Class 1 National Insurance Contributions Run Out

Ad Extensive Motor Insurance Policy. These are the four classes of National Insurance.

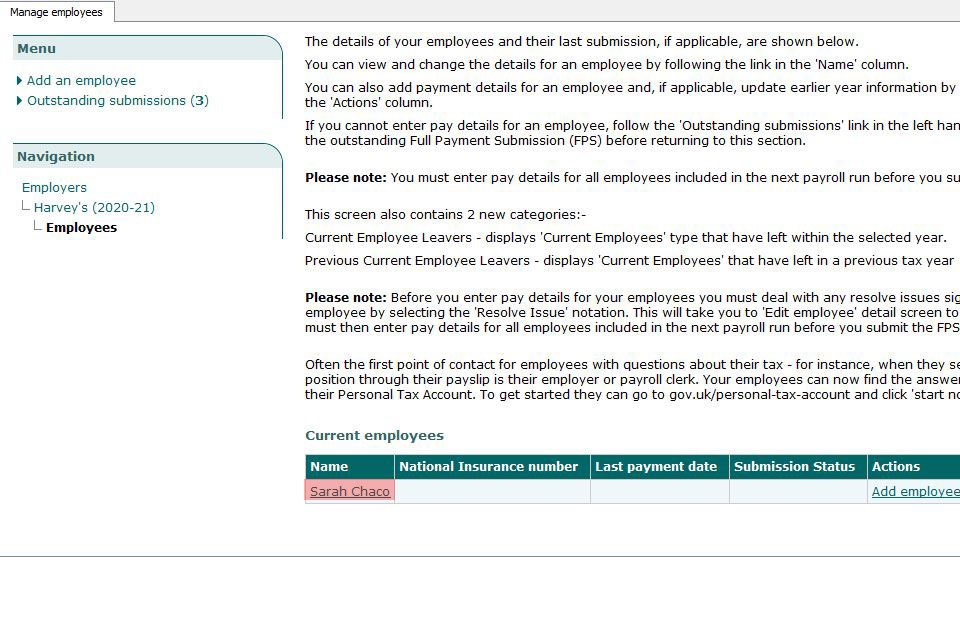

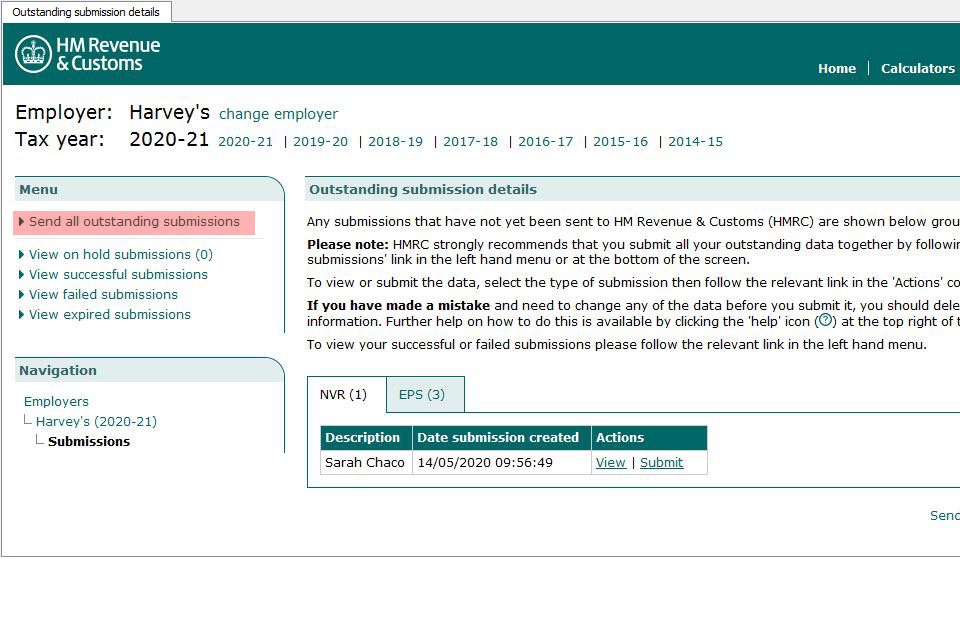

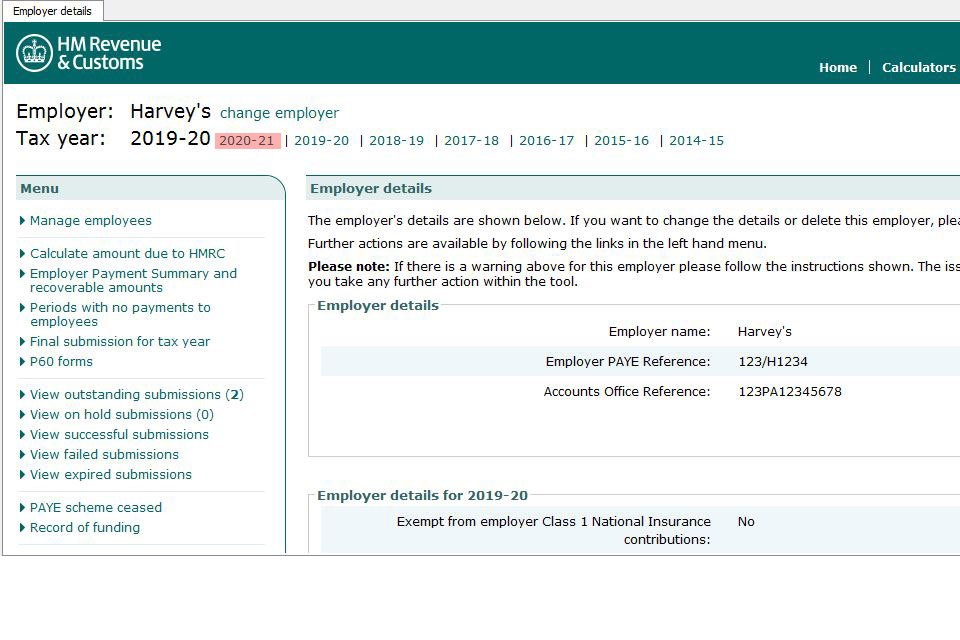

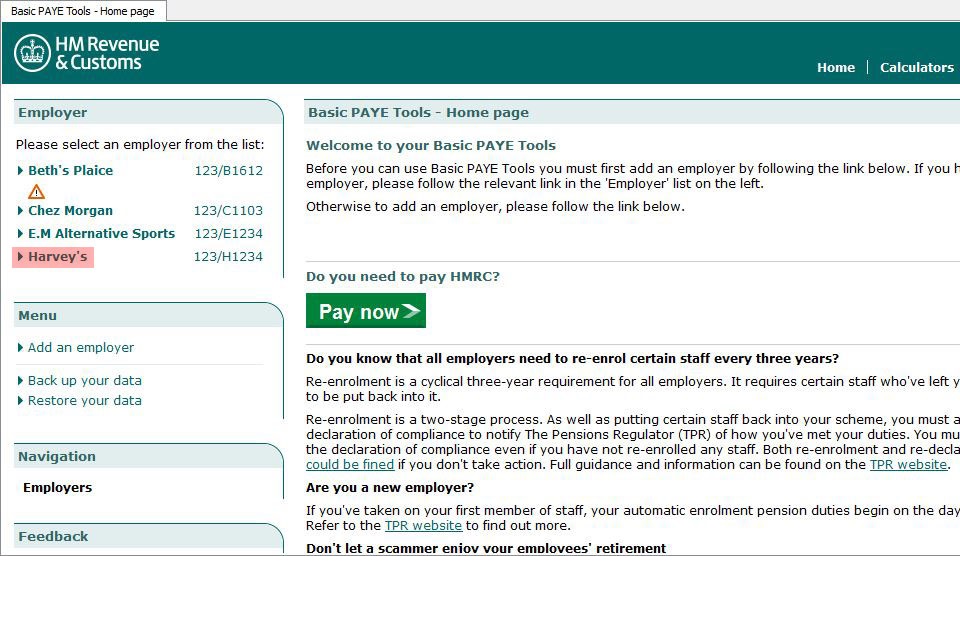

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Note that the advisers may suggest that they can do no more for you and that you should sign off.

Class 1 national insurance contributions run out. We cannot pay you Jobseekers Allowance after 28th July because your entitlement based on Class 1 National Insurance Contributions has run out 3. The rest of the letter tells me how to appeal but I dont suppose I can. But class 1 are paid automatically bt those on PAYE class 2 are paid by the self employed over a certain amount the contributions and eligability are based on how many weeks you have been working so if you pay 100 pounds 1 week and nothing for the rest of thr weeks of the year you will get nothing if you pay 1 pound a week and someone else pays 100 pounds a week they will both get the same amount.

National Insurance category letters are used during payroll runs. This is for employees earning more than 70200 a month and are under the state pension age. As youve not paid enough Class 1 National Insurance Contributions you wont be able to get contribution-based JSA.

Income-based JSA is means-tested and so would depend on. Youll pay 2 on any earnings above 50270. Class 1 Employees earning more than 184 a week and under State Pension age - theyre automatically deducted by your employer Employers pay these.

Class 1 Class 2 Class 3 and Class 4. Basically it sounds like you have run out of class 1 which is basically where you are actually getting back the ni money you have paid into the system in the past 2. Write to the National Insurance Contributions Office to ask for the information to be corrected.

We will pay you Jobseekers Allowance of 71 per week from 24th Jan however the next pay says Contribution-based Jobseekers Allowance of 71 living expenses from 30th Jan-9th April - Are these 2 separate amounts then. If your National Insurance class has been recorded in the wrong way it could affect the benefits youre entitled to. However this is a specialist area and youll need to take advice based on your individual circumstances.

Employers work out how much needs to be contributed by using these. From April 2015 the rate of employer Class 1 secondary NICs for employees under the age of 21 is 0 up to the Upper Secondary Threshold UST. If you earn more youll pay 12 of your earnings between 9568 and 50270.

For example you can only claim contribution-based Jobseekers Allowance if youve paid enough Class 1 National Insurance. All of the below categorys are for class 1 National Insurance contributions. National Insurance Contributions Quick Refresher.

We cannot pay you because you have not paid or been credited with enough Class 1 National Insurance Contributions. Employers should ensure that they hold the. If you earn less than this you wont pay National Insurance contributions.

Only Class 1 National Insurance contributions count for this benefit so this is not available to most self-employed people - If you do not have the required class 1 contributions from a previous employment please select No to the question Did you spend at least 26 weeks in work between 6th April 2017 and 5th April 2019 as you will not qualify for contributory JSA. Get Free Quotation Buy Online Now. For 2021-22 the Class 1 National Insurance threshold is 9568 a year.

The current way in which NICs is assessed remains unchanged. If either of these applies you can choose to make voluntary Class 3 National Insurance contributions which are 1530 a week for the 202021 tax year or 1540 a week for the 202122 tax year. Class 1 National Insurance Contributions NICs are payable by employed taxpayers and are made up of a combination of employee salary deductions through PAYE and employer payments.

Class 1 secondary NICs continue to be payable on all earnings above this threshold. What are Class 1 National Insurance Contributions. 1 decade ago.

But there is another type of JSA income-based that you may be able to claim. Its entirely likely I havent paid enough last year I earned around 100 per week and didnt pay much NI. Find out all you need to know about Class 1 National Insurance Contributions with Tax Rebate Services Guide.

Ad Extensive Motor Insurance Policy. When your JSA-CB runs out you will continue to get full National Insurance credits provided you go fortnightly to sign. This guide tells you what you need to know about Class 1A NICs.

Get Free Quotation Buy Online Now. The class of National Insurance applicable to you very much depends on your working practices. Class 1A National Insurance contributions NICs are payable on most benefits provided to employees.

Problem is I really need some money.

How To Check Your National Insurance Contributions Saga

How To Check Your National Insurance Contributions Saga

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

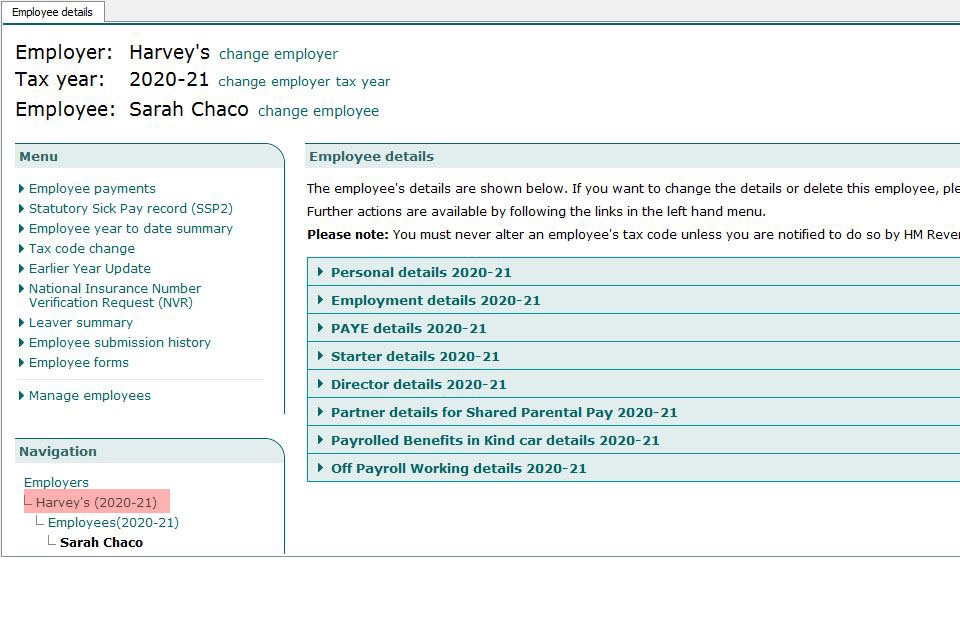

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

P45 Vs P60 What S The Difference Revolut

P45 Vs P60 What S The Difference Revolut

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

Guide To National Insurance Contributions Nics For Small Business Owners Bytestart

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

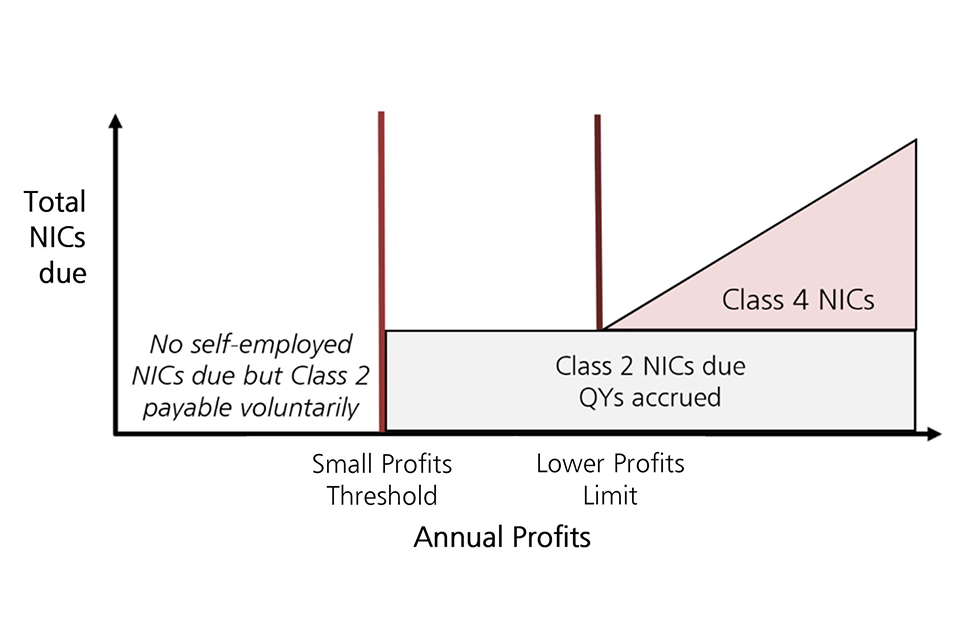

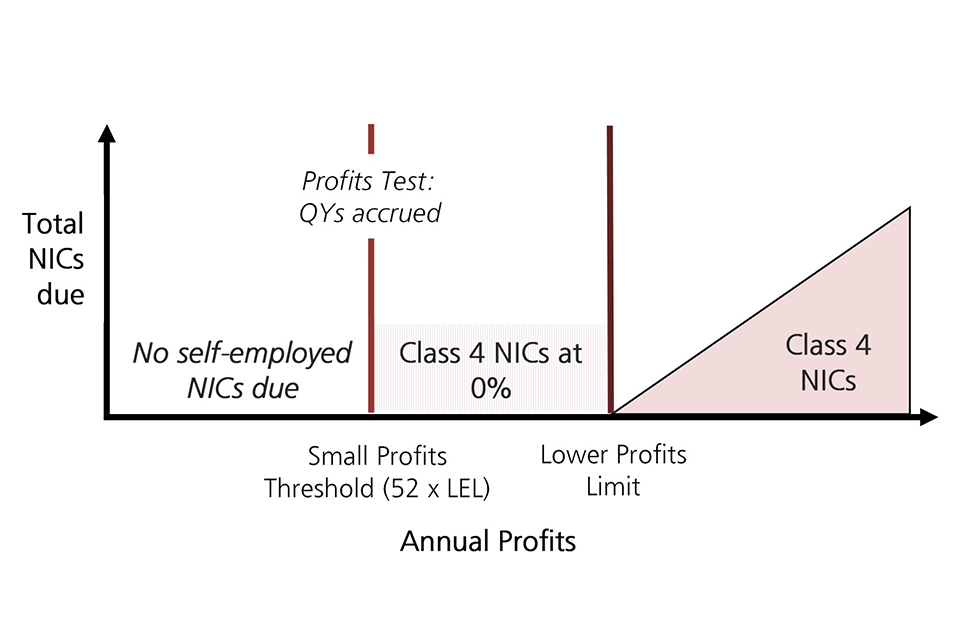

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Everything You Need To Know About National Insurance The Inbounder Britbound

Everything You Need To Know About National Insurance The Inbounder Britbound

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

Lelkes Van Aldozat Jobcentre Ni Number Orabura Org

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Check A National Insurance Number Using Basic Paye Tools Gov Uk

National Insurance Contributions The Mix

National Insurance Contributions The Mix

Employer S National Insurance Contributions

Employer S National Insurance Contributions

Post a Comment for "Class 1 National Insurance Contributions Run Out"