Class 2 National Insurance Voluntary

If youre a man born after 5. Class 2 voluntary National Insurance contributions for 202021 are a mere 305 per week.

Example Document For Partnership Agreement General Partnership Sample Resume Agreement

Example Document For Partnership Agreement General Partnership Sample Resume Agreement

Who can pay voluntary contributions.

Class 2 national insurance voluntary. Those who are self-employed use voluntary Class 2 NIC to help qualify for benefits and the State Pension. Class 2 National Insurance This is a fixed weekly amount of 3 regardless of your income. 305 a week for Class 2 1540 a week for Class 3 You usually pay the current rate when you make a voluntary contribution.

Living abroad and paying voluntary Class 2 contributions a person who makes investments - but not as a business and without getting a fee or commission a non-UK resident whos self-employed in the. Most people will pay class 2 National Insurance along with class 4 National Insurance and income tax in January self-assessment payments. Some people do not pay Class 2 contributions through Self Assessment but may want to pay voluntary contributions.

Your entitlement to certain State benefits and the amount you can get depends on your National Insurance contribution NICs record. Class 4 contributions were payable at 9 on profits above 8632 falling to 2 on earnings above 50000. Ordinarily self-employed or employed right before going abroad.

It may be possible to pay voluntary Class 3 National Insurance contributions Class 2 if youre self-employed or possibly if youre living abroad in order to get a higher State Pension. Gaps in National Insurance Payments. In 2019-20 you owed Class 2 contributions if you earned more than 6365 which cost 3 a week.

Paying Class 2 NICs voluntarily may feel like an extra cost but chances are your future self will thank you. Voluntary contributions may be paid to make up the shortfall for a year where Class 1 or Class 2 contributions were not paid for the full 52 weeks or for a year for which there was no liability to either Class 1 or Class 2. Paying voluntary National Insurance counts towards many state benefits and towards the UK State Pension.

People with profits of less than the Small Profit Threshold 6475 for 202021 will not have to pay any class 2 National Insurance. For this class you must meet either of the following conditions. Those who are self-employed or living abroad may choose to pay voluntary Class 2 contributions instead.

National Insurance contributions that employees pay voluntarily are usually Class 3 contributions. If you are either self-employed or employed overseas then you can pay voluntary class 2 National Insurance contributions. If you dont pay into the pot you cant expect to receive money back out from it.

If you are a man born on April 6 1951 or later or a woman born on April 6 1953 or later you can top-up your missing NIC years with voluntary Class 3 NICs that vary. Nevertheless it could be worth making voluntary Class 2 contributions. Examiners moderators invigilators and.

Voluntary class 2 contributions are possible if you qualify at an even lower cost around 158 per year. You should be able to qualify for class 2 if you are living and working abroad and have previously lived in the UK for 3 years in a row as described here. These tables explain whos eligible to pay Class 2 or Class 3 contributions.

As a rule the majority of self employed workers pay their contributions as part of their Self Assessment tax returns. Voluntary Class 3 contributions Class 3 National. Class 2 Self-employed people earning profits of 6515 or more a year.

Start by reviewing your national insurance record in your personal tax account to check for any NIC gaps. Class 2 285 a week Class 3 - 1425 a week The rates change each April. People with some qualifying years but less than 10 may want to make voluntary contributions to bring their contribution record up to the minimum of 10 years needed for a reduced pension.

If youre earning less than this you can choose to pay voluntary contributions to fill or avoid gaps in your National. Which class to pay. Youre not obliged to make Class 2 contributions unless your profits turnover minus allowable expenses exceed 6365.

Employed but earning under 120 a week and.

Invest In Nps Investing How To Get Rich How To Plan

Invest In Nps Investing How To Get Rich How To Plan

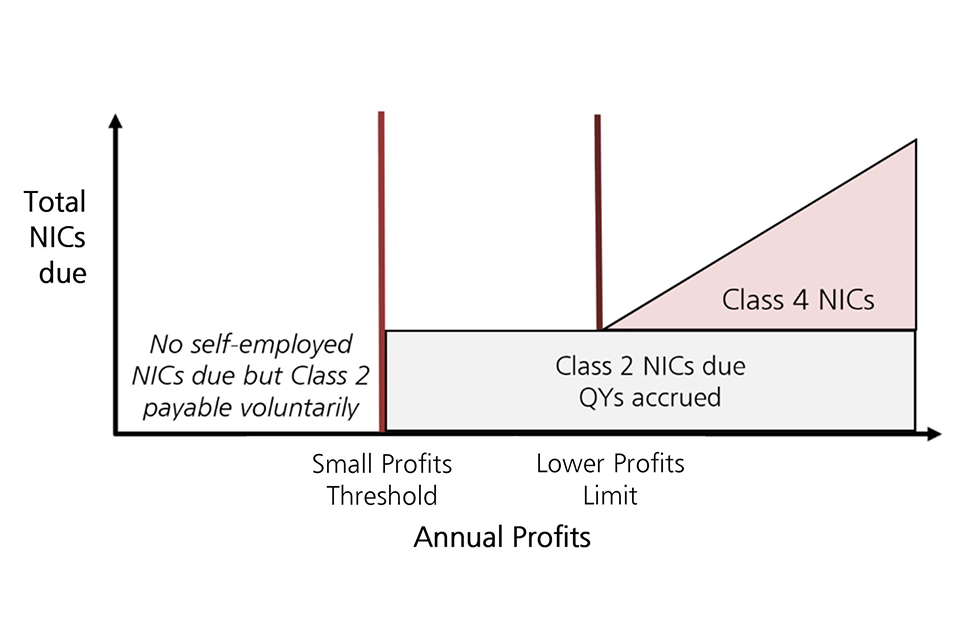

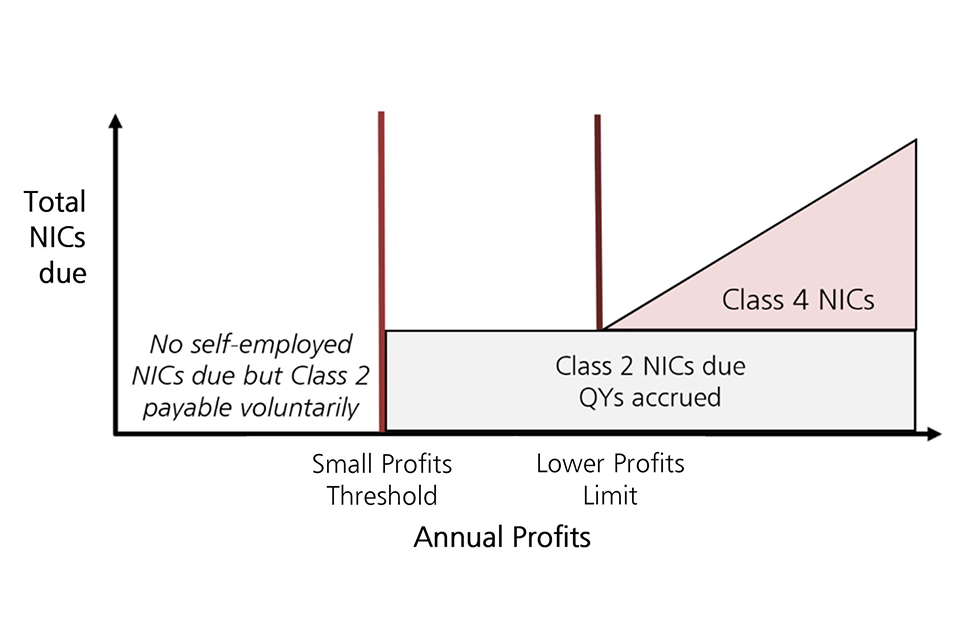

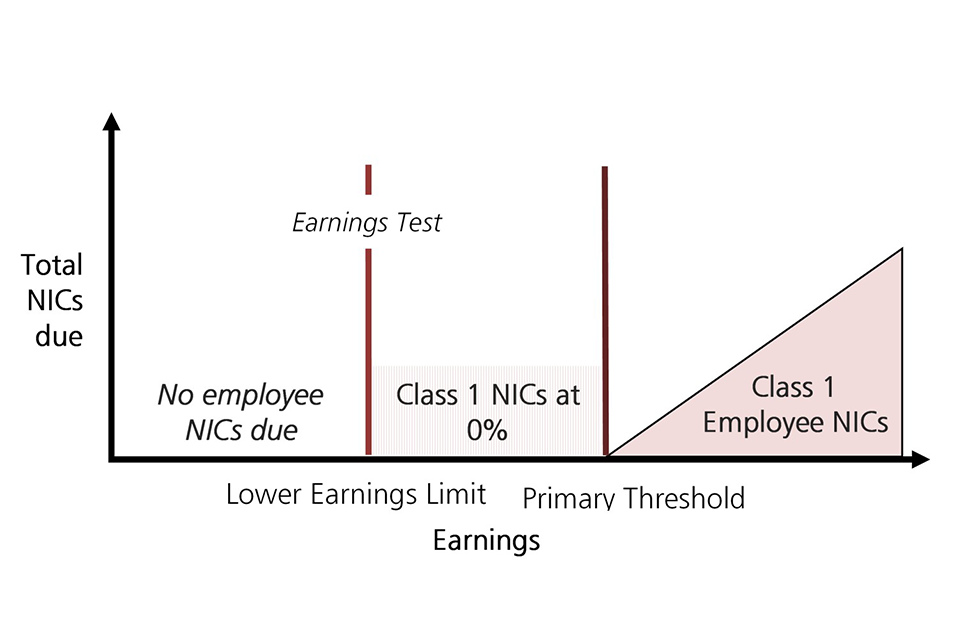

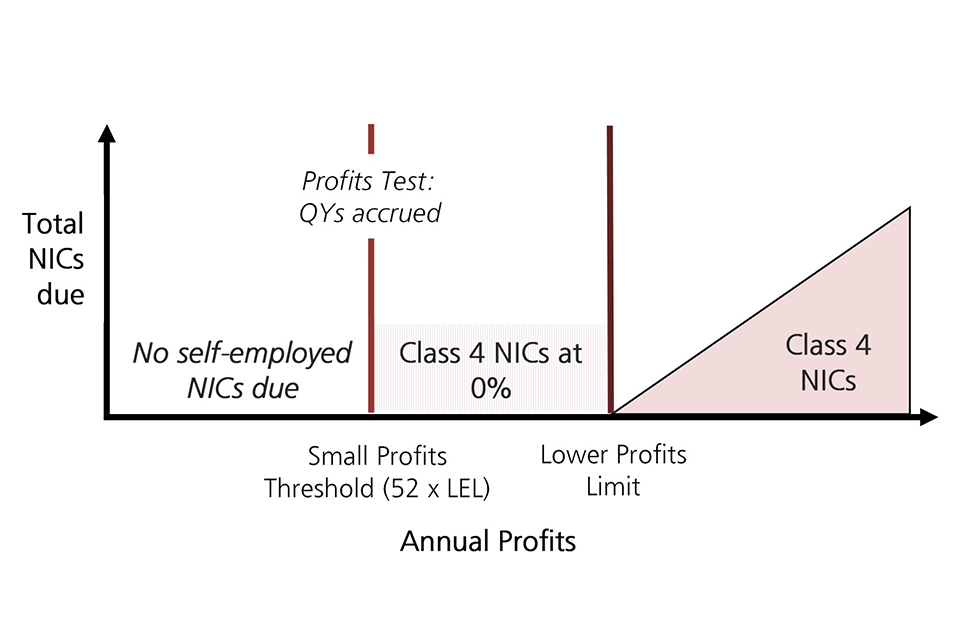

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Self Employed 2018 19 Final Year For Paying Voluntary Class 2 Nics

Self Employed 2018 19 Final Year For Paying Voluntary Class 2 Nics

Dutch Aluminium Producer Damco Aluminium Delfzijl Cooperatie U A Delfzijl Aldel Has Set Foot In An Agreement Solar Power Renewable Electricity Sources Energy

Dutch Aluminium Producer Damco Aluminium Delfzijl Cooperatie U A Delfzijl Aldel Has Set Foot In An Agreement Solar Power Renewable Electricity Sources Energy

Invest Now And Secure Your Future Investing How To Get Rich Fintech

Invest Now And Secure Your Future Investing How To Get Rich Fintech

What Are National Insurance Contributions Low Incomes Tax Reform Group

What Are National Insurance Contributions Low Incomes Tax Reform Group

Voluntary National Insurance Contributions Should You Pay Arthur Boyd

Voluntary National Insurance Contributions Should You Pay Arthur Boyd

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Extrapyramidal Tract Google Search Nursing Study Nursing Books Parkinsons Disease

Extrapyramidal Tract Google Search Nursing Study Nursing Books Parkinsons Disease

Professional Resume Format Free Download 2 Free Professional Resume Template Free Resume Template Download Resume Template Professional

Professional Resume Format Free Download 2 Free Professional Resume Template Free Resume Template Download Resume Template Professional

Voluntary National Insurance Contributions Should You Pay Arthur Boyd

Voluntary National Insurance Contributions Should You Pay Arthur Boyd

Expatnhis Jpg National Insurance Maternity Pay Uk States

Expatnhis Jpg National Insurance Maternity Pay Uk States

The Process Of Pre Start Health And Safety Review Health And Safety Health Safety

The Process Of Pre Start Health And Safety Review Health And Safety Health Safety

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Discovering The Link Between Nutrition And Skin Aging Disorders Disease Cardiovascular

Discovering The Link Between Nutrition And Skin Aging Disorders Disease Cardiovascular

Thousands Unable To Get An Ni Number Because Of Coronavirus Bbc News

Thousands Unable To Get An Ni Number Because Of Coronavirus Bbc News

New Boat Checklist The Boat Galley Boat Plans Liveaboard Sailboat Boat Building

New Boat Checklist The Boat Galley Boat Plans Liveaboard Sailboat Boat Building

Post a Comment for "Class 2 National Insurance Voluntary"