Class 2 National Insurance Exemption

They will not need to claim an exemption in advance. If the Class 1 National Insurance Contributions paid in respect of the employment are such that the individual is making maximum contributions then the Class 4 National Insurance Contributions need only be made at the lower 2 rate.

What Are National Insurance Contributions Low Incomes Tax Reform Group

What Are National Insurance Contributions Low Incomes Tax Reform Group

The Class 2 National Insurance contribution is a fixed amount of 305 a week and its only charged if your annual profits are 6475 or more.

Class 2 national insurance exemption. In certain circumstances you may be exempt. When you reach state pension age you are no longer liable to pay class 2 National Insurance. You could write to them and ask for a refund of the contributions that your client hasnt paid and ask them to set that refund against those unpaid contributions.

Class 2 rate. If your profits are less than 5500 there is a small earnings exemption from Class 2 NIC. Theyre automatically deducted by your employer.

This can be done online here. Class 2 National Insurance Guide. From the tax year 201516 onwards Class 2 is part of Self Assessment and will not be payable separately by monthly or weekly Direct Debit.

If you earn less than the Small Profits Threshold 6025 for 201718 you are automatically exempted from paying Class 2 NI. Self-employed people with profits of more than 9568 a year in addition to Class 2 Paid through self-assessment. The amount of Class 2 NIC due is based on the number of weeks of self-employment in the tax year.

Class 2 NIC give effective entry to the contributory benefits system including the state retirement pension. Get Free Quotation Buy Online Now. You need to apply for it otherwise you must pay.

National Insurance contributions If youre employed you pay Class 1 National Insurance contributions based on your level of earnings. Class 2 small earnings exceptionsmall profits per year 6205. Self-Employed people normally have to pay Class 2 NI contributions.

If you would like some help with your National Insurance contributions click here and we would be. Ad Extensive Motor Insurance Policy. It is important to note that an application for deferment must be made to HMRC before the start of the relevant tax year.

Special Class 2 rate for share fishermen. Class 2 if your profits are 6475 or more a year Class 4 if your profits are 9501 or more a year You work out your profits. Voluntary contributions made by those with gaps in their National Insurance contributions history.

Ad Better Health Insurance for student Start at just 099day Save Money. Class 2 is paid through your self-assessment tax return. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948 the system has been subjected to numerous amendments.

Class 2 NIC arise where a self-employed individual has income chargeable to tax as trading income although there are certain exemptions which are considered below. If you earn less than 5725 201314 per year from your self employment you can claim an exception from paying Class 2 national insurance contributions for the year. Self-employed people with profits of more than 6515 a year.

Class 4 National Insurance contributions are only charged if your profits are above 9500 a year. Get Free Quotation Buy Online Now. People with profits of less than the Small Profit Threshold 6475 for 202021 will not have to pay any class 2 National Insurance.

Ad Extensive Motor Insurance Policy. Class 2 NIC are a fixed weekly amount 305 per week for 202021 assuming your profits are above the small profits threshold. If an application is not made then Class 4 National Insurance.

Most people will pay class 2 National Insurance along with class 4 National Insurance and income tax in January self-assessment payments. If your self-employed profits exceed the lower earnings limit for class 4 you will pay class 4 National Insurance in the tax year in which you reach state pension age as class 4 is based on profits for a tax year but not for the following year. Special Class 2 rate for volunteer development workers.

25th Jun 2015 1618. You cant claim the small earnings exception retrospectively. Paid to HMRC via form CF83.

Once you start self employment you become liable to pay Class 2 National Insurance. See low earnings in this link. Class 2 NI counts towards your entitlement to certain benefits like the basic State Pension Maternity Allowance and Bereavement Benefit.

Class 2 NIC are flat rate contributions which is a fixed weekly amount payable at 305 for 202122 and 202021. National Insurance NI is a fundamental component of the welfare state in the United KingdomIt acts as a form of social security since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Class 2 are paid weekly and Class 4 are paid with your tax.

For the weekly rates prior to that tax year see the GOVUK website. The rate for 201718 was 285 per week. You usually pay 2 types of National Insurance if youre self-employed.

List Of Exempted Incomes Tax Free Under Section 10

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

What Are The Key Highlights From The Indian Union Budget 2018 19 Budgeting Financial News Marketing

What Are The Key Highlights From The Indian Union Budget 2018 19 Budgeting Financial News Marketing

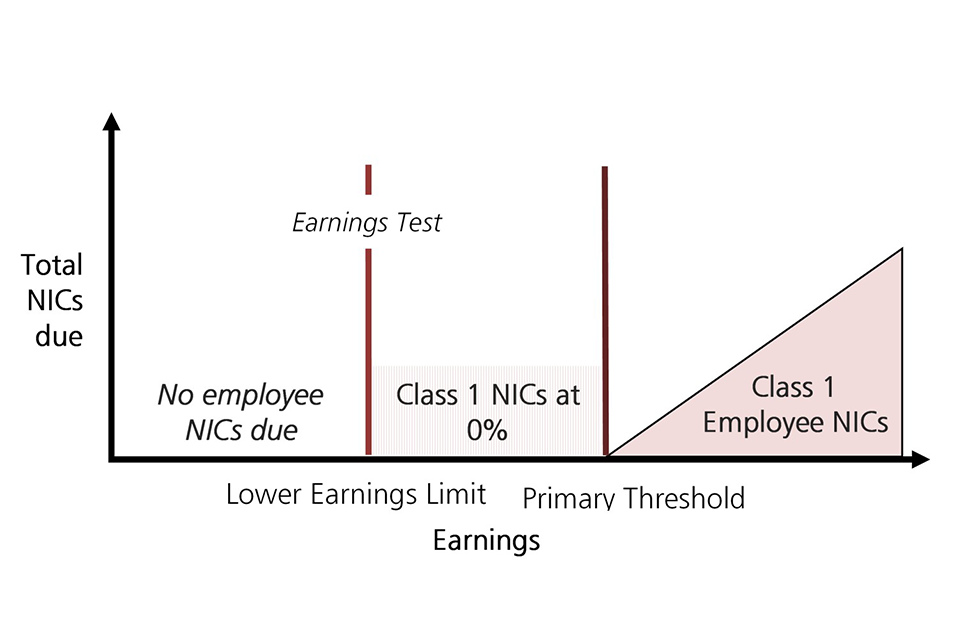

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Department Reorganization Plan Template Best Of Reorganization Transition Plan Template Hamiltonp In 2021 Preschool Lesson Plan Template How To Plan Board Governance

Department Reorganization Plan Template Best Of Reorganization Transition Plan Template Hamiltonp In 2021 Preschool Lesson Plan Template How To Plan Board Governance

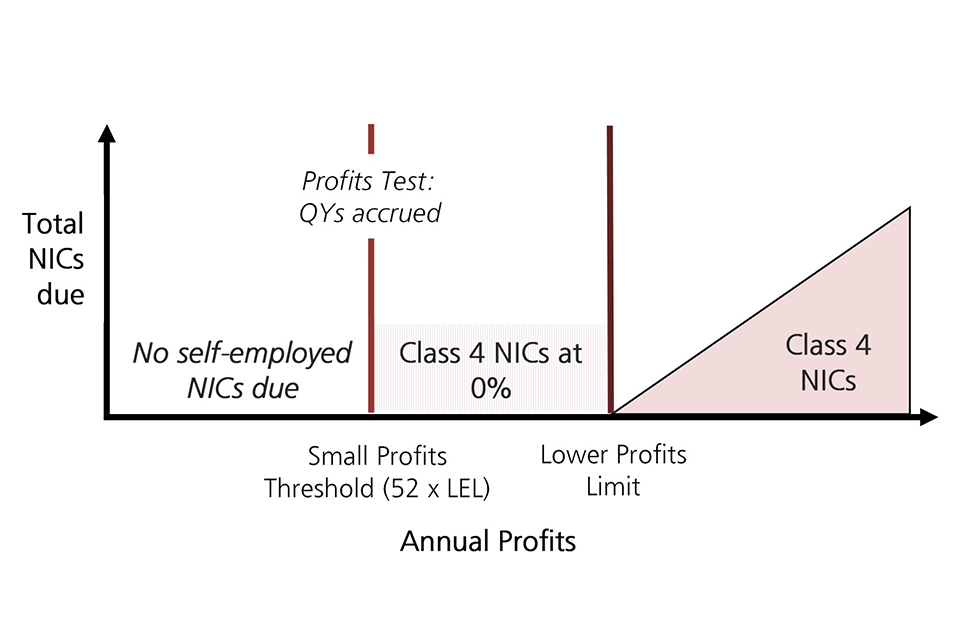

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Project American Class I Railroad Heralds 1959 Transit Map Railroad Equine Logo Design

Project American Class I Railroad Heralds 1959 Transit Map Railroad Equine Logo Design

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

Personal Training Agreement Free Printable Documents Personal Training Personal Training Business Contract Template

Personal Training Agreement Free Printable Documents Personal Training Personal Training Business Contract Template

Britains Largest Digital Thermometer Makes Electronic Temperature Instruments Eti Has Rolled Out Two M Water Proof Case Extruded Aluminum Digital Thermometer

Britains Largest Digital Thermometer Makes Electronic Temperature Instruments Eti Has Rolled Out Two M Water Proof Case Extruded Aluminum Digital Thermometer

Risk Report A Quad 4 Investing Playbook Investing Risk Management Implied Volatility

Risk Report A Quad 4 Investing Playbook Investing Risk Management Implied Volatility

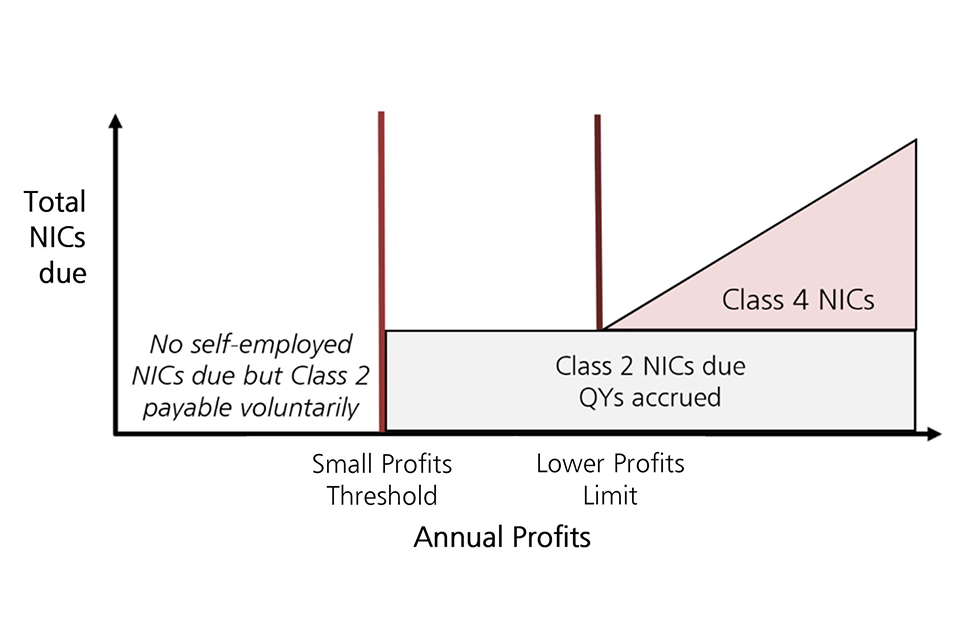

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Accountant In Gurgaon In 2020 Tax Deducted At Source Tax Credits Goods And Services

Accountant In Gurgaon In 2020 Tax Deducted At Source Tax Credits Goods And Services

Travellerontheroad Vacation Checklist Travel Tools Checklist

Travellerontheroad Vacation Checklist Travel Tools Checklist

Self Employed 2018 19 Final Year For Paying Voluntary Class 2 Nics

Self Employed 2018 19 Final Year For Paying Voluntary Class 2 Nics

Post a Comment for "Class 2 National Insurance Exemption"