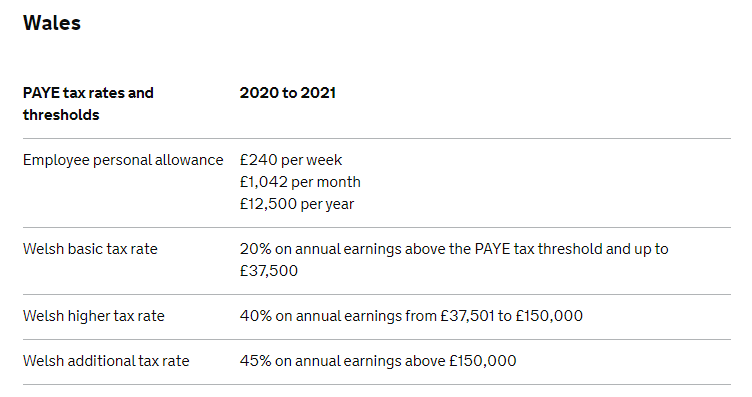

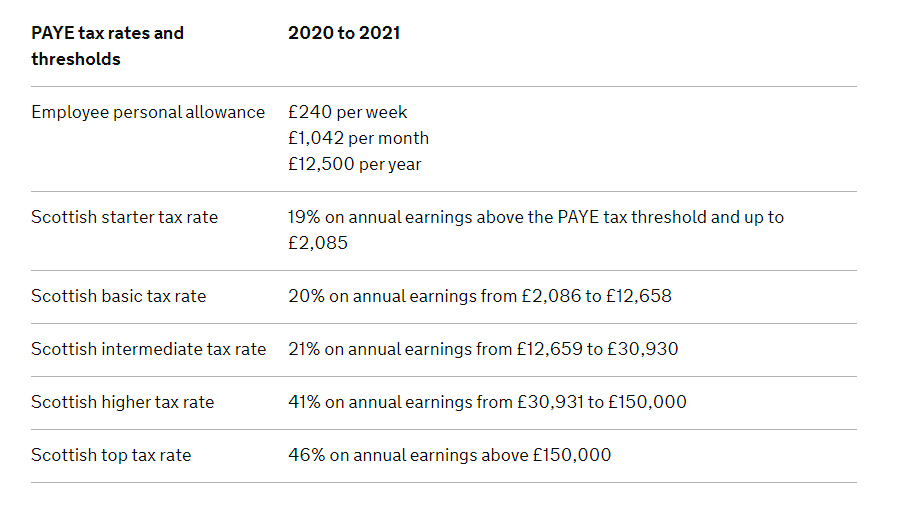

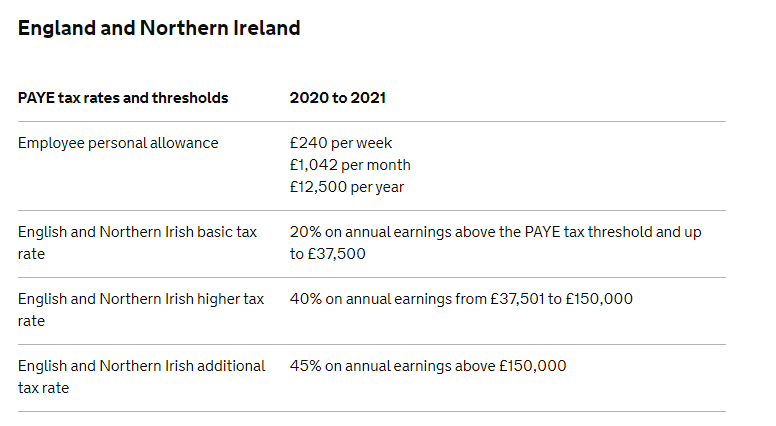

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

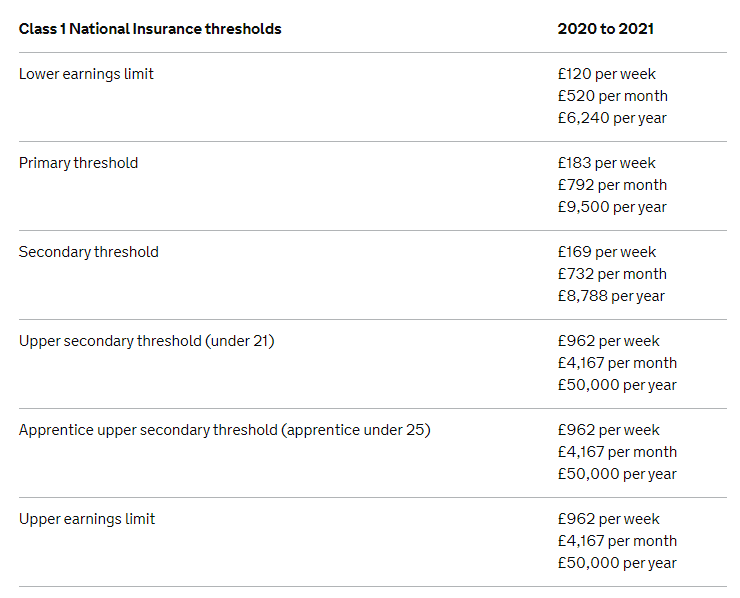

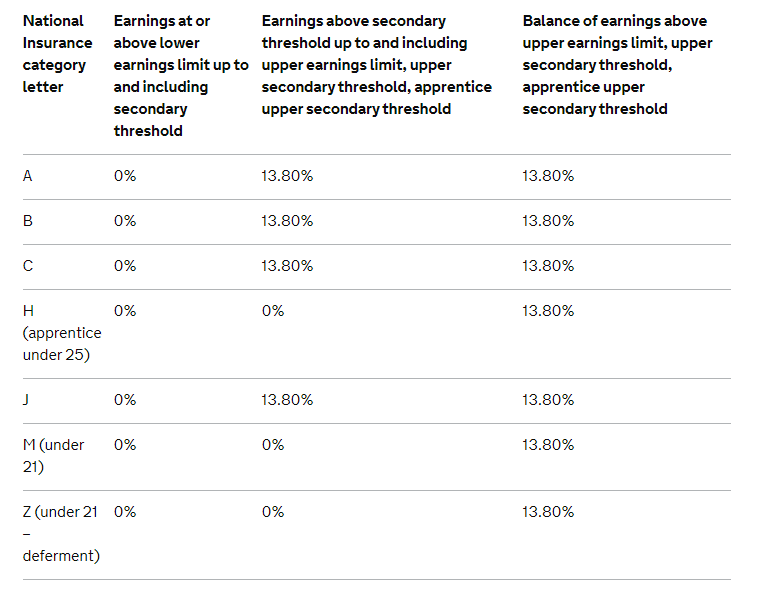

Class 1 National Insurance Thresholds.

National insurance qualifying year threshold. Working and paying National Insurance. A written ministerial statement by the Financial Secretary to the Treasury on 16 December concerning national insurance contributions NICs re-rating for the tax year 202122 confirmed that the government will use the September consumer price index CPI figure 05 as the basis for setting all national insurance limits and thresholds and. Youll need 35 qualifying years to get the full new State Pension.

But as you say there is a lower point at which you are credited with NI contributions even though you dont have to pay them. From April 2020 the threshold for National Insurance Contributions will rise to 9500 a year meaning a typical employee will save around 104 a year. Employed and earning over 166 a week from one employer Self.

Under these rules youll usually need at least 10 qualifying years on your National Insurance record to get any State Pension. Ad Extensive Motor Insurance Policy. These limits are respectively 120 and 183 per week for 202021.

To get the full basic State Pension you need a total of 30 qualifying years of National Insurance contributions or credits. Unfortunately this does not apply to companies such as those which only employ one director and no other staff. For a year of your working life to be a qualifying year towards your state pension you have to have paid or been credited with NI contributions on earnings equal to 52 times the weekly.

The government detail that for a year to be qualifying the person must either be. This means that for you dont pay Employers National Insurance for the first 4000 in the tax year. Get Free Quotation Buy Online Now.

Qualifying years if youre working. This remains at 120 per week for 202122 520 per month. Get Free Quotation Buy Online Now.

Once an employees earnings reach the primary threshold they must start paying employee Class 1 National Insurance contributions. It has risen from 8632 to 9500 following the start of the new tax year on April 6. 184 per week 797 per month 9568 per year.

This means you were either. 120 per week 520 per month 6240 per year. Ad Extensive Motor Insurance Policy.

Primary Threshold PT 166 per week. This month the National Insurance threshold increased. For 202122 the primary threshold is set at 184 per week 797 per month.

Class 1 National Insurance thresholds 2021 to 2022. For qualifying employers the 4000 Employers National Insurance allowance remains in force for the 2021-22 year. Youll need 35 qualifying years to get the new full State Pension if you do not have a National Insurance record before 6 April 2016.

Employees come within the ambit of Class 1 National Insurance contributions once their earnings reach the lower earnings threshold. If you earn between the Lower Earning Limit and the Primary Threshold you will get National Insurance credits that is you will be entitled to some basic National Insurance benefits but wont actually pay any National Insurance. The now-former Chancellor of the Exchequer Sajid.

National Insurance Rates Limits And Thresholds For 2021 22 House Of Lords Library

National Insurance Rates Limits And Thresholds For 2021 22 House Of Lords Library

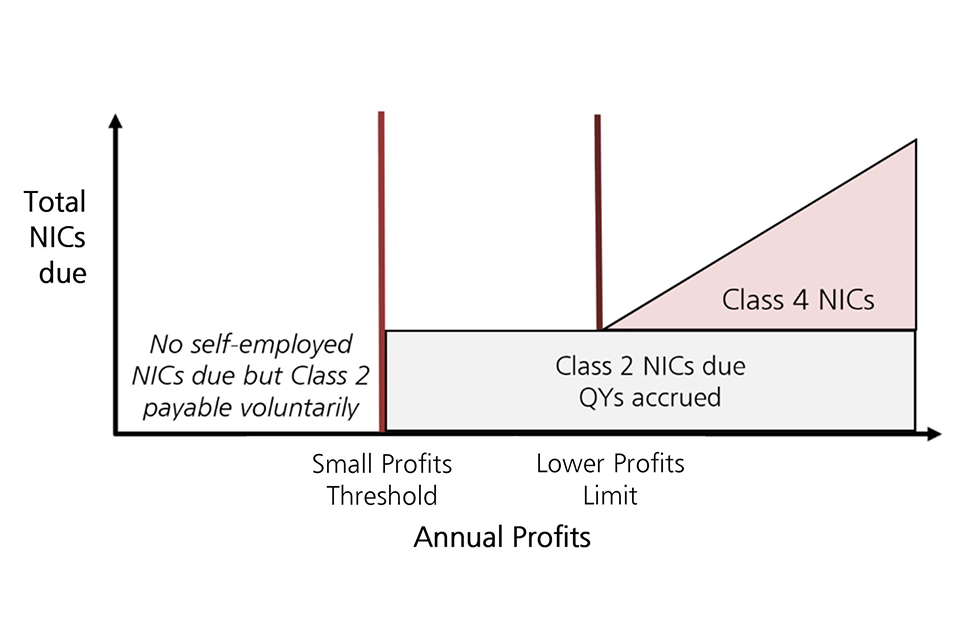

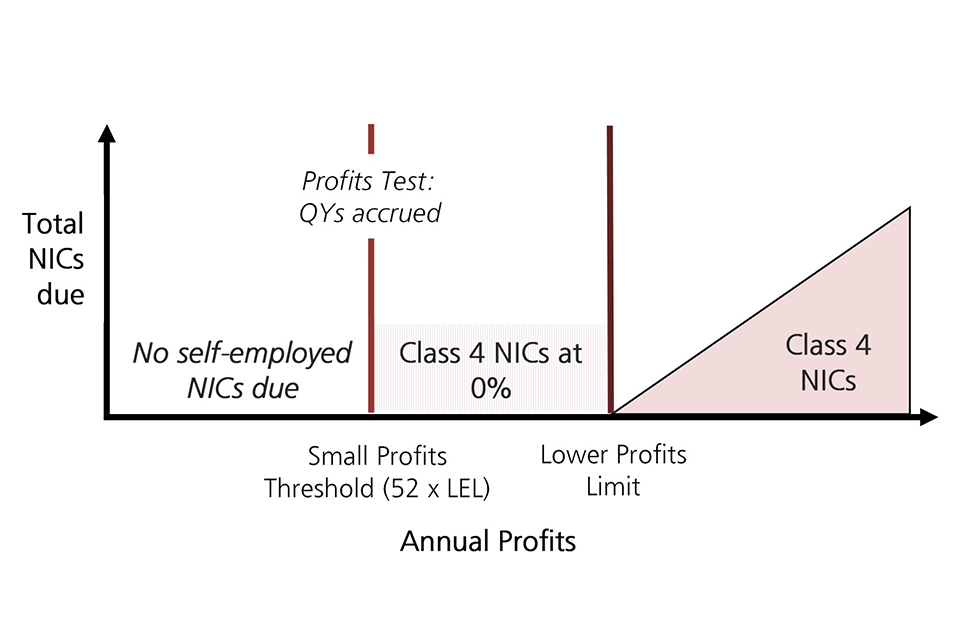

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Understanding Your Tax Code Dns Accountants Coding Understanding Understanding Yourself

Understanding Your Tax Code Dns Accountants Coding Understanding Understanding Yourself

Looking To Reduce Employee Health Insurance Costs A Self Funded Health Plan Might Work For You Health Plan Health Insurance Plans Health Quotes

Looking To Reduce Employee Health Insurance Costs A Self Funded Health Plan Might Work For You Health Plan Health Insurance Plans Health Quotes

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

State Pension How A National Insurance Record Can Be Built Up Without Working In 2020 National Insurance Pensions Building Society

State Pension How A National Insurance Record Can Be Built Up Without Working In 2020 National Insurance Pensions Building Society

Rolling With Ailerons On Rc Airplane Rcairplanes Aeromodelismo Aviacao Civil Aviacao

Rolling With Ailerons On Rc Airplane Rcairplanes Aeromodelismo Aviacao Civil Aviacao

David Corn Davidcorndc Twitter Health Insurance Infographic Childrens Health Kids Health

David Corn Davidcorndc Twitter Health Insurance Infographic Childrens Health Kids Health

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Calculate The National Insurance That Is To Be Paid By Both Employers And Employees Belonging To Class 1 Cla National Insurance Employment Accounting Services

Calculate The National Insurance That Is To Be Paid By Both Employers And Employees Belonging To Class 1 Cla National Insurance Employment Accounting Services

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

An Objective Look At The Affects Of Obamacare On Businesses And Individuals In The United States Healthcare Infographics Infographic Health Health Care

An Objective Look At The Affects Of Obamacare On Businesses And Individuals In The United States Healthcare Infographics Infographic Health Health Care

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

Good News Insuranceagents Www Arizonagroup Com Life Insurance Facts Life Insurance Companies Life And Health Insurance

Good News Insuranceagents Www Arizonagroup Com Life Insurance Facts Life Insurance Companies Life And Health Insurance

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Life Hint 17 Lost Weight You May Qualify For Lower Life Insurance Ask An Agent Life And Health Insurance Life Insurance Broker Life Insurance Quotes

Life Hint 17 Lost Weight You May Qualify For Lower Life Insurance Ask An Agent Life And Health Insurance Life Insurance Broker Life Insurance Quotes

Post a Comment for "National Insurance Qualifying Year Threshold"