What Is The W-8ben Form Used For

Submit Form W-8 BEN when requested by the withholding agent or payer. When the payor of the income has the W-8BEN on file the payor will be apprised that the payee is a non-US person and will undertake its withholding duties.

Foreign persons complete one of the forms in the Form W-8 series eg Form W-8BEN or W-8BEN-E.

What is the w-8ben form used for. If youre a legal citizen of the United States at no point will you have to worry about filling out the form. Form W-8BEN is used by foreign individuals who receive nonbusiness income in the United States whereas W-8BEN-E is used by foreign entities who receive this type of income. Current Revision Form W-8 BEN-E PDF Information about Form W-8 BEN-E Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities including recent updates related forms and instructions on how.

US persons do not complete a form in the W-8 series. Often brokers that allow you to trade US stocks with them will allow you to fill out and return your W-8BEN form to them. The W-8BEN tax form serves to.

It is required because of an intergovernmental agreement between Canada and the US. The official name for the W-8BEN form is the Certificate of. To trade US stocks you need to complete a W-8BEN form so that youre entitled to tax savings on interest earned.

Clients taxed at a 30 rate. The W-8BEN-E form asks for information such as. The W-8BEN-E form is an IRS Internal Revenue Service form used by foreign organizations doing business in the US.

What Is the W-8BEN-E Form. These tax forms are only used by foreign persons or entities certifying. Form W-8 BEN-E is used by foreign entities to document their status for purposes of chapter 3 and chapter 4 as well as other code provisions.

The W-8BEN-E form is used for reporting to the IRS information about a non-US. What is a W-8BEN. This fact will alert them to take out the appropriate withholding tax from the payees salary.

Find out what W-8BEN is and why you need to know about it. You can send a copy of the form to your non-resident alien employees but theyll need to fill it out themselves. About Form W-8 BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding.

Tax Withholding and Reporting. Claim that the individual or sole proprietor that is providing the W-8BEN is an NRA nonresident alien. For example a Form W-8BEN signed on September 30 2012 remains valid through December 31 2015.

If you are a non-US person that does business in the US Form W-8BEN will establish your foreign status and allow you to claim tax exemption or reduced tax rates on US-sourced income. Form W-8BEN is a Certificate of Foreign Status of Beneficial Owner for US. W-8BEN is used by foreign individuals who acquire various types of income from US.

Form W-8BEN allows Canadians and other foreign contractors from countries with similar treaties with the US to claim exemptions or special withholding rates. According to the University of Washington the form is used to validate that a vendor is a foreign organization. Instead they use Form W-9.

US taxpayers use Form W-9 to file theirs. Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US. How Long is the Form W-8BEN Valid.

W-8BEN forms are used to certify that foreign individuals not businesses have been paid with the appropriate withholding rate. Only partnerships and organizations need to file the W-8BEN-E form. The Substitute Form W-8BEN Tax Residency Self-Certification W-8BEN generally remains in effect from the date of signing until the end of.

The purpose of the form is to establish. Generally a current W-8BEN form will be in effect till 31st December three years after the date of signing. Form W-8BEN must be signed and dated by the beneficial owner of the income or by an authorized representative as evidenced by a duly completed Power of Attorney The IRS Form 2848 Power of Attorney may be used for this purpose.

IRS Form 2848 Power of Attorney may be used for this purpose. Which obligates Canadian Financial Institutions to provide this information. The payor of the earned income is informed of the filing status of the individual when they have a W-8BEN on file.

A W-8BEN form is a tax document used to certify that your country of residence for tax purposes is outside of the United States. Or by foreign business entities who make income in the US. Establish that an individual or sole proprietor is a foreign person who is subject to the 30 tax rate on domestic income earned by foreign businesses.

It is for individual use and not for business entities. To take advantage of any potential tax reduction you must maintain a current W-8BEN form as part of your account documentation. Form W-8BEN is also considered if Form 8833 must be filed.

Generally a Form W-BEN is valid from the date signed until the last day of the third succeeding calendar year. Company earning money from US. Canadian sole proprietors or independent contractors can claim an exemption from withholdings ie not have their payments from US.

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

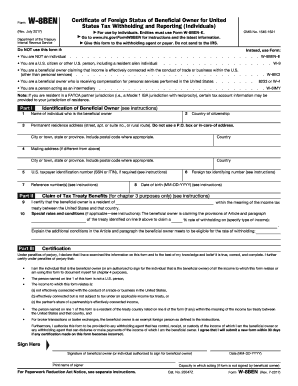

Fake Form W 8ben Used In Irs Tax Scams Trendlabs Security Intelligence Blog

W8ben E Form Download Fill Out Digital Pdf Sample

W8ben E Form Download Fill Out Digital Pdf Sample

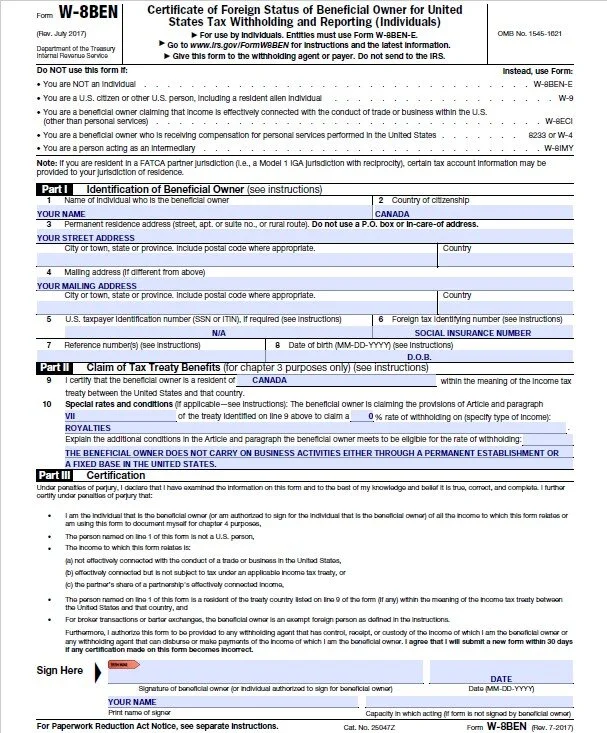

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

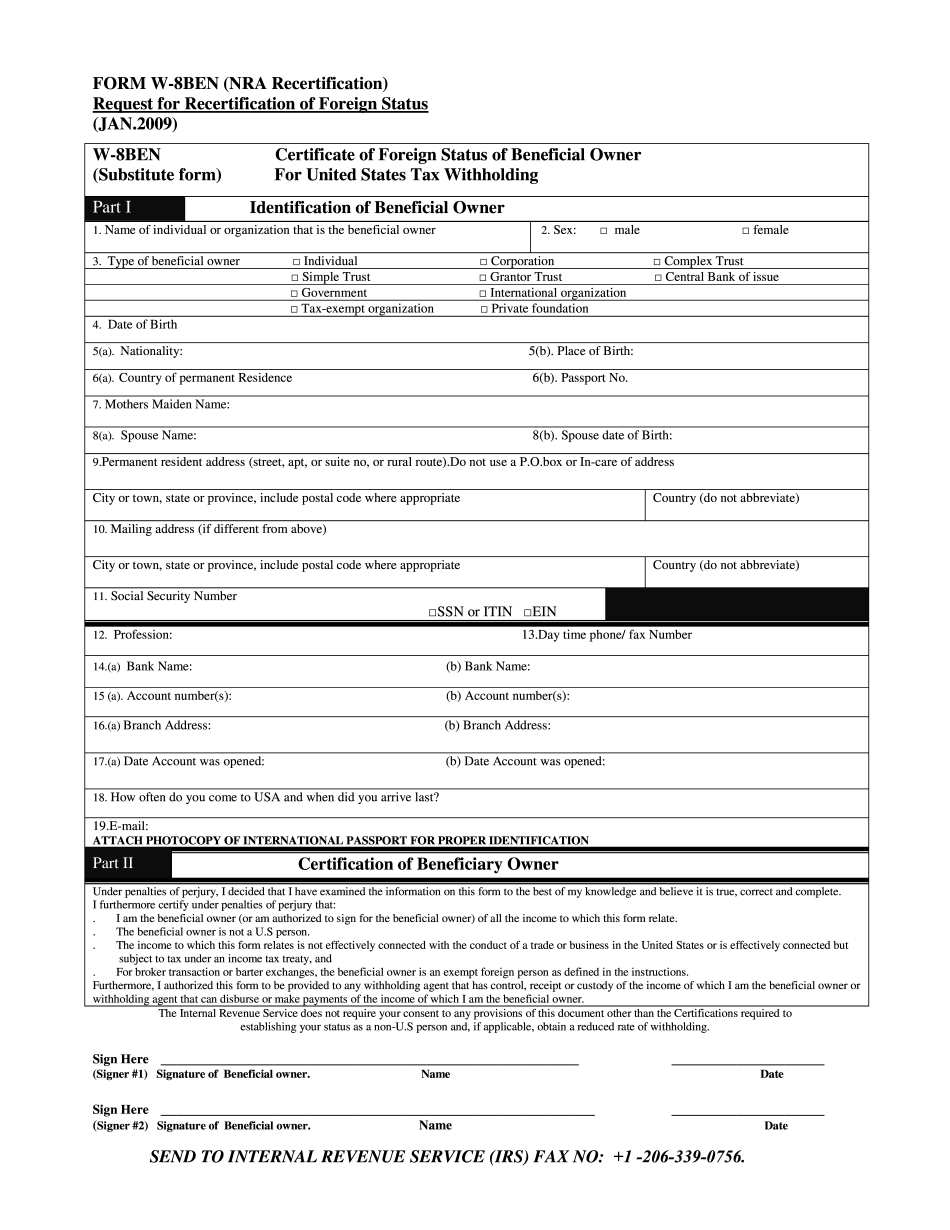

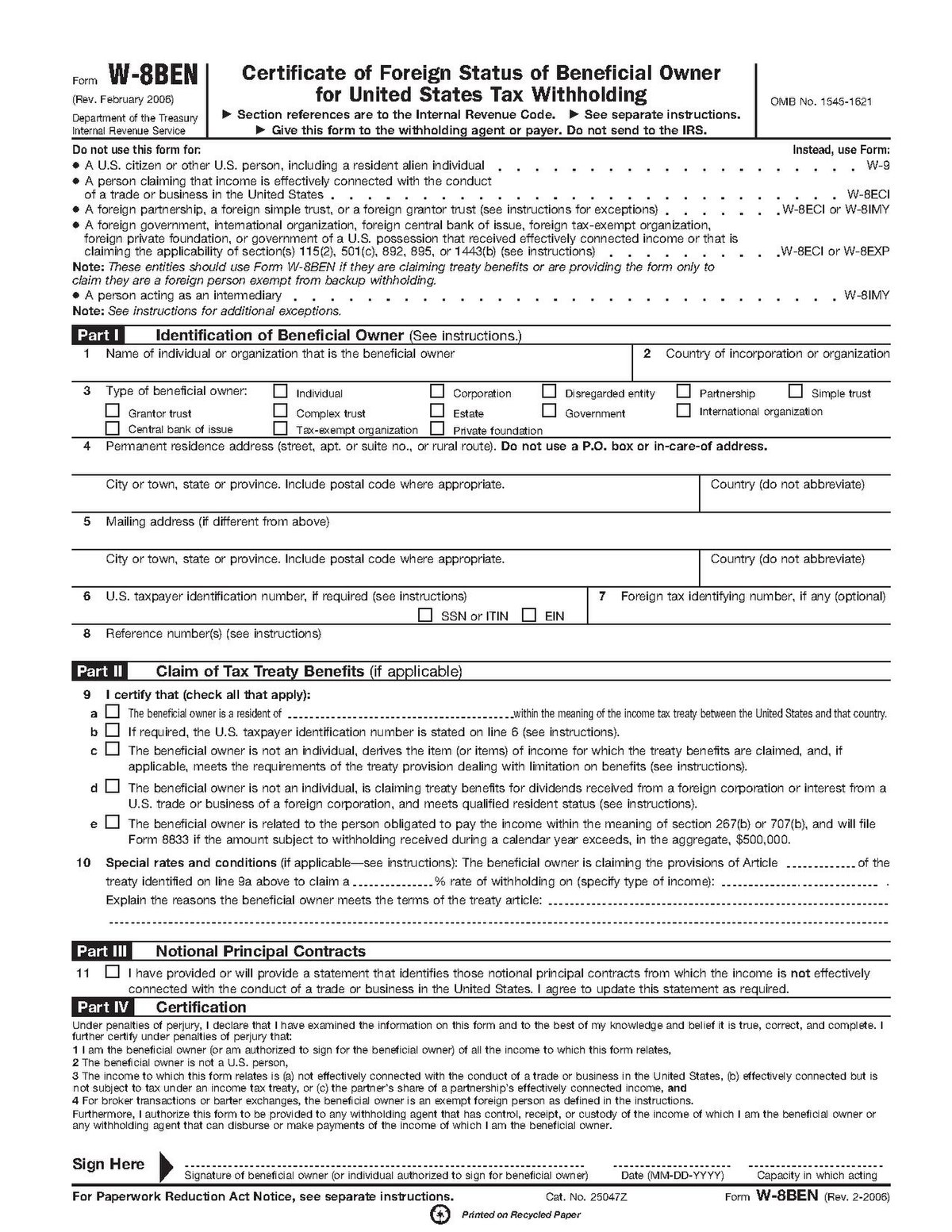

File Form W8 Ben 2006 Pdf Wikimedia Commons

File Form W8 Ben 2006 Pdf Wikimedia Commons

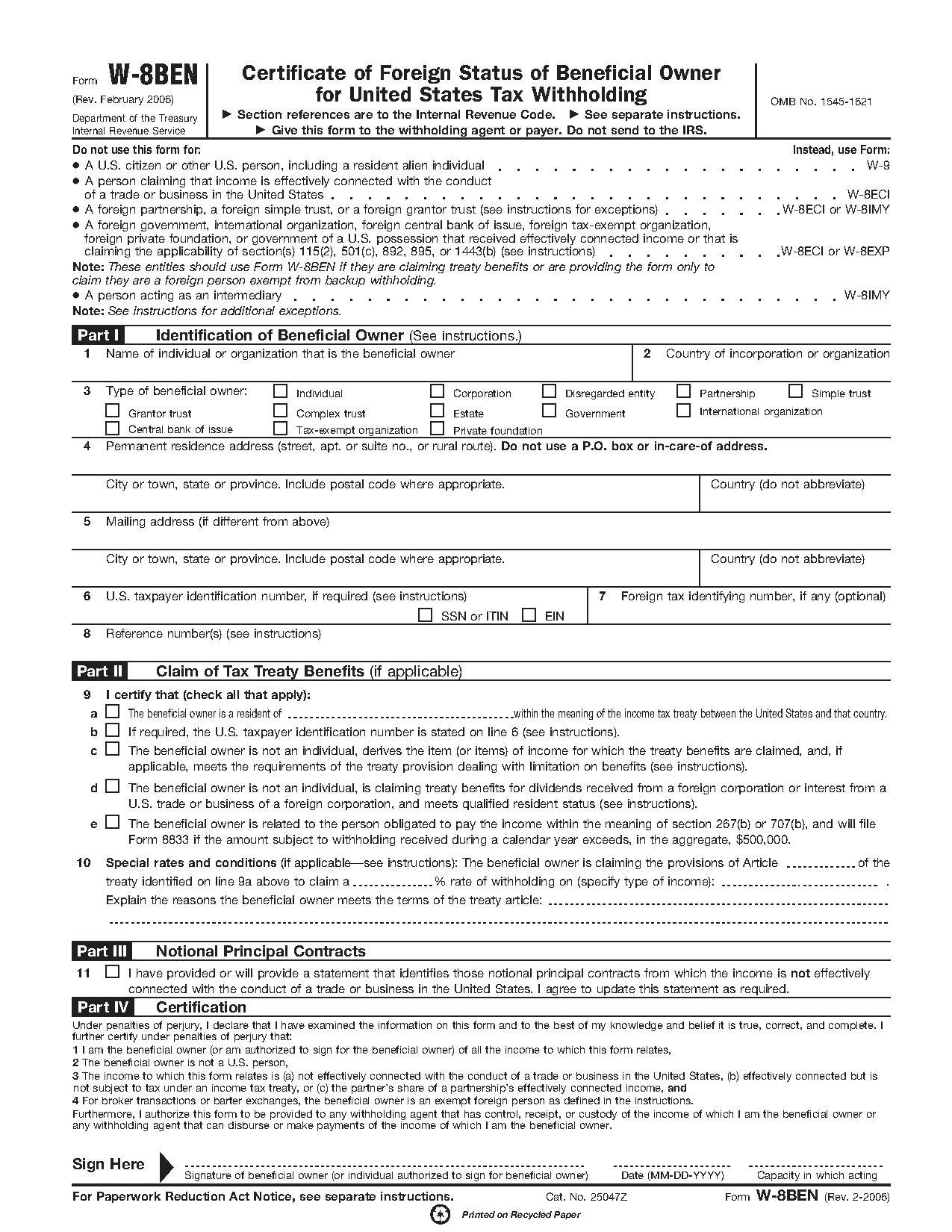

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Criminal Tax Considerations Tax Expatriation

Criminal Tax Considerations Tax Expatriation

File Form W8 Ben 2006 Pdf Wikimedia Commons

File Form W8 Ben 2006 Pdf Wikimedia Commons

W 8 Tax Forms Frequently Asked Questions Offset Artist Support And Faq

Fake Form W 8ben Used In Irs Tax Scams Don T Get Hooked

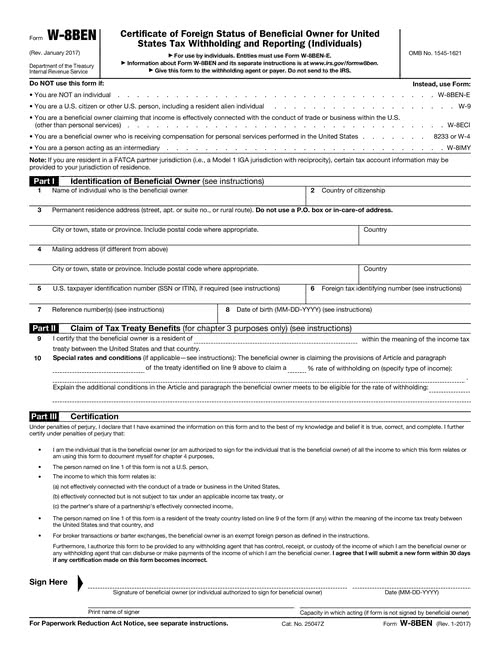

Irs W 8ben Form Template Fill Download Online Free Pdf

Irs W 8ben Form Template Fill Download Online Free Pdf

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Fake Form W 8ben Used In Irs Tax Scams Don T Get Hooked

/W-8BEN-f742fd00d28643d9b8bffe36547ab6c7.png)

Post a Comment for "What Is The W-8ben Form Used For"